Bitcoin Price Forecast: BTC stabilizes as focus shifts to key macroeconomic data releases

- Bitcoin consolidates around $110,800 on Thursday after a mild recovery earlier this week.

- Traders turn cautious ahead of Friday’s macroeconomic data, which could shape expectations for the Fed’s rate-cut path.

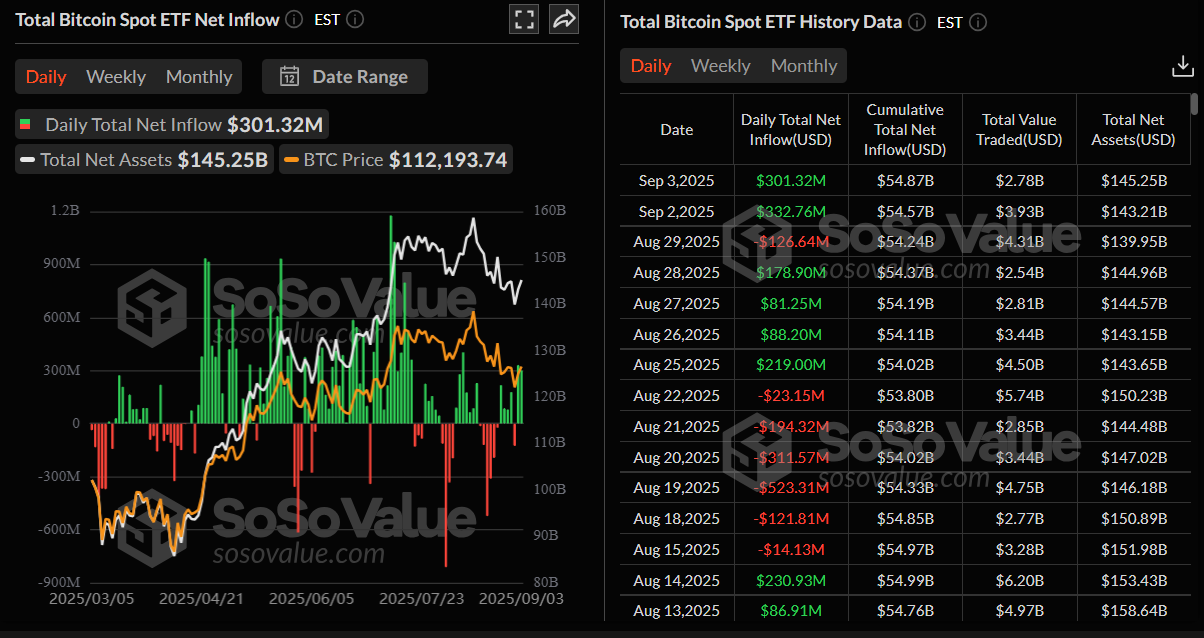

- US-listed spot Bitcoin ETFs saw over $300 million in inflows on Wednesday, marking a two-day positive streak.

Bitcoin (BTC) is holding steady around $110,800 at the time of writing on Thursday, having recovered slightly so far this week. Traders adopt a cautious stance ahead of key US macroeconomic data due to be released on Friday, which could influence the Federal Reserve’s (Fed) monetary policy outlook, keeping crypto markets on edge. Meanwhile, the spot Bitcoin Exchange Traded Funds (ETFs) continue to attract strong demand, recording over $300 million in inflows on Wednesday and extending their positive streak for a second consecutive day.

Bitcoin traders await key macroeconomic data

Bitcoin price started the week on a positive note, recovering slightly and hovering around $110,500 on Thursday, after extending its three-week trend of lower lows from its record high of $124,474.

The US JOLTS Job Openings data released on Wednesday signaled that the labor market is cooling, reaffirming bets that the Federal Reserve (Fed) will lower borrowing costs later this month. There is a 97.6% chance that the central bank will lower borrowing costs by 25 basis points at the end of the two-day policy meeting on September 17, according to the CME Group’s FedWatch tool.

Furthermore, market participants expect the Fed to deliver at least two rate cuts by the end of 2025, which could further boost riskier asset prices such as BTC.

