US Dollar Index (DXY) surges past 101.00, hits one-month top on US-China trade deal optimism

The USD regains positive traction following Friday's modest downtick and jumps to over a one-month high.

The US-China trade deal optimism eases recession fears and boosts the USD amid the Fed's hawkish pause.

The benchmark 10-year US Treasury yield touches a nearly one-month high and further benefits the buck.

The US Dollar Index (DXY), which tracks the Greenback against a basket of currencies, catches aggressive bids at the start of a new week and rallies to over a one-month top, around the 101.35-101.40 region during the early European session. The latest leg of a sudden spike over the past hour or so followed the highly anticipated US-China joint statement on the first round of trade talks held over the weekend in Geneva, Switzerland.

The US will modify the application of the rate of duty on articles of China for an initial period of 90 days, and now only a 10% base rate will be applied. China will also suspend its tariffs on the US, marking the end of the tit-for-tat trade war between the world's two largest economies. The positive development helps to ease market concerns about a recession in the US, which, along with the Federal Reserve's (Fed) hawkish pause, provides a strong boost to the US Dollar (USD).

The US central bank signaled last week that it is not leaning towards cutting interest rates anytime soon amid rising near-term inflation expectations on the back of US tariffs. The outlook continues to push the US Treasury bond yields higher, with the benchmark 10-year yield hitting its highest level since April 14 and providing an additional boost to the Greenback. The safe-haven buck, meanwhile, seems rather unaffected by a fresh wave of global risk-on trade.

As investors digest positive trade-related developments, the market focus now shifts to the release of the latest US inflation figures – the Consumer Price Index (CPI) and the Producer Price Index (PPI) on Wednesday and Thursday, respectively. Apart from this, Fed Chair Jerome Powell's appearance on Thursday will be looked for more cues about the future rate-cut path. This, in turn, will influence the USD price dynamics and provide a fresh directional impetus to the index.

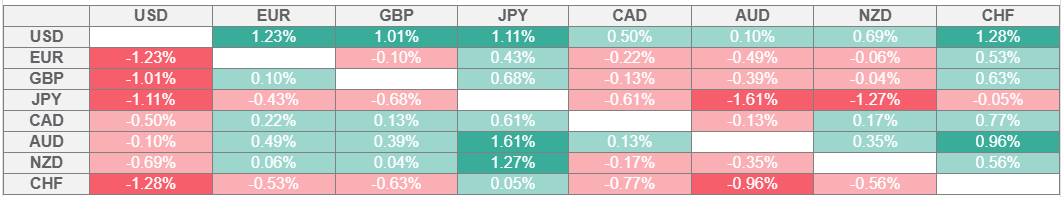

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.