Forex Today: US Dollar rebounds after long weekend, focus shifts to mid-tier US data

Here is what you need to know on Tuesday, May 27:

The US Dollar (USD) benefits from the improving risk mood early Tuesday, while trading conditions normalize following a three-day weekend in the US. The European Commission will publish business and consumer sentiment data for May. Later in the day, the US economic calendar will feature April Durable Goods Orders and May CB Consumer Confidence Index data.

US Dollar PRICE Today

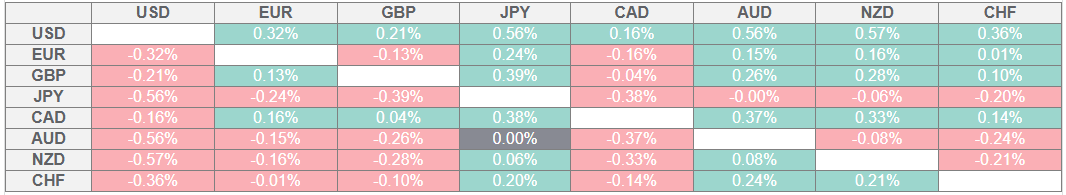

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index edged lower on Monday as markets adopted a cautious stance to start the week. In the European morning on Tuesday, US stock index futures rise more than 1% on the day and the USD Index recovers toward 99.50, reflecting a positive shift in risk sentiment.

EUR/USD stays under modest bearish pressure and trades at around 1.1350 in the early European session. The data from Germany showed on Tuesday that the GfK Consumer Confidence Index for June edged slightly higher to -19.9 from -20.8. This reading came in worse than the market expectation of -19.7.

During the Asian trading hours, Bank of Japan (BoJ) Governor Kazuo Ueda acknowledged that they are close to the inflation target than any time in the last few decades but added that they are not quite there yet. "In light of growing uncertainties, particularly those related to trade policy, we have recently revised down our economic and inflation outlook," Ueda added. After posting small gains on Monday, USD/JPY stretches higher early Tuesday and trades above 143.50.

GBP/USD loses its traction and trades in negative territory below 1.3550 after posting marginal gains on Monday.

NZD/USD turns south on Tuesday and trades below 0.6000. The Reserve Bank of New Zealand (RBNZ) will announce monetary policy decisions in the Asian session on Wednesday. The RBNZ is expected to lower the policy rate by 25 basis points.

Gold struggles to find demand as a safe haven and continues to push lower toward $3,300 after posting small losses on Monday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.