Traders now look forward to Thursday’s US economic docket featuring the ADP report on private-sector employment, the usual weekly Initial Jobless Claims and ISM Services PMI. The market focus, however, will remain glued to the release of the official monthly employment report, as the Nonfarm Payrolls (NFP) for August is scheduled for Friday at 12:30 GMT.

These key economic data releases would provide more clues about the Fed’s rate-cut path and a fresh directional impetus for the largest cryptocurrency by market capitalization.

Institutional demand continues to strengthen

Bitcoin price has been supported by institutions so far this week. The SoSoValue data below shows that Bitcoin spot Exchange Traded Funds (ETFs) recorded a fresh inflow of $301.32 million on Wednesday after a $332.76 million inflow on Tuesday. If inflow continues and intensifies, the BTC price could see further recovery.

Total Bitcoin Spot ETF Net inflow daily chart. Source: Coinglass

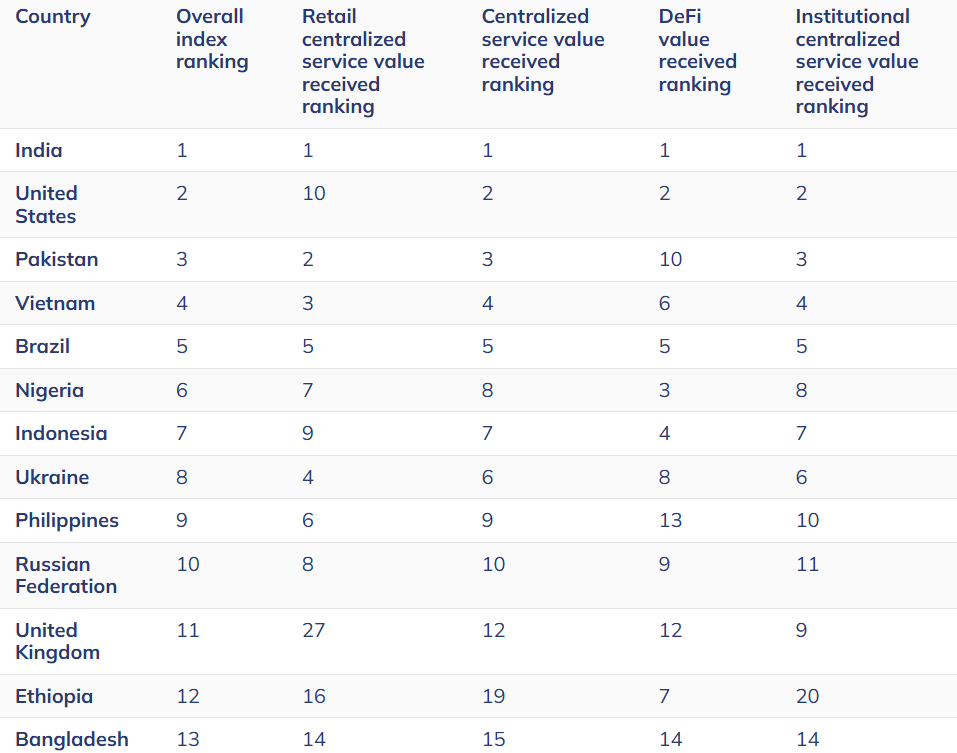

According to Chainalysis’ 2025 Global Crypto Adoption Index, released earlier this week, countries such as India, the US, and Pakistan are ranked among the top three, followed by Vietnam and Brazil, indicating the top three, the countries with the best cryptocurrency adoption.

