Forex Today: Trump's renewed tariff threats weigh on USD, lift Gold

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

Here is what you need to know on Monday, October 13:

Markets adopt a cautious stance to begin the week after United States (US) President Donald Trump announced late Friday that they will impose 100% tariffs on Chinese imports. The economic calendar will not feature any high-tier data releases on Monday, allowing the risk mood to remain as the primary market driver.

US Dollar Price Today

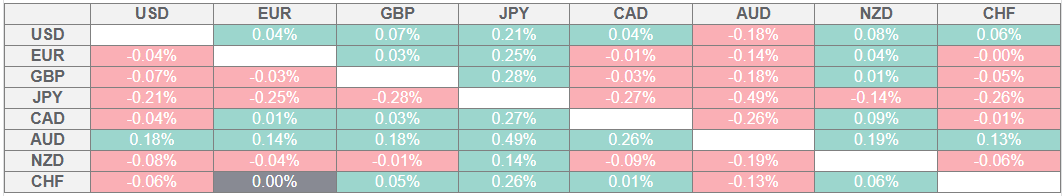

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

In a post published on Truth Social late Friday, Trump said that he learned that China has taken an "extraordinarily aggressive position" on trade, telling trading partners that they are going to impose large scale export controls on virtually every product they make.

"Based on the fact that China has taken this unprecedented position, and speaking only for the USA, and not other Nations who were similarly threatened, starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying," Trump said in response.

The US Dollar (USD) came under heavy selling pressure toward the end of the week and Wall Street's main equity indexes declined sharply. After losing more than 0.5% and snapping a four-day winning streak on Friday, the USD Index clings to modest recovery gains at around 99.00 in the European morning on Monday. Meanwhile, US stock index futures rise between 1% and 2%. Bond markets in the US will remain closed in observance of the Columbus Day holiday on Monday but both the New York Stock Exchange (NYSE) and Nasdaq will be operational during their regular hours.

Following the deep correction seen on Thursday, Gold reversed its direction and closed in positive territory on Friday. XAU/USD preserves its bullish momentum to start the new week and trades at a new all-time peak above $4,070 in the European morning.

EUR/USD struggles to build on Friday's gains and holds steady at around 1.1600 in the European session. French President Emmanuel Macron re-appointed Prime Minister Sebastien Lecornu, who is now expected to present the 2026 budget ahead of the Tuesday deadline.

GBP/USD stays under modest bearish pressure and trades slightly below 1.3350 early Monday. On Tuesday, the UK's Office for National Statistics will publish labor market data for September.

After losing more than 1% on Friday, USD/JPY opened with a bullish gap and continued to stretch higher during the European trading hours. At the time of press, USD/JPY was up more than 0.7% on the day at 152.30.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.