Here is what you need to know on Tuesday, July 1:

Investors will keep a close eye on comments from central bankers as the European Central Bank's (ECB) Forum on Central Banking held in Sintra, Portugal, gets underway. Federal Reserve (Fed) Chairman Jerome Powell, ECB President Christine Lagarde, Bank of England (BoE) Governor Andrew Bailey and Bank of Japan (BoJ) Governor Kazuo Ueda will participate in a policy panel later in the day.

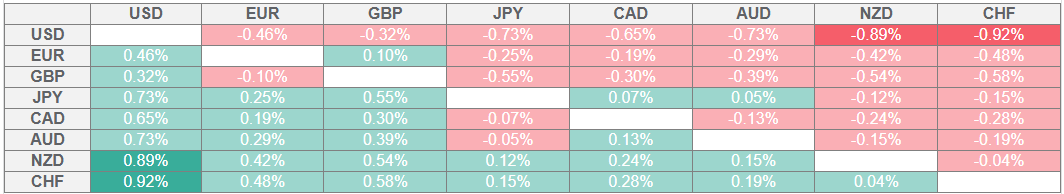

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Following a quiet European session, the US Dollar (USD) came under renewed selling pressure in the American session on Monday and the USD Index lost about 0.5%. White House press secretary Karoline Leavitt told reporters on Monday that US President Donald Trump sent a handwritten note to Fed Chairman Powell, urging him to lower interest rates. She added that Trump believes interest rates should be lowered to about 1%.

On Tuesday, the US economic calendar will feature JOLTS Job Openings data for May and the Institute for Supply Management (ISM) will release the Manufacturing Purchasing Managers' Index (PMI) report for June. In the European session, the USD Index struggles to gain traction and stays in negative territory at around 96.70. Meanwhile, US stock index futures lose between 0.1% and 0.2%, reflecting a cautious market stance.

EUR/USD benefited from the broad-based selling pressure surrounding the USD and climbed above 1.1800 for the first time since September 2021. The pair corrects lower in the European morning and trades near 1.1780. Eurostat will publish preliminary June Harmonized Index of Consumer Prices (HICP) data for the Eurozone.

BoE Governor Bailey reiterated on Tuesday that the path of interest rates will continue to be gradually downwards. He further added that the labour market is softening but noted that they have to watch very carefully for consequences of inflation. Following these comments, GBP/USD clings to modest daily gains at around 1.3750.

After posting small losses on Monday, USD/JPY gathers bearish momentum and loses about 0.5% below 143.50 in the European morning on Tuesday.

The data from China showed that the Caixin Manufacturing PMI improved to 50.4 in June from 48.3 in May. This reading came in better than the market expectation of 49. After rising nearly 0.8% on Monday, AUD/USD continues to stretch higher and trades at a fresh 2025-top near 0.6600.

Gold extends its rebound from multi week lows and gains more than 1% on the day to trade around $3,350.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.