Forex Today: All eyes on Fed Chair Powell speech as shutdown continues

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

Here is what you need to know on Thursday, October 9:

With key data releases from the US getting postponed because of the ongoing government shutdown, market participants will focus on comments from central bank officials, including Federal Reserve (Fed) Chair Jerome Powell, on Thursday.

US Dollar Price This week

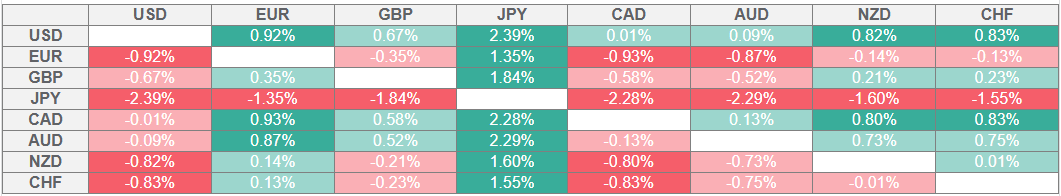

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

After posting gains for three consecutive days, the US Dollar (USD) Index holds steady at around 99.00 in the European morning on Thursday. Fed Chair Powell will deliver welcoming remarks via pre-recorded video at the Community Bank Conference in Washington. Fed Governor Michelle Bowman, Minneapolis Fed President Neel Kashkari and Fed Governor Michael Barr will be other Fed speakers of the day. Late Wednesday, the minutes of the Fed's September policy meeting showed that policymakers are leaning toward further rate cuts this year, citing heightened labor market risks and a more balanced inflation outlook.

Meanwhile, the Senate, once again, failed to advance Republicans' stopgap funding bill in a 54 to 45 vote on Wednesday. US President Donald Trump told reporters most federal workers effected by the government shutdown will get back pay.

Early Thursday, Trump also announced that Israel and Hamas agreed on a peace plan and that hostages could be released by next Monday. Qatar media confirmed that the deal will include the release of hostages and the withdrawal of Israeli troops. Israeli Prime Minister Benjamin Netanyahu is expected to convene parliament on Thursday to present and then to approve the plan. Following this development, US stock index futures trade marginally higher on the day.

EUR/USD stays on the back foot and declines toward 1.1600 in the European session on Thursday. The European Central Bank will release the minutes of the September policy meeting later in the day.

After rising more than 1% on Wednesday, Gold edges lower amid easing geopolitical tensions early Thursday but manages to hold comfortably above $4,000.

GBP/USD remains under bearish pressure and trades in negative territory below 1.3400 in the European morning on Thursday.

USD/JPY extends its bullish rally and trades at its highest level since mid-February above 153.00 to begin the European session.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.