Forex Today: USD weakens, Gold slumps below $4,000 as risk flows dominate

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Tuesday, October 28:

The market mood remains upbeat early Tuesday and Gold extends its slide as investors cheer news of a trade agreement between the United States (US) and Japan, while remaining optimistic about a US-China deal. The US economic calendar will feature the Conference Board's Consumer Confidence data for October and Housing Price Index figures for August.

US Dollar Price This week

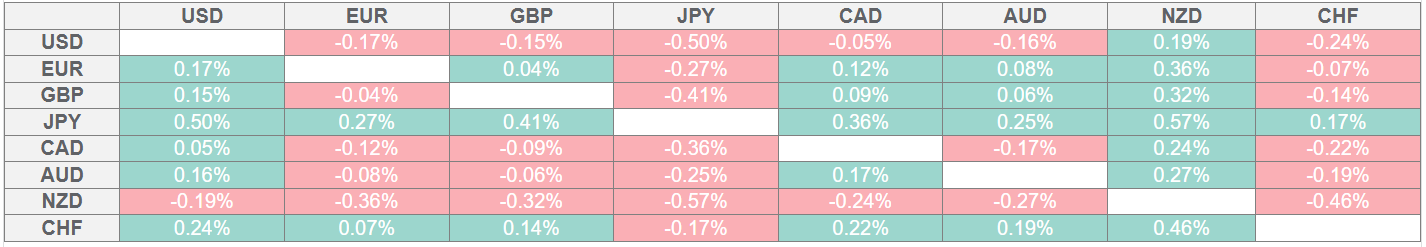

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

US President Donald Trump met with Japan's new Prime Minister Sanae Takachi early Tuesday and signed a framework deal for securing the supply of critical minerals and rare earths. Trump also signed separate deals with Malaysia and Camdonia, in addition to frameworks for trade pacts with Thailand and Vietnam. Wall Street's main indexes registered strong gains on Monday, with the S&P 500, the Nasdaq Composite and the Dow Jones Industrial Average all closing at new record-highs. Early Tuesday, US stock index futures trade mixed. In the meantime, the US Dollar (USD) Index stays under modest bearish pressure below 99.00 after closing modestly lower on Monday.

Gold stays under heavy bearish pressure following the previous week's deep correction. After losing more than 3% on Monday, Gold was last seen losing about 1.2% on the day at $3,940.

EUR/USD holds its ground after posting small gains on Monday and trades at around 1.1650 in the European session on Tuesday. The data from Germany showed earlier in the day that the GfK Consumer Confidence Index declined to -24.1 for November from -22.5 in October.

GBP/USD clings to marginal gains near 1.3350 in the European morning after closing in positive territory and snapping a six-day losing streak on Monday.

AUD/USD gained more than 0.6% on Monday after opening with a bullish gap. The pair stays in a consolidation phase at around 0.6550 on Tuesday. In the early trading hours of the Asian session on Wednesday, investors will scrutinize third-quarter inflation data from Australia.

After rising above 153.00 on Monday, USD/JPY reversed its direction in the Asian session on Tuesday. At the time of press, the pair was trading slightly below 152.00, losing about 0.5% on the day. Japan's Economics Minister Minoru Kiuchi reiterated on Tuesday that it’s important for foreign exchange (FX) moves to reflect fundamentals and be stable.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.