Forex Today: Gold corrects from record-high, USD awaits key data releases

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Thursday, September 4:

Financial markets turn relatively quiet early Thursday, following the volatile action seen in the first half of the week. The US Dollar (USD) holds its ground as investors await key macroeconomic data releases, including weekly Jobless Claims, July Goods Trade Balance, August ADP Employment Change and the Institute for Supply Management's (ISM) Services Purchasing Managers' Index (PMI). Several Federal Reserve (Fed) policymakers are scheduled to deliver speeches during the American trading hours as well.

US Dollar Price This week

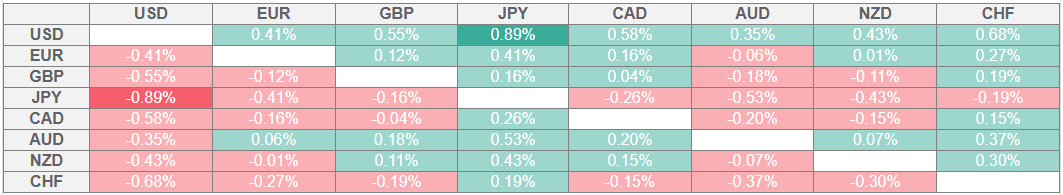

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The improving risk mood and the disappointing employment-related data from the US, which showed that the JOLTS Job Openings declined to 7.18 million in July from 7.35 million in June, caused the USD Index to stretch lower in the American session on Wednesday. US President Donald Trump said on Wednesday that he remains committed to pursuing a peace agreement between Russia and Ukraine, despite mounting uncertainty over the prospect of talks between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy. In the European session on Thursday, the USD Index clings to small daily gains above 98.00, while US stock index futures trade virtually unchanged.

Gold extended its bullish rally into a seventh consecutive trading day on Wednesday and touched a new record-high of $3,578. Early Thursday, XAU/USD corrects lower and trades below $3,550.

EUR/USD closed marginally higher on Wednesday but struggled to gather further bullish momentum early Thursday. The pair was last seen fluctuating in a narrow channel at around 1.1650. Later in the European session, Eurostat will release Eurozone Retail Sales data for July.

The data from Australia showed in the Asian session that the trade surplus widened to A$7.3 billion ($4.74 billion) in July, from a revised A$5.4 billion in June. This reading surpassed the market expectation for a surplus of A$4.9 billion by a wide margin. Despite the upbeat data, AUD/USD stays on the back foot and trades in negative territory below 0.6550.

GBP/USD rose nearly 0.4% on Wednesday and erased a portion of Tuesday's losses as yields on the long-dated UK gilts corrected lower. GBP/USD edges lower early Thursday and trades below 1.3450. United Kingdom (UK) Chancellor of the Exchequer Rachel Reeves dismissed concerns from Britain's National Institute of Economic and Social Research (NIESR), which forecast that the UK faces a £50 billion budget gap and that the government may need to dip into International Monetary Fund (IMF) funding pools in the future if Parliament can't sort out its budget issues.

After rising to its highest level in a month above 149.00 on Wednesday, USD/JPY lost its traction and closed the day marginally lower. USD/JPY holds its ground early Thursday and rises toward 148.50.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.