US Dollar Index maintains position above 99.00 as US-China trade concerns weaken

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

The US Dollar Index is finding support amid renewed optimism surrounding US-China trade relations.

Trump has indicated a readiness to ease tariffs on Chinese goods, while Beijing has exempted selected US imports.

The Greenback remains vulnerable, as the unpredictability of Trump’s trade policy continues to undermine investor confidence in US assets.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against a basket of six major currencies, is rebounding after falling over 0.50% in the previous session. The DXY is trading around 99.20 during the European hours on Monday.

The US Dollar’s recovery is supported by renewed optimism over US-China trade relations. US President Donald Trump has signaled a willingness to ease tariffs on Chinese goods, while Beijing has announced exemptions for certain US imports. These developments have fueled hopes for a resolution to the prolonged trade dispute between the world’s two largest economies.

Trump also underscored ongoing progress in negotiations and confirmed continued dialogue with Chinese President Xi Jinping. According to the *Wall Street Journal*, the President is aiming to reduce the impact of automotive tariffs by eliminating overlapping duties on foreign-made vehicles and cutting tariffs on imported auto parts.

Despite this positive momentum, the Greenback remains vulnerable due to the unpredictable nature of Trump’s trade policy, which has at times eroded investor confidence in US assets. Any renewed tensions in the US-China trade dispute could place further downside pressure on the USD, potentially shifting investor preference toward the euro and other alternatives.

Meanwhile, US Treasury Secretary Scott Bessent noted on Monday that he held discussions with Chinese officials last week but did not address tariffs. He emphasized that while communication between the two governments continues, it is up to Beijing to take the first steps toward easing trade tensions, citing the existing trade imbalance.

Traders are awaiting a series of key US economic releases this week, including the preliminary Q1 GDP report, March PCE inflation data, and April Nonfarm Payrolls. These indicators are expected to provide critical clues about the Federal Reserve’s next policy steps and the overall economic trajectory.

US Dollar PRICE Today

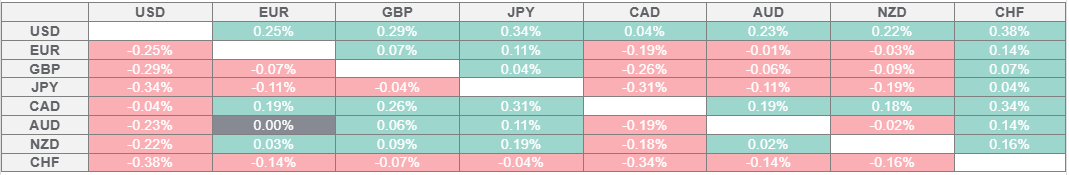

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.