USD/CAD faces challenges due to a risk-on mood, driven by the news of the US scaling back its tariff deal goals.

Traders would likely gauge upcoming US employment data to gain fresh insights into the Fed interest rate decision in July.

White House’s Hassett said that the US would start trade talks after Canada suspended to impose digital services tax on US.

USD/CAD moves little after registering over half of a percent losses in the previous session, trading around 1.3600 during the early European hours on Tuesday. The pair may further depreciate amid improving market sentiment, driven by the news expecting the US President Donald Trump’s top trade officials are scaling back their goals for comprehensive reciprocal agreements with trading partners.

The Financial Times cited four people familiar with the discussions, saying that the US officials were seeking phased deals with the most engaged countries as they hurried to reach an agreement by the July 9 deadline, when Trump had vowed to reimpose his harshest levies, per the Financial Times.

The USD/CAD pair faced challenges as the US Dollar (USD) remains subdued amid growing uncertainty over the Federal Reserve (Fed) policy outlook and a rising fiscal concern in the United States (US). Additionally, traders adopt caution over a sweeping tax and spending bill currently under consideration in the Senate, which could add $3.3 trillion to the national debt.

Tuesday will see the US June ISM Manufacturing Purchasing Managers Index (PMI) data. Focus will shift toward US Nonfarm Payrolls (NFP), due later in the week, to gain fresh impetus on Fed monetary policy stance for the July decision.

Canada suspended its plans to charge a new digital services tax targeting US technology companies just hours before this was due to start on Monday, to advance stalled trade negotiations with the United States. On the other side, White House economic advisor Kevin Hassett noted that the US would immediately begin trade talks with Canada.

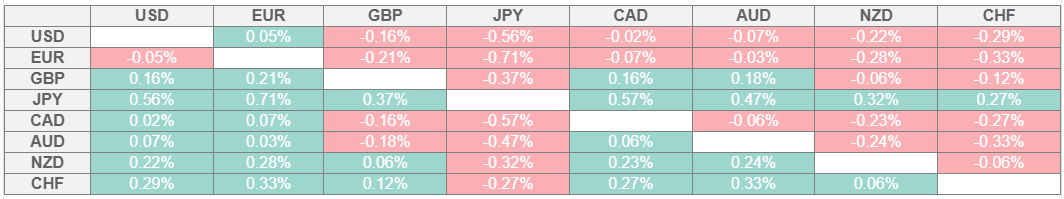

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.