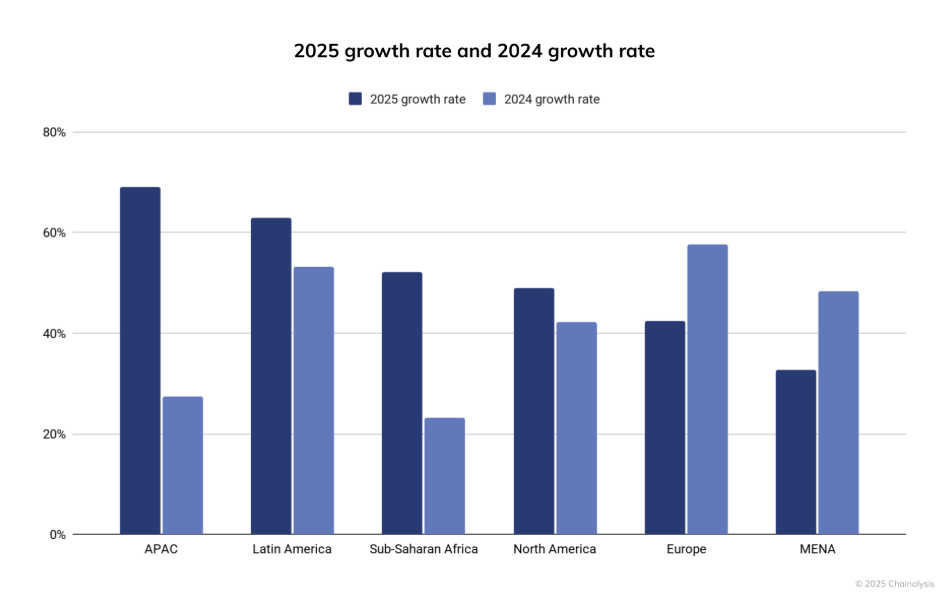

The report notes that the Asia-Pacific (APAC) region led with 69% year-over-year growth in on-chain crypto transactions, driven primarily by India, Vietnam and Pakistan, while Latin America followed with 63% growth.

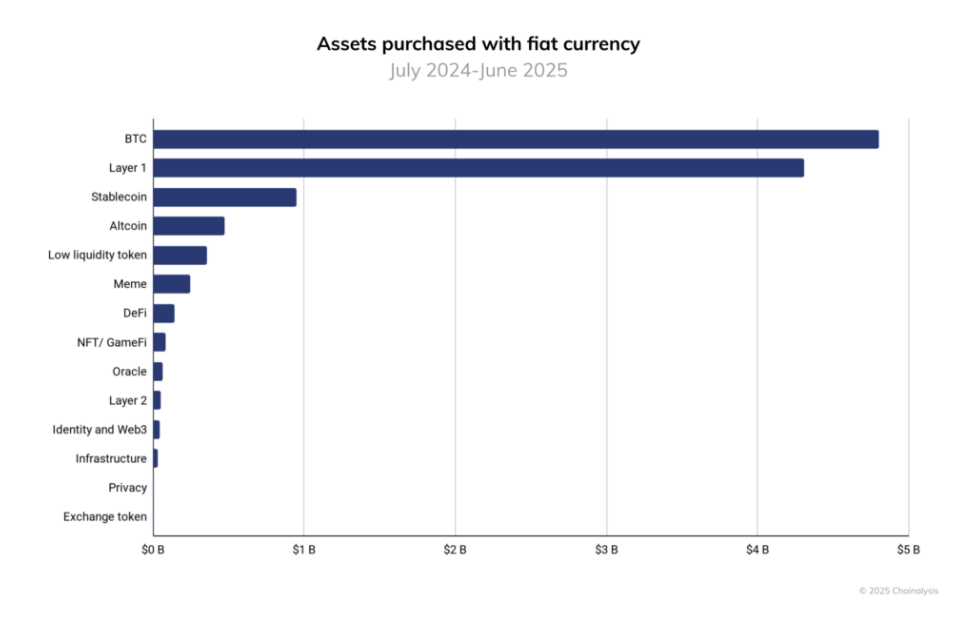

Moreover, Bitcoin remains the primary entry point (serves as the primary gateway into the crypto economy), with over $4.6 trillion in fiat inflows between July 2024 and June 2025, double that of Layer 1 tokens (excluding BTC and ETH).

