GBP/USD holds steady around 1.3740, remains close to multi-year top amid a bearish USD

GBP/USD trades with a mild positive bias on Tuesday amid sustained USD selling bias.

Fed rate cut bets, US fiscal concerns, and a positive risk tone weigh on the Greenback.

Bulls look to BoE Governor Bailey and Fed Chair Powell’s remarks for a fresh impetus.

The GBP/USD pair edges higher during the Asian session on Tuesday and currently trades around the 1.3740 area, just below its highest level since October 2021 touched last week amid a bearish US Dollar (USD).

The USD Index (DXY), which tracks the Greenback against a basket of currencies, slides to its lowest level since February 2022 amid expectations that the Federal Reserve (Fed) would resume its rate-cutting cycle in the near future. Traders are currently pricing in a smaller chance that the next rate reduction by the Fed will come in July and see a roughly 74% probability of a rate cut as soon as September. The bets were reaffirmed by the US Personal Consumption Expenditures (PCE) report on Friday, which showed that consumer spending unexpectedly declined in May.

Adding to this concerns about the worsening US fiscal condition keep the USD bulls on the defensive. The Senate narrowly approved a procedural vote to open debate on Trump’s comprehensive “One Big Beautiful Bill”. The bill would add around $3.3 trillion to the federal deficit over the next decade. Furthermore, the prevalent risk-on environment contributes to the bearish sentiment surrounding the safe-haven Greenback. This, in turn, is seen as a key factor acting as a tailwind for the GBP/USD pair and supports prospects for a further near-term appreciating move.

Traders, however, seem reluctant to place aggressive bets and opt to wait for Bank of England (BoE) Andrew Bailey and Fed Chair Jerome Powell's appearance at the European Central Bank’s (ECB) Forum on Central Banking 2025 in Sintra. Investors will look for cues about the central bank's policy outlook. Apart from this, the US macro data – the ISM Manufacturing PMI and Job Openings and Labor Turnover Survey (JOLTS) – should provide some meaningful impetus to the GBP/USD pair. Nevertheless, the aforementioned fundamental backdrop favors bullish traders.

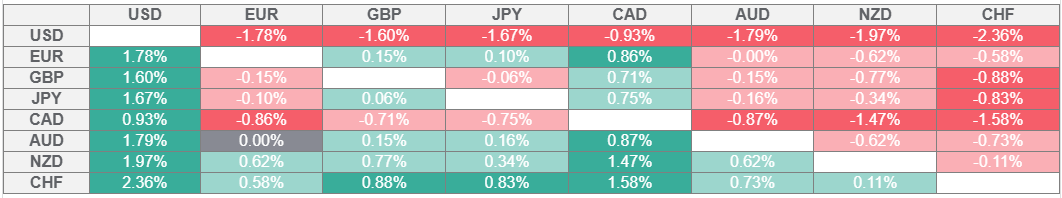

US Dollar PRICE Last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.