US Dollar Index falls toward 99.50 as Fed officials express economic concerns

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

US Dollar Index declines as Fed officials highlighted a drop in both business and consumer confidence.

Atlanta Fed Bostic alerted that the inconsistent and shifting tariff policies by the Trump administration risk disrupting US trade logistics.

The US Dollar has extended its losses since Moody’s downgraded the US credit rating from Aaa to Aa1.

The US Dollar Index (DXY), which tracks the US Dollar (USD) against a basket of six major currencies, is extending its losses for the third successive session and trading lower at around 99.70 during the Asian hours on Wednesday. The Greenback depreciates, pressured by cautious remarks from Federal Reserve (Fed) officials regarding the economic outlook and business sentiment.

San Francisco Fed President Mary C. Daly and Cleveland Fed President Beth Hammack stated growing concerns about the US economy. While key economic indicators remain robust, both officials pointed to deteriorating business and consumer confidence, attributing part of the sentiment shift to US trade policy.

Meanwhile, no Fed official agreed to ease tightening amid an ongoing economic slowdown in the United States (US). On Monday, the Atlanta Fed President Raphael Bostic said that he favors one cut in 2025. Bostic also warned that the inconsistent and shifting tariff policies introduced during the Trump administration risk disrupting US trade logistics, which are heavily dependent on large-scale imports to satisfy domestic demand.

The US Dollar continues to struggle since Moody’s announced its downgrade of the US credit rating from Aaa to Aa1. This move follows similar downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011.

Moody’s also forecasts US federal debt to rise to around 134% of GDP by 2035, up from 98% in 2023, with the budget deficit expected to increase to nearly 9% of GDP. This deterioration is attributed to rising debt-servicing costs, expanding entitlement programs, and falling tax revenues.

US Dollar PRICE Today

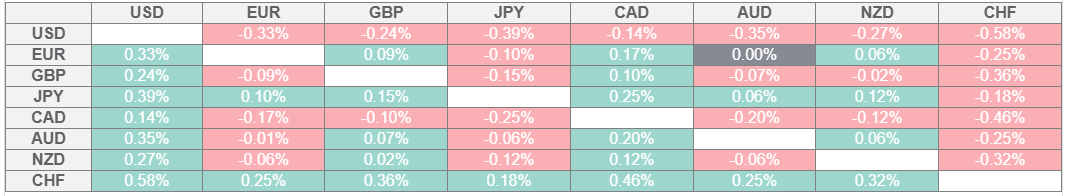

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.