SEC preparing more charges against Elon Musk, probing Neuralink

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

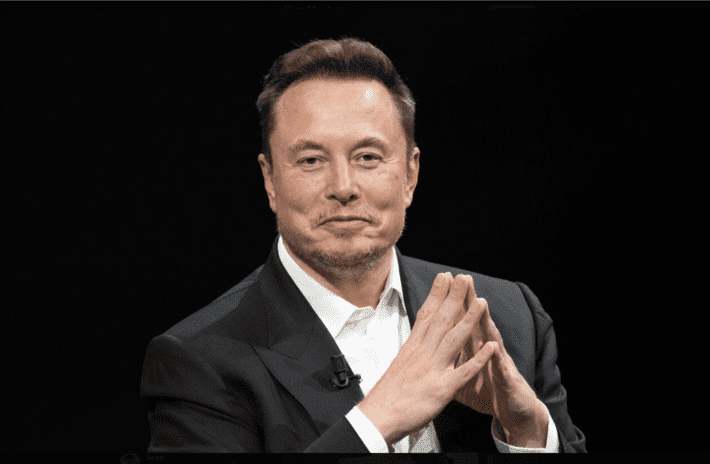

Investing.com-- The Securities and Exchange Commission is preparing more charges against Elon Musk and is also probing Neuralink, according to a letter from Musk’s lawyer which the Tesla Inc (NASDAQ:TSLA) Chair posted on X.

The letter- which was addressed to SEC Chair Gary Gensler by Musk’s lawyer Alex Spiro, states that Musk had a 48 hour deadline to accept a monetary payout settlement, or face “charges on numerous counts.”

The letter did not specify the nature of these charges, but stated that the SEC’s demands came after a multi-year investigation.

The letter also showed that the SEC had reopened an investigation into Musk’s neurotechnology venture Neuralink. Reports in 2023 had shown that some lawmakers had asked the SEC to investigate Neuralink over Musk’s claims of the safety of its brain chip.

Musk has a long history with the SEC, having paid the agency $20 million in 2018 over his Tweets claiming that Tesla will go private, and that he had secured the necessary funding.

Musk is facing an investigation over his Twitter takeover, while lawmakers were also looking into Tesla’s self-driving claims.

The letter characterized Musk’s history with the agency as “six years of harassment” by the agency. The letter also demanded to know who had directed the SEC's actions against Musk.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.