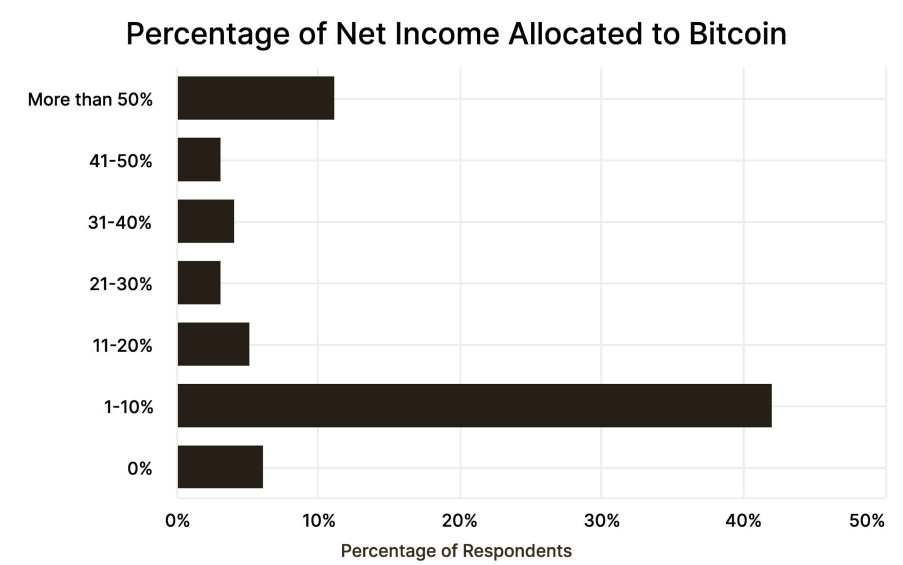

Business owners are putting 22% of profits into Bitcoin

Bitcoin financial services firm River released a research report this week, which states that many businesses are allocating far more than a hypothetical 1% of their funds to Bitcoin. Businesses using River allocate an average of 22% of their net income, according to a survey conducted in July 2025. The median allocation is 10%, signaling growing grassroots adoption.

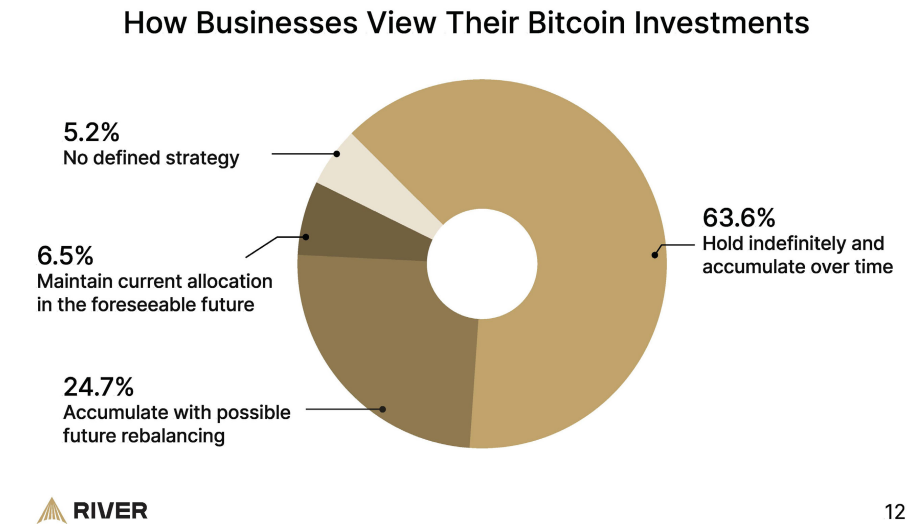

The report further explained that 63.6% of these businesses view BTC as a long-term investment, steadily accumulating without plans to sell or rebalance in the foreseeable future.

Bitcoin Price Forecast: Technical indicators show fading bearish momentum

Bitcoin price recovered slightly on Monday after a nearly 5% correction the previous week. BTC closed above the 100-day Exponential Moving Average (EMA) at $110,736 on Tuesday and found support above it the next day. At the time of writing on Thursday, it is nearing its 100-day EMA at around $110,800.

If BTC continues its recovery, it could extend the rally toward its daily resistance at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 44 and is hovering just below its neutral level of 50, which indicates the bearish momentum is fading. The Moving Average Convergence Divergence (MACD) lines are also converging, with decreasing red histogram bars, suggesting a bullish crossover is likely.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline toward its daily support level at $105,573.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.