Australian Dollar weakens due to market caution amid ongoing geopolitical tensions

The Australian Dollar edges lower as traders adopt caution amid the ongoing war between Israel and Iran.

The AUD may regain ground due to optimism after Iran reportedly asked for an immediate ceasefire.

Traders await the US Retail Sales data for May due on Tuesday.

The Australian Dollar (AUD) declines against the US Dollar (USD) on Tuesday, retracing its recent gains registered in the previous session. The AUD/USD pair faces challenges as traders adopt caution amid ongoing geopolitical tensions.

However, the risk-sensitive AUD/USD pair gained ground due to optimism after Iran reportedly asked many countries, including Oman, Qatar, and Saudi Arabia, to urge US President Donald Trump to use his influence on Israel for an immediate ceasefire, per Reuters. Moreover, risk sentiment improved as the Canadian Prime Minister Mark Carney had agreed with Trump that their two nations should try to wrap up a deal on tariffs within 30 days.

Traders await Australia’s upcoming labor data this week, including Employment Change and Unemployment Rate, which are expected to offer fresh impetus on the strength of the domestic economy and shape expectations for the Reserve Bank of Australia’s (RBA) policy outlook.

Australian Dollar declines as US Dollar edges higher due to risk aversion

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading higher at around 98.20 at the time of writing. The US Retail Sales data for May will be eyed on Tuesday. The focus will shift to the Federal Reserve's (Fed) interest rate decision, due on Wednesday.

On Monday, President Trump called for the evacuation of Iran’s capital, Tehran, hours after urging the country's leaders to accept a deal to limit its nuclear program, as Israel hinted that attacks would continue, per Bloomberg.

Trump posted in a social media post, “What a shame, and a waste of human life. Simply stated, IRAN CAN NOT HAVE A NUCLEAR WEAPON. I said it over and over again! Everyone should immediately evacuate Tehran. Iran should have signed the ‘deal’ I told them to sign.”

The University of Michigan (UoM) reported on Friday that the Consumer Sentiment Index climbed to 60.5 in June from 52.2 prior. This reading came in above the market consensus of 53.5.

The US Producer Price Index (PPI) climbed 0.1% month-over-month in May, compared to a decline of 0.2% (revised from -0.5%). This reading came in softer than the expected 0.2% rise. Meanwhile, the core PPI, excluding food and energy, increased 0.1% MoM in May versus -0.2% prior (revised from -0.4%), below the consensus of 0.3%.

The US Federal Reserve (Fed) is expected to keep its policy rate unchanged within the 4.25%–4.50% range in its upcoming decision on Wednesday. Traders now expect a 25 basis point rate cut by September.

Reuters reported Thursday that President Trump expanded steel tariffs starting June 23 on imported “steel derivative products,” including household appliances, such as dishwashers, washing machines, refrigerators, etc. The tariffs were initially imposed at 25% in March and later doubled to 50% for most countries. This is the second time the scope of affected products has been expanded.

China Retail Sales rose 6.4% year-over-year in May, surpassing the 5.0% expected and April’s 5.1% increase. Meanwhile, Industrial Production increased 5.8% YoY, but came in below the 5.9% forecast and 6.1% prior.

Moreover, the National Bureau of Statistics (NBS) in China noted that the domestic economy is expected to have remained generally stable for the first half (H1) of 2025. However, economic growth in China may struggle since the second quarter due to uncertain trade policies.

Australian Dollar falls to near nine-day EMA, tests 0.6500

AUD/USD is trading around 0.6510 on Tuesday. The bullish bias prevails, as the daily chart’s technical analysis indicates that the pair remains within the ascending channel. Moreover, the 14-day Relative Strength Index (RSI) remains above the 50 mark, suggesting a prevailing bullish outlook. Additionally, the pair is positioned above the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is stronger.

The pair may target the fresh seven-month high of 0.6552, which was reached on June 16. A break above this level could support the pair to target the eight-month high at 0.6687, followed by the upper boundary of the ascending channel around 0.6730.

On the downside, the AUD/USD pair may test the nine-day EMA at 0.6506, followed by the ascending channel’s lower boundary around 0.6470. A break below the channel would indicate the weakening of the bullish bias and put downward pressure on the pair to test the 50-day EMA at 0.6431.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

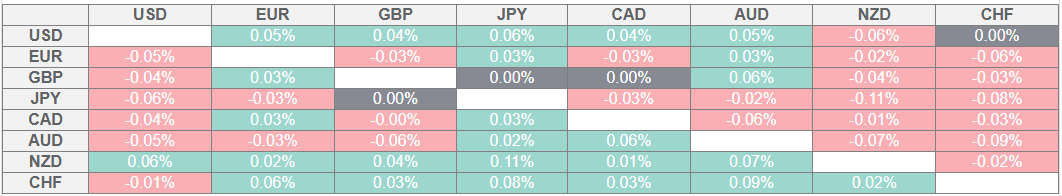

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.