The Australian Dollar depreciates as the US Dollar extends its gains on Wednesday.

Australia’s Monthly Consumer Price Index remained steady at a 2.4% increase YoY in April, against the expected 2.3% rise.

The Greenback gained ground as the US Consumer Confidence Index increased to 98.0 in May from a previous 86.0 reading.

The Australian Dollar (AUD) extends its losses against the US Dollar (USD) on Wednesday for the third successive session. The AUD/USD pair loses ground after the release of the Monthly Consumer Price Index (CPI). However, the Australian Bureau of Statistics reported that monthly inflation, in the price of a fixed basket of goods and services acquired by household consumers, steadied at 2.4% year-over-year in April, surpassing the expected 2.3% increase.

The Reserve Bank of Australia (RBA) restarted its cutting cycle by delivering a 25 basis points rate cut last week. The Aussie central bank acknowledged progress in curbing inflation and warned that US-China trade barriers pose downside risks to economic growth.

National Australia Bank (NAB) expects the RBA to adopt a less dovish stance and continue to see the need for the central bank to return the cash rate to a neutral stance over the coming months. However, the NAB has lifted terminal rate expectation to 3.1% from the previous 2.6%.

The RBA is expected to deliver further interest rate cuts in the upcoming policy meetings, which could put a limit on the Australian Dollar’s upside. Markets are pricing in a 65% odds of another rate cut in July, with expectations of a total 75 bps in easing by the first quarter of 2026. Governor Michele Bullock stated that the central bank is prepared to take additional action if the economic outlook deteriorates sharply, raising the prospect of future rate cuts.

Australian Dollar depreciates as US Dollar extends gains amid stronger consumer confidence

The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, is rising following a more than 0.50% gain in the previous session. The DXY is trading around 99.70 at the time of writing. The Greenback received support from the stronger US Consumer Confidence data released on Tuesday. Traders likely await the FOMC Minutes, which are due later on Wednesday.

The Conference Board's Consumer Confidence Index increased to 98.0 in May from 86.0 (revised from 85.7), suggesting a growing optimism among US consumers. Meanwhile, US Durable Goods Orders declined by 6.3% in April against a 7.6% increase prior (revised from 9.2%), the US Census Bureau showed on Tuesday. This figure came in better than the estimated decrease of 7.9%.

Additionally, the US Dollar received some support as the long-term US yields declined. At the time of writing, the 10- and 30-year yields on US Treasury bonds are standing at 4.46% and 4.97%, respectively.

The US fiscal deficit could increase further when Trump's “One Big Beautiful Bill” goes through the Senate floor, increasing the risk of bond yields staying higher for longer. Higher bond yields can keep borrowing costs higher for consumers, businesses, and governments. Trump’s bill is expected to increase the deficit by $3.8 billion, as it would deliver tax breaks on tip income and US-manufactured car loans, according to the Congressional Budget Office (CBO).

US Senator Ron Johnson told CNN on Sunday that "I think we have enough votes to stop the process until the president gets serious about spending reduction and reducing the deficit.” Johnson added, “My primary focus now is spending. This is completely unacceptable. Current projections are a $2.2 trillion per year deficit.”

Moody’s downgraded the US credit rating from Aaa to Aa1, following similar downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011. Moody’s now projects US federal debt to climb to around 134% of GDP by 2035, up from 98% in 2023, with the budget deficit expected to widen to nearly 9% of GDP. This deterioration is attributed to rising debt-servicing costs, expanding entitlement programs, and falling tax revenues.

The AUD/USD pair may gain ground as the US Dollar is poised to face challenges amid rising concerns over the United States' (US) fiscal deficit. Additionally, the pair is expected to draw support from improving risk-on sentiment following the alleviated trade tension between the United States (US) and the European Union (EU). US President Donald Trump extended the tariff deadline on imports from the EU from June 1 to July 9.

Traders will keep an eye on Australia-China relations as China’s ambassador has criticised Australia’s plan to renege Darwin Port lease. The port was leased to the Chinese company Landbridge in 2015 for 99 years. The Chinese embassy called this decision an unfair and unethical move, per Reuters.

China Industrial Profits rose 3% year-over-year in April, following a previous growth of 2.6%. Additionally, the profits increased 1.4% YoY in the first four months of 2025, advancing from 0.8% growth in the January–March period. The Global Times, a Chinese state media outlet, reported that positive developments contributed to a rise in industrial profits in April.

Australian Dollar breaks below 0.6450, nine-day EMA

AUD/USD is trading around 0.6440 on Wednesday, with a prevailing bullish bias. The technical analysis of the daily chart indicates that the pair is remaining within the ascending channel pattern. However, the short-term price momentum weakened as the pair moved below the nine-day Exponential Moving Average (EMA). The 14-day Relative Strength Index (RSI) remains slightly above 50, suggesting upward momentum is in play.

On the upside, the AUD/USD pair could test the immediate barrier at the nine-day EMA of 0.6443, followed by a six-month high at 0.6537, which was recorded on May 26. A successful break above this level could reinforce the bullish bias and lead the pair to approach the upper boundary of the ascending channel around 0.6620.

The AUD/USD pair could test, amid weakening short-term price momentum, the ascending channel’s lower boundary around 0.6430, followed by the 50-day EMA at 0.6381.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

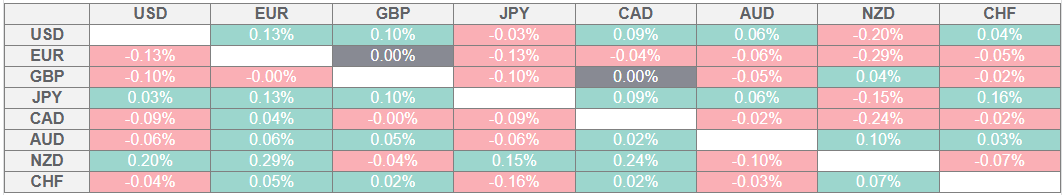

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.