Australian Dollar rises after Trump and Albanese sign USD 8.5 billion US–Australia critical minerals deal.

US and Australia pledged to invest at least USD 1 billion each in mining and processing projects over six months.

The US Dollar continues to weaken due to the ongoing government shutdown and growing Fed rate cut bets.

The Australian Dollar (AUD) advances against the US Dollar (USD) on Tuesday, extending its gains for the third successive session. The AUD/USD pair appreciates as the AUD receives support from improved market sentiment amid progress on a United States (US)-Australia trade agreement.

US President Donald Trump and Australian Prime Minister Anthony Albanese signed an USD 8.5 billion critical minerals agreement at the White House on Monday, aimed at securing access to Australia’s abundant rare-earth resources amid China’s tighter export controls.

The US and Australia committed to investing at least USD 1 billion each over the next six months in mining and processing projects, while also agreeing to establish a price floor for critical minerals. Trump noted that the agreement had been “negotiated over several months,” while Albanese described it as taking US–Australia relations “to the next level.”

President Trump also said he expects to reach a “fair deal” with China’s President Xi Jinping during their upcoming meeting in South Korea, signaling a possible easing of trade tensions. However, US Trade Representative Jamieson Greer adopted a tougher stance, accusing Beijing of engaging in a “broader pattern of economic coercion” targeting companies making strategic investments in critical US industries. Any shift in China’s economic conditions could also affect the Australian dollar (AUD), given the close trade ties between China and Australia.

US Dollar declines as government shutdown extends into third week

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is losing ground for the second consecutive day and trading around 98.50 at the time of writing. The Greenback struggles amid the ongoing US government shutdown continues to weigh on the broader economic outlook. Additionally, the increased likelihood of Fed rate cuts put downward pressure on the US Dollar.

The US federal government shutdown has entered its third week, with no clear end in sight amid a partisan fight in the Senate over federal funding priorities. The shutdown is now the third-longest funding lapse in modern history.

St. Louis Fed President Alberto Musalem spoke at the Institute of International Finance Annual Membership Meeting in Washington, DC, on Friday that he could support a path with another rate cut if more risks to jobs emerge and inflation is contained. Musalem added that the Fed should not be on a preset course and follow a balanced approach.

US Federal Reserve (Fed) Governor Christopher Waller stated on Thursday that he supports another interest rate cut at this month’s upcoming policy meeting. Meanwhile, the Fed’s newest governor, Stephen Miran, reiterated his call for a more aggressive rate-cut trajectory for 2025 than that favored by his colleagues.

Federal Reserve Chair Jerome Powell stated last week that the central bank is on track to deliver another quarter-point interest-rate reduction later this month, even as a government shutdown significantly reduces its read on the economy. Powell highlighted the low pace of hiring and noted that it may weaken further.

The CME FedWatch Tool indicates that markets are now pricing in nearly a 99% chance of a Fed rate cut in October and a 99% possibility of another reduction in December.

The People’s Bank of China (PBOC) decided on Monday to keep its its one- and five-year Loan Prime Rates (LPRs) unchanged at 3.00% and 3.50%, respectively.

China’s Gross Domestic Product (GDP) grew 4.8% year-over-year (YoY) in the third quarter (Q3) of 2025, as expected following a 5.2% growth in the second quarter. Meanwhile, the economy expanded 1.1% quarter-over-quarter (QoQ), surpassing the market consensus of 0.8% print.

China’s annual June Retail Sales increased by 3.0% in September, against 2.9% expected and 3.4% prior, while Industrial Production came in at 6.5% vs. 5.0% estimate and August’s 5.2%.

The Reserve Bank of Australia (RBA) is expected to deliver a rate cut in November, driven by a surprise uptick in the Unemployment Rate, which rose to 4.5% in September, jumping to a near four-year high. The figure came in above the market consensus and the previous 4.3%.

Australian Dollar struggles to break above nine-day EMA amid bearish bias

AUD/USD is trading around 0.6510 on Tuesday. Technical analysis of a daily chart suggests a persistent bearish bias, with the pair trading within a descending channel. The 14-day RSI remains below 50, strengthening the bearish outlook.

On the downside, the AUD/USD pair may navigate the area around the lower boundary of the descending channel, aligned with the four-month low of 0.6414, recorded on August 21. Further declines below this confluence support zone would strengthen the bearish bias and prompt the pair to test the five-month low of 0.6372.

The AUD/USD pair is testing the immediate barrier at the nine-day Exponential Moving Average (EMA) of 0.6517, followed by the 50-day EMA at 0.6546 and the descending channel’s upper boundary around 0.6570.

AUD/USD: Daily Chart

Australian Dollar Price Today

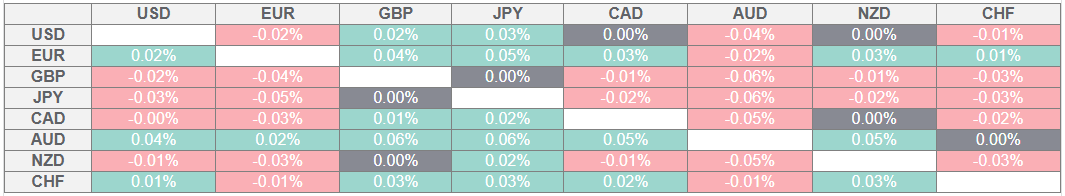

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.