Here is what you need to know on Monday, May 26:

The US Dollar (USD) continues to weaken against its major rivals to begin the new week as investors remain cautious about the economic growth prospects following United States (US) President Donald Trump's latest tariff threats. Stock and bond markets in the US will remain closed in observance of the Memorial Day holiday on Monday.

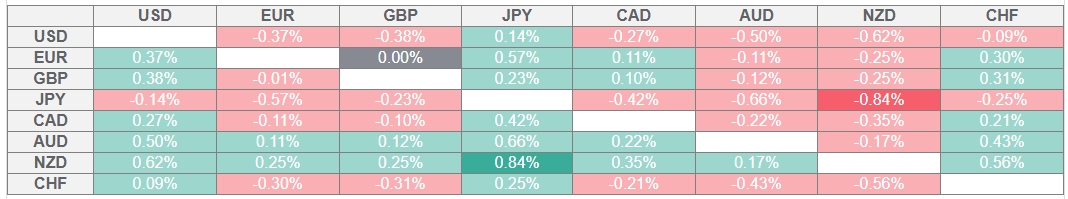

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

President Trump said on Friday that he is recommending a "straight 50% tariff" on imports from the European Union (EU), adding that their discussions were going nowhere. Additionally, he noted that he was planning to impose tariffs on Apple iPhones not manufactured in the US and suggested that they could do something similar with Samsung products. The USD Index extended its slide on Friday and lost nearly 2% for the week.

President Trump announced on Sunday that he agreed to an extension on the 50% tariff deadline on the EU until July 9 after a phone call with European Commission President Ursula von der Leyen. Nevertheless, the USD Index continues to stretch lower early Monday and was last seen trading at its lowest level in a month near 98.80, losing about 0.3% on the day. Meanwhile, US Senator Ron Johnson told CNN News on Sunday that he thinks that they will have enough votes to stop President Trump's spending/tax cut bill until he gets serious about spending reduction and reducing the deficit.

EUR/USD benefits from the broad-based USD weakness and trades at a fresh multi-week high above 1.1400 in the European morning on Monday. Later in the session, European Central Bank (ECB) President Christine Lagarde is scheduled to deliver a speech.

GBP/USD extends its rally after gaining nearly 2% in the previous week and trades at its highest level since February 2022 above 1.3550.

USD/JPY stays relatively quiet and fluctuates in a tight channel below 143.00 after losing more than 2% last week.

Gold capitalized on safe-haven flows and registered impressive gains last week. XAU/USD corrects lower early Monday and trades below $3,350.

USD/CAD stays under bearish pressure following the previous week's sharp decline and trades below 1.3700 for the first time in 2025.

AUD/USD preserves its bullish momentum after rising more than 1% on Friday and trades at a fresh 2025-high above 0.6500.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.