AUD/USD firms as traders brace for Australia Q3 inflation data and Fed decision

- AUD/USD extends its advance for the fifth consecutive day, supported by broad-based US Dollar weakness.

- Investors turn their focus to Australia’s Q3 CPI data and the Federal Reserve’s policy decision on Wednesday.

- Technical setup turns constructive as AUD/USD breaks above key SMAs near 0.6550.

The Australian Dollar (AUD) edges higher against the US Dollar (USD) on Tuesday, extending its winning streak for the fifth consecutive session as the Greenback stays under pressure ahead of the Federal Reserve’s (Fed) interest rate decision on Wednesday. At the time of writing, AUD/USD trades around 0.6586, up nearly 0.5% on the day and marking its highest level in over two weeks.

Traders are turning their attention to key Australian inflation data due early Wednesday, which could shape expectations for the Reserve Bank of Australia’s (RBA) monetary policy path. The third quarter Consumer Price Index (CPI) is forecast to show a notable pickup, with quarterly inflation seen rising 1.1% after 0.7% in Q2, while annual CPI is expected at 3.0%, up from 2.1% in the previous quarter.

The RBA’s trimmed mean CPI is projected to climb 0.8% QoQ and hold steady at 2.7% YoY, while the monthly CPI for September is expected to come in at 3.1%, up from 3.0% in August.

A stronger-than-expected inflation reading would reinforce the view that the RBA may maintain a cautious stance, potentially bolstering the Aussie. Meanwhile, across the Pacific, the Fed is widely expected to deliver another 25-basis-point rate cut on Wednesday, a move already priced into markets.

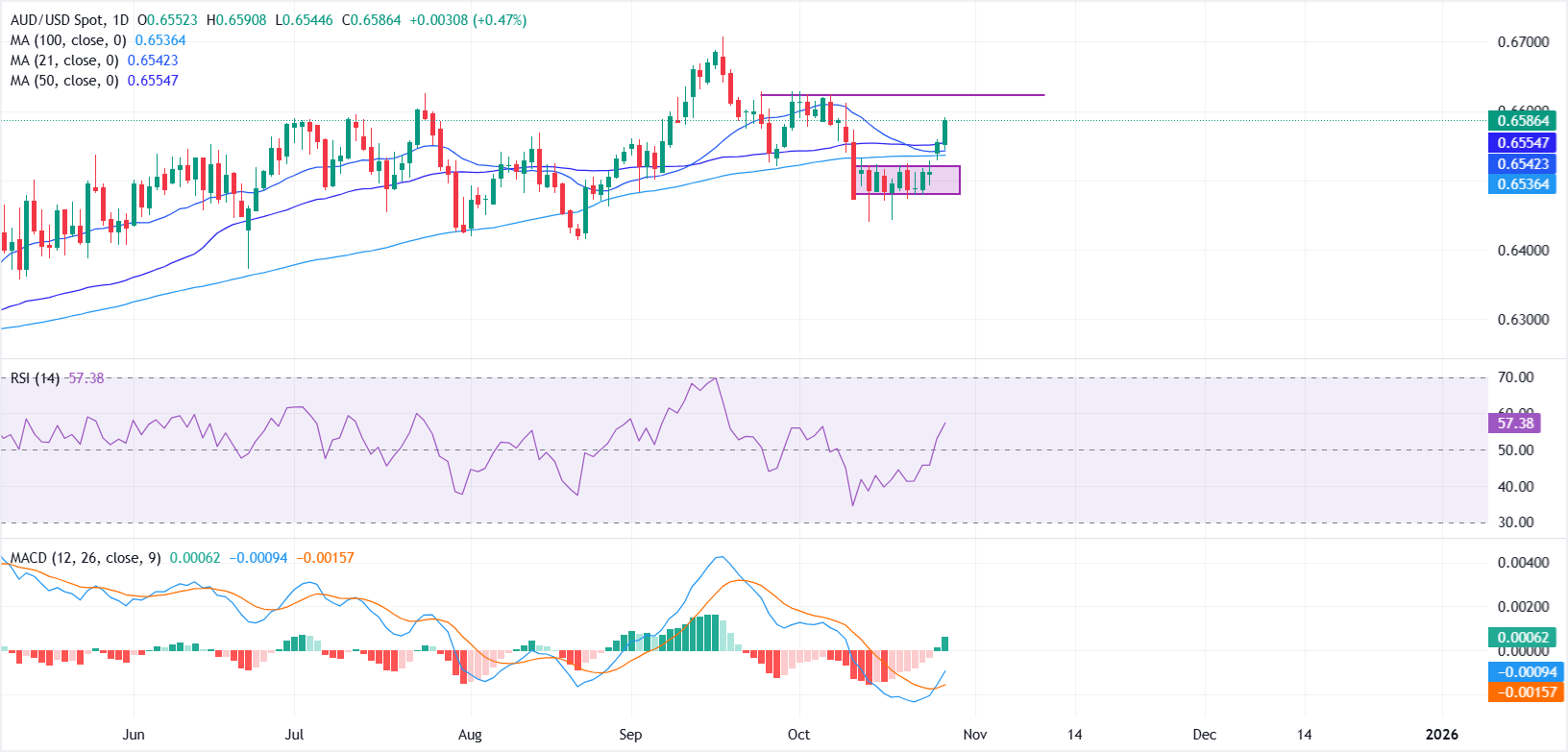

From a technical perspective, AUD/USD has broken above a short-term consolidation range between 0.6520 and 0.6480, signaling renewed bullish momentum. The pair now trades comfortably above the 21-, 50-, and 100-day Simple Moving Averages (SMAs) clustered between 0.6540 and 0.6555, which have turned into near-term support.

Momentum indicators also point to improving sentiment. The Relative Strength Index (RSI) is pointing north and has climbed above the 50 mark, while the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover with the signal line, accompanied by rising green histogram bars, a sign of strengthening bullish momentum.

A sustained move above 0.6600 could open the path toward the October swing high near 0.6629, and a decisive break above this level could pave the way for a retest of the year-to-date high around 0.6707 and beyond. On the downside, initial support lies at 0.6550, followed by 0.6520.

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by the Australian Bureau of Statistics on a quarterly basis, measures the changes in the price of a fixed basket of goods and services acquired by household consumers. The CPI is a key indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference quarter to the same quarter a year earlier. A high reading is seen as bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 29, 2025 00:30

Frequency: Quarterly

Consensus: 3%

Previous: 2.1%

Source: Australian Bureau of Statistics

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.