US Dollar Index slides to near 98.00 on Israel-Iran ceasefire, Fed’s dovish comments

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The US Dollar Index falls sharply to near 98.00 as easing geopolitical tensions have diminished its safe-haven demand.

US President Trump urged Israel and Iran not to violate the ceasefire agreement.

Fed’s Bowman shows openness for reducing interest rates in the July meeting.

The US Dollar (USD) underperforms its major peers during European trading hours on Tuesday as its safe-haven demand has diminished significantly, following the announcement of a ceasefire between Israel and Iran.

Theoretically, easing geopolitical tensions reduce demand for safe-haven assets, such as the US Dollar.

At the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against a basket of currencies, falls sharply to near 98.00 from the two-week high of 99.40 posted on Monday.

US Dollar PRICE Today

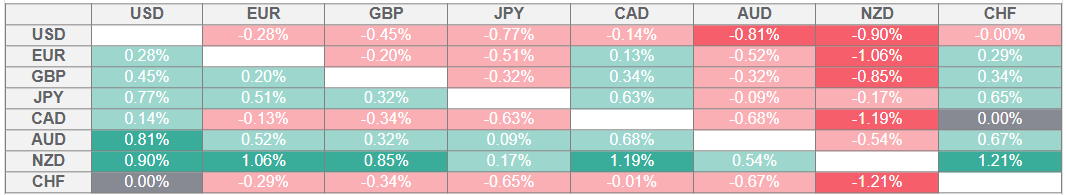

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

During the European trading session, United States (US) President Donald Trump stated in a post on Truth.Social that both Israel and Iran have agreed to a truce and urged them not to violate. “The ceasefire is now in effect. Please do not violate it!" Trump wrote.

The aerial war between Israel and Iran has stopped on its 12th day, which started after Israeli Defence Forces (IDF) launched airstrikes on Iran to stop Tehran from building nuclear warheads. During the period, the US also joined Israel’s assault on Iran and dismantled Tehran’s three nuclear facilities.

Another reason that is contributing to weakness in the US Dollar is a dramatic shift in Federal Reserve (Fed) officials’ stance on the monetary policy outlook. A few Fed policymakers have argued in favor of reducing interest rates in the July policy meeting, citing downside risks to labor market and limited impact of tariffs on inflation imposed by Washington since the return of US President Trump to the White House.

On Monday, Fed Governor Michelle Bowman stated that she is “open to cut interest rates as soon as in the July policy meeting amid growing concerns over job market”. “It is time to consider adjusting the policy rate, and we [Fed] should put more weight on downside risks to the job market going forward,” Bowman said.

Going forward, investors will focus on the US Personal Consumption Expenditure Price Index (PCE) data for May, which will be released on Friday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.