US Dollar Index corrects to near 98.30 as Trump fires Fed’s Cook

- Bitcoin Cash Unveiled: Why Did BCH Price Surpass BTC? Can it Soar to $1,000 in the Future?

- AUD/USD holds steady below 0.6650, highest since September ahead of China's trade data

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- WTI drifts lower to near $58.50 on Iraq oilfield recovery

- AUD/USD sticks to gains above 0.6600, highest since late October after Aussie trade data

The US Dollar Index has retraced to near 98.30 from Monday’s high of 98.55 as Trump fires Fed Governor Cook.

Fed Cook’s removal has raised concerns over the credibility of the US central bank.

Fed’s Powell turned dovish on the interest rate outlook.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, corrects to 98.30 during the Asian trading session on Tuesday, following a decent recovery move the previous day.

US Dollar Price Today

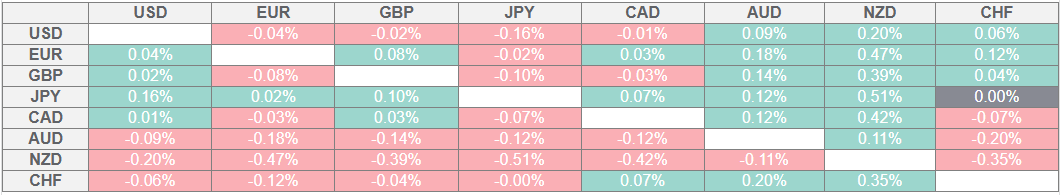

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) faces selling pressure as the independence of the Federal Reserve (Fed), which is an autonomous body and its decisions are not impacted by political influence, has been dampened after the removal of Federal Reserve (Fed) Governor Lisa Cook by United States (US) President Donald Trump over mortgage allegations.

Last week, US President Trump called Fed Governor Cook to resign after his political allies accused her of holding mortgages in Michigan and Georgia. In response, Cook stated that she had "no intention of being bullied to step down" from her position at the central bank, Wall Street Journal (WSJ) reported.

The ousting of Fed’s Cook has been taken as a serious attack on Fed’s independence by market experts, and they are anticipating that interest rate cuts will come quickly. Markets aren’t panicking, but they are recalibrating; earlier rate cuts look more likely after Cook’s removal," analysts at Saxo said, Reuters reported.

Meanwhile, firm expectations that the Fed will cut interest rates in the September policy meeting are also keeping a lid on the US Dollar’s upside. According to the CME FedWatch tool, there is an 84% chance that the Fed will cut interest rates in the September monetary policy meeting.

Fed’s dovish expectations intensified after comments from Chair Jerome Powell at the Jackson Hole (JH) Symposium on Friday signaled that he is open to interest rate cuts amid escalating labor market concerns.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.