The Euro extends its rebound from 161.00 to levels above 163.00.

The Yen is losing ground alongside a sharp decline in super long-term Japanese yields.

ECB’s Lagarde affirmed the Euro’s position as a viable alternative to the US Dollar.

The Euro is trading higher for the second consecutive day, still fuelled by the delay of Trump’s deadline to avoid 50% tariffs in the US, while the Yen declines alongside super long-term Japanese yields.

The pair extended its rebound from last week’s lows, at 161.00, to levels above 163.00 and is aiming for the 163.45 area, favoured by broad-based Yen weakness.

Japan is considering reducing long-term bond sales

News that Japan’s Ministry of Finance is considering reducing the super long-term bond issuance for the fiscal year has triggered a sharp decline in the yields of the 20, 30, and 40 JGB yields.

The hawkish comments by BoJ Governour Ueda, highlighting the upside risks of inflation, and keeping hopes for further rate hikes alive, have failed to provide any significant support to the Yen.

The Euro, on the other hand, maintains a moderately positive tone on higher hopes of a deal with the US, which will avoid high tariffs.

Comments from ECB President Lagarde on Monday, suggesting that the Euro might become a viable alternative to the US Dollar amid Trump’s erratic trade policy and growing concerns of a debt crisis, have provided additional support to the common currency.

Japanese Yen PRICE Today

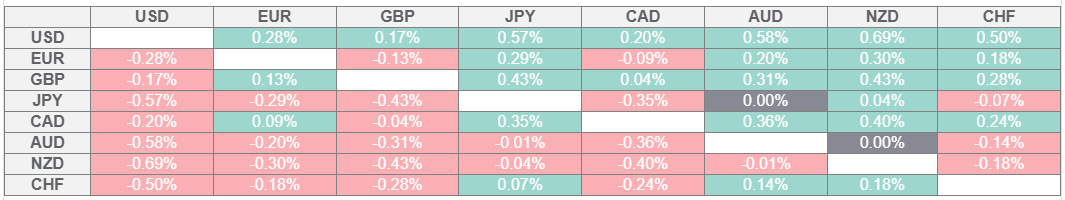

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.