US Dollar Index treads water above 98.00 due to renewed geopolitical tensions, CPI awaited

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The US Dollar Index may gain ground due to increased safe-haven demand.

Trump has warned to impose “very severe” tariffs on Russia if no peace deal is made within 50 days.

Trump confirmed that European allies have agreed to buy American-made weapons for Ukraine to help counter Russian attacks.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is edging lower after four days of gains and trading around 98.10 during the Asian hours on Tuesday. Investors are likely awaiting June's Consumer Price Index (CPI) data on Tuesday to gain fresh impetus over the Federal Reserve’s (Fed) monetary outlook.

The Greenback may regain its ground amid renewed geopolitical concerns, driven by the US President Donald Trump’s latest threat to impose “very severe” tariffs on Russia if no peace deal is reached within 50 days. Trump also warned of secondary tariffs on countries importing Russian Oil.

President Trump, alongside NATO Secretary-General Mark Rutte, confirmed that European allies will purchase billions of dollars’ worth of American-made weapons, such as Patriot missile systems. These weapons will be transferred to Ukraine in the coming weeks to tackle intensified Russian attacks.

The US government immediately imposed on Monday a 17% duty on most imports of fresh tomatoes from Mexico after negotiations ended without an agreement to avert the tariff. Trump announced, on Saturday, a 30% tariff on imports from the European Union (EU) and Mexico starting August 1. He also proposed a blanket tariff rate of 15%-20% on other trading partners, an increase from the current 10% baseline rate.

Cleveland Fed President Beth Hammack depicted a fundamentally robust economy, despite inflation persistently surpassing the Fed's target. Hammack highlighted the importance of keeping monetary policy restrictive. She added that they don’t know what the tariff impact will be and don’t see an imminent need to cut rates.

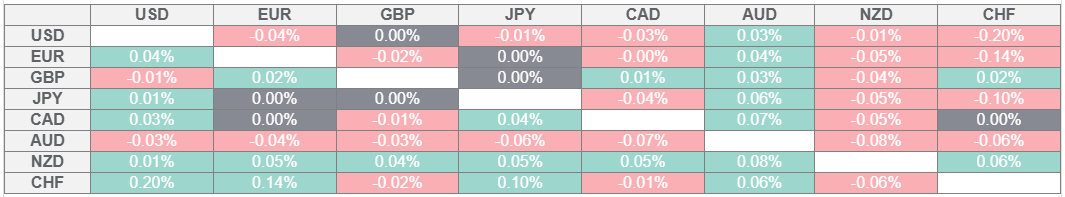

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.