Australian Dollar weakens as RBA rate cut expectations rise

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- After Upheaval in the World’s Largest Oil Reserve Holder, Who Will Emerge as the Biggest Winner in Venezuela’s Oil Market?

- US Q4 Earnings Season Set to Begin: Can US December CPI Data Bolster Rate Cut Case? [Weekly Preview]

- Trump’s Tariff Ruling Lands Today: Market to Rise or Fall — The Decision Will Tell

- Gold Price Forecast: XAU/USD declines to near $4,450 as safe-haven demand eases

- Silver Price Analysis: XAG/USD explodes above $80 as rally extends

The Australian Dollar declines as RBA is widely expected to deliver a 25 basis point rate cut next week.

The prospects for an RBA rate cut have strengthened as core inflation eased, with continued economic momentum in June.

Trump has nominated Stephen Miran to replace Adriana Kugler on the Federal Reserve Board of Governors.

The Australian Dollar (AUD) depreciates against the US Dollar (USD) on Friday, after three days of gains. The AUD/USD pair loses ground as traders are pricing in over 92% odds of a 25 basis point rate cut by the Reserve Bank of Australia (RBA) next week, which would bring the cash rate down to 3.60%.

The likelihood of an RBA rate cut has increased as core inflation eased to 2.7% in June, well within the RBA’s 2–3% target, along with rising unemployment and slowing wage growth. Supporting this outlook, Australia’s Trade Surplus increased to 5,365 million month-over-month in June, surpassing the expected 3,250 million, while exports grew by 6.0% month-over-month, signaling continued economic momentum.

According to Reuters, US President Donald Trump warned China, Australia’s close trading partner, that he could impose further tariffs similar to the 25% levies announced earlier on India over its Russian Oil purchases, depending on future developments.

Australian Dollar declines as US Dollar recovers recent losses

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is gaining ground and trading around 98.10 at the time of writing.

Trump has nominated Stephen Miran, chair of the Council of Economic Advisors, to succeed Adriana Kugler on the Federal Reserve Board of Governors. Traders will also keep their eyes on Trump’s plans to replace Fed Chair Powell. Fed Governor Christopher Waller is emerging as a top candidate to serve as the central bank’s chair among Trump’s advisers, per Bloomberg.

US Initial Jobless Claims showed that the number of US citizens submitting new applications for unemployment insurance increased to 226K for the week ending August 2. This figure came in above the market consensus of 221K and was higher than the previous week’s 218K.

The July US Nonfarm Payrolls (NFP) report pointed to a cooling labor market. boosted expectations that the US Federal Reserve (Fed) will deliver a 25 basis point rate cut in September. Markets have priced in nearly a 93% possibility of a 25 basis point (bps) cut at the September meeting, up from 48% a week ago, according to the CME FedWatch tool.

Federal Reserve Bank of San Francisco President Mary Daly said on Wednesday that the Fed still has some ground to cover on its fight with inflation pressures despite overall progress. Daly highlighted that the Fed may be forced to act soon without having the full picture.

Boston Fed President Susan Collins and Fed Board of Governors member Lisa Cook cautioned that persistent uncertainty remains a major obstacle to effective policy transmission and challenges the central bank’s ability to manage interest rates efficiently.

The US and China were unable to reach an agreement on extending the 90-day tariff pause during their latest round of talks in Stockholm, Sweden. The current pause is set to expire on August 12, with the final decision resting in the hands of US President Donald Trump. In the meantime, US tariffs have been lowered from 145% to 30%, while Chinese tariffs have been reduced from 125% to 10%.

China's Trade Balance arrived at CNY705.10 billion in July, expanding from the previous figure of CNY585.96 billion. Exports rose 8.0% YoY in July following 7.2% in June, while imports increased 4.8% YoY against 2.3% recorded previously. In US Dollar (USD) terms, China’s Trade Balance arrived at +98.24 billion versus +105 billion expected and +114.77 billion priors.

Australia was spared from the latest United States (US) tariff hikes, indicating that President Donald Trump had left the 10% baseline tariffs on Australian goods unchanged.

Australian Dollar remains above 0.6500, near nine-day EMA

The AUD/USD pair is trading around 0.6510 on Friday. Technical analysis on the daily chart suggests a bullish market sentiment, with the 14-day Relative Strength Index (RSI) positioning above the 50 level. Additionally, the pair remains above the nine-day Exponential Moving Average (EMA), signaling that short-term momentum is strengthening.

On the upside, the AUD/USD pair could explore the area around the psychological level of 0.6600, followed by the nine-month high at 0.6625, which was recorded on July 24.

The AUD/USD pair may test the nine-day EMA at 0.6501, aligned with the 50-day EMA at 0.6498. Further declines below could weaken the short- and medium-term price momentum and prompt the pair to test the two-month low of 0.6419, which was recorded on August 1, followed by a three-month low at 0.6372, recorded on June 23.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

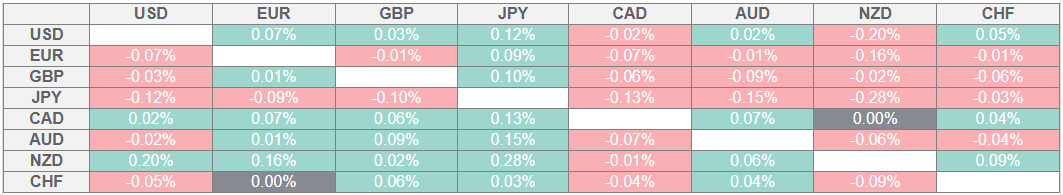

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.