PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

- Pepe price hit $0.00007 on Wednesday, up 33% from the year-to-date lows of $0.00005 recorded on Tuesday.

- Crypto traders leaned into top 3 memecoins as the market recovered on positive US CPI readings.

- Technical indicators on the PEPEUSD 12-hourly chart show that short-term momentum remains bullish.

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

PEPE skips ahead of DOGE and SHIB as US inflation tips off bulls recovery

PEPE led the memecoin sector's recovery on Wednesday, outperforming Dogecoin (DOGE) and Shiba Inu (SHIB) as broader crypto markets rebounded.

The rally was driven by renewed risk appetite and fresh capital inflows.

PEPE price analysis

As of Thursday, PEPE price rose as high as $0,000007, its highest since March 3, when market rallied in reaction to Trump’s crypto strategic reserve announcement,

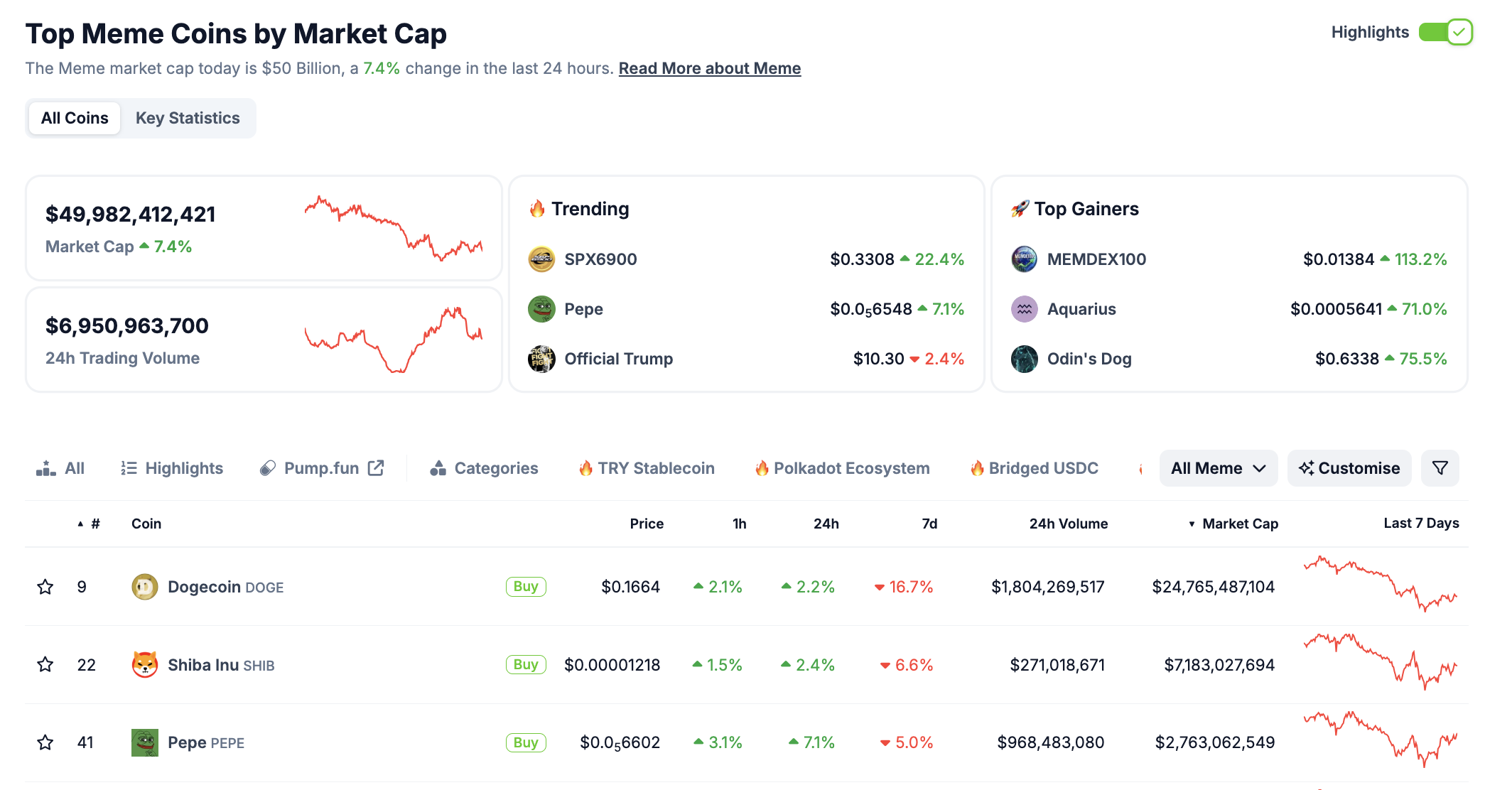

According to CoinGecko data, memecoins saw a surge in inflows, with their total market capitalization climbing 7.4% to nearly $50 billion.

Memecoin market performance, March 12 | Source: Coingecko

Among the top-ranked tokens, PEPE stood out, establishing an early lead with 7% gains at the onset of the rally on Wednesday,

In comparison, DOGE added 2.2%, while SHIB rose 2.4% over the past 24 hours.

Historically, when memecoins outperform the broader market, it signals increased speculative interest, as these assets tend to be highly sensitive to shifts in sentiment and liquidity.

PEPE price forecast: Bulls eye $0.00000800 breakout, but resistance threatens reversal

PEPE price is leaning bullish following a 38% surge over four days, yet resistance at $0.00000760 remains a key hurdle.

The 12-hour Bollinger Bands show widening volatility, with price testing the midline at $0.00000707.

A sustained hold above this level could allow bulls to challenge the upper Bollinger Band at $0.00000760, setting up a potential breakout toward $0.00000800.

However, failure to close above resistance may invite selling pressure, with the lower band at $0.00000579 as a downside target.

PEPE price forecast

The Relative Strength Index (RSI) at 49.29 signals indecision, hovering near neutral territory.

A move above 55 would confirm bullish strength, while a dip below 38.93 could trigger a reversal.

Meanwhile, the Volume-Weighted Average Price (VWAP) at $0.00000707 suggests that the market remains fairly priced, but any rejection here could indicate overleveraged long positions unwinding.

If bulls lose control, a retracement toward $0.00000669 becomes likely.

For sustained upside, PEPE must clear $0.00000760 with rising volume to confirm momentum.

However, excessive leverage could introduce sharp liquidations, leading to heightened volatility.

Bulls remain in control for now, but failure to hold key support levels above $0.000006 could see bears regain dominance.