Pound Sterling stays on sidelines with eyes on US core PCE inflation

- The Pound Sterling exhibits choppiness around 1.2700 as the US core PCE Inflation comes under the spotlight.

- UK’s high service inflation remains a barrier to the sustainable return of price pressures toward the 2% target.

- Traders pare Fed rate-cut bets for September due to the stubborn inflation outlook.

The Pound Sterling (GBP) trades in a tight range near the round-level figure of 1.2700 against the US Dollar (USD) in Thursday’s European session. The GBP/USD pair is broadly under pressure due to uncertain market sentiment ahead of the United States (US) core Personal Consumption Expenditures Price Index (PCE) data for April, which will be published on Friday.

Sterling will seldom be influenced by market speculation about Bank of England (BoE) interest rate cuts, which financial markets expect will start from the August meeting. Earlier in the year, investors anticipated the BoE would begin lowering key borrowing rates in June. However, traders pare rate-cut bets for June after the United Kingdom (UK) Consumer Price Index (CPI) report for April showed that price pressures decelerated at a slower pace than estimates.

Though UK headline CPI has significantly declined, BoE policymakers still worry about a sharp slowdown in service inflation momentum, which is almost double the pace required to bring core inflation down to the 2% target.

Daily digest market movers: Pound Sterling struggle for direction

- The Pound Sterling consolidates in a tight range near 1.2700 as investors shift focus to the US core PCE Price Index data for April, which will be published on Friday. Annual and monthly core PCE inflation readings are estimated to have grown steadily by 2.8% and 0.3%, respectively.

- Investors will keenly focus on the US Federal Reserve’s (Fed) preferred inflation gauge as it will significantly influence speculation about Fed rate cuts in the September meeting. The CME FedWatch tool shows that the probability of interest rates being lower than current levels in September has come down to 47% from the previous week’s reading of 51%. Traders pare Fed rate-cut bets for September after the US Conference Board showed on Tuesday that Consumer Confidence for May surprisingly improved and the preliminary S&P Global PMI report for May outperformed expectations.

- US Consumer Confidence rose to 102.00 from 97.5 in April after deteriorating consecutively for three months. The Consumer Confidence report, which releases the Present Situation Index and the Expectations Index that reflects current and the near-term outlook, respectively, of business and labor market conditions, outperformed their prior readings.

- Meanwhile, the Fed’s hawkish guidance on interest rates has also weighed on Fed rate-cut bets. Policymakers want to see inflation slowing for months before leaning toward the policy normalization process. Officials maintained a hawkish stance despite a slowdown in price pressures in April. They argued that a one-time decline in inflation is insufficient to get confidence that the progress in the disinflation process has resumed after stalling for the entire first quarter.

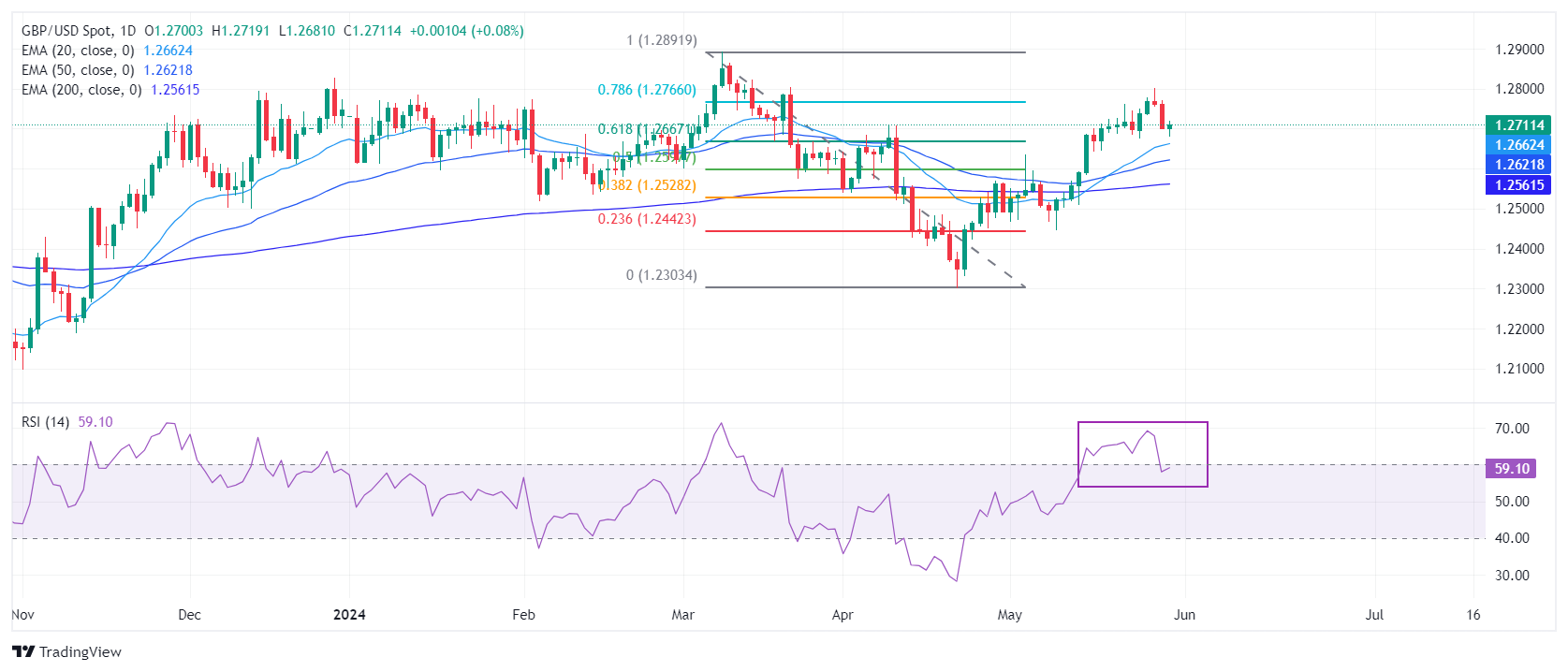

Technical Analysis: Pound Sterling seems uncertain near 1.2700

The Pound Sterling finds temporary support slightly below 1.2700 in Thursday’s European session after a sharp sell-off on Wednesday. The near-term outlook of the GBP/USD pair is still upbeat as it holds the 61.8% Fibonacci retracement support (plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300) at 1.2670. The Cable is expected to remain bullish as all short-to-long-term Exponential Moving Averages (EMAs) are sloping higher, suggesting a strong uptrend.

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside, has faded for now.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.