Forex Today: US Dollar struggles to rebound as NFP data revive September rate cut bets

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Here is what you need to know on Monday, August 4:

The US Dollar (USD) finds it difficult to gather strength against its rivals at the beginning of the week as market expectations for a 25 basis points (bps) Federal Reserve (Fed) rate cut gains traction after dismal employment data. The US economic calendar will feature mid-tier data releases on Monday.

US Dollar PRICE Last 7 days

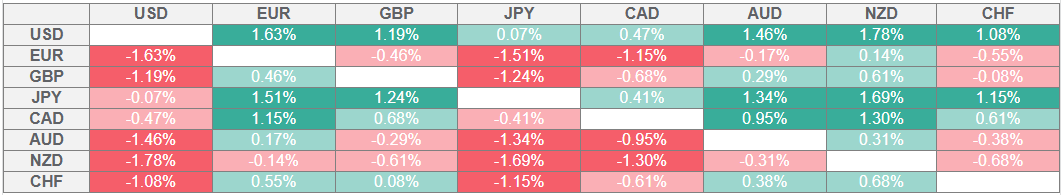

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Bureau of Labor Statistics (BLS) reported on Friday that Nonfarm Payrolls (NFP) rose by 73,000 in July, missing the market expectation of 110,000. Additionally, the BSL announced that it revised down May and June NFP increases by 125,000 and 133,000, respectively. "With these revisions, employment in May and June combined is 258,000 lower than previously reported," the press release read.

With the immediate reaction, the probability of a 25 bps Fed rate cut in September jumped above 70% from about 30% before the data, as per CME FedWatch Tool. In turn, the USD Index lost nearly 1.5% on a daily basis and erased a large portion of its weekly gains. Early Monday, the USD Index stays in a consolidation phase below 99.00. Later in the day, June Factory Orders data and second-quarter Loan Officer Survey will be watched closely by market participants.

Meanwhile, US President Donald Trump criticized the Fed's policy decisions and called upon Chairman Jerome Powell to lower interest rates after weak jobs data. Trump also announced that he fired BLS Chief Erika McEntarfer, accusing her of manipulating the numbers for political purposes. In the European session on Monday, US stock index futures rise about 0.4%, while the 10-year US Treasury bond yields rise nearly 1% on the day near 4.25% after losing 3.8% on Friday.

EUR/USD benefited from the renewed USD weakness on Friday and rose 1.5% on the day. Nevertheless, the pair ended the week in negative territory. In the European morning on Monday, EUR/USD trades in a tight channel above 1.1550. Sentix Investor Confidence data for August will be featured in the European economic calendar.

GBP/USD rose more than 0.5% on Friday but still registered large losses for the week. The pair holds steady early Monday and moves sideways below 1.3300.

USD/JPY fell 2.2% on Friday and registered its one of the biggest one-day losses of this year. The pair corrects higher on Monday and recovers toward 148.00.

The sharp decline seen in US T-bond yields triggered a decisive rally in Gold on Friday. XAU/USD struggles to preserve its bullish momentum early Friday but manages to hold above $3,350.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.