Australian Dollar holds ground following Trade Balance, China Services PMI data

The Australian Dollar maintains its position despite a decline in Australia’s trade surplus.

China’s Caixin Services PMI came at 51.1 in May, improving from 50.7 in April.

The US Dollar continues to struggle after the weaker economic data released on Wednesday.

The Australian Dollar (AUD) extends its gains for the second successive session against the US Dollar (USD) on Thursday. The AUD/USD pair remains stronger following the release of domestic trade balance and China’s Caixin Services Purchasing Managers’ Index (PMI) data.

Australia’s trade surplus fell to 5,413M month-over-month in April, came below the 6,100M expected and 6,892M (revised from 6,900M) in the previous reading. Exports declined by 2.4% MoM in April, against a 7.2% rise prior (revised from 7.6%). Meanwhile, Imports rose by 1.1%, compared to a decline of 2.4% (revised from -2.2%) seen in March. China’s Caixin Services PMI rose to 51.1 in May as expected, from 50.7 in April.

The AUD/USD pair also gained ground as the US Dollar continues to face challenges following the weaker economic data and rising economic uncertainty in the United States (US). Traders will likely observe the US Balance of Trade and the weekly Initial Jobless Claims later in the North American session.

Australian Dollar advances as US Dollar struggles amid rising tariff uncertainty

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is extending its losses and trading at around 98.70 at the time of writing. The Greenback receives downward pressure from dampened risk sentiment amid rising tariff uncertainty and its potential to hurt growth in the US economy.

Institute for Supply Management's (ISM) Services Purchasing Managers Index (PMI) declined to 49.9 in May, from 51.6 in April. This reading surprisingly came in weaker than the expected 52.0. Meanwhile, US ADP private sector employment rose 37,000 in May, against a 60,000 increase (revised from 62,000) recorded in April, far below the market expectation of 115,000.

House Republicans passed Trump’s “Big Beautiful Bill,” a multitrillion-dollar tax and spending package, which could increase the US fiscal deficit, along with the risk of bond yields staying higher for longer. This scenario raises concerns over the US economy and prompts traders to sell American assets under the “Sell America” trend. Policy experts anticipate Senate changes as GOP lawmakers aim to finalize the “big bill” by July 4.

Last week, Trump accused China of breaching a truce on tariffs reached earlier this month. Washington and Beijing agreed to temporarily lower reciprocal tariffs in a meeting in Geneva. Trump said that China had "totally violated its agreement with us." US Trade Representative Jamieson Greer also said that China had failed to remove non-tariff barriers as agreed. In response, a spokesperson from China’s Ministry of Commerce said on Monday that China had complied with the agreement by cancelling or suspending relevant tariff and non-tariff measures aimed at US "reciprocal tariffs."

China's Caixin Manufacturing Purchasing Managers' Index (PMI) unexpectedly fell to 48.3 in May from 50.4 in April, falling short of the market expectations of a 50.6 expansion. However, the weekend data showed that the National Bureau of Statistics (NBS) Manufacturing PMI rose to 49.5 in May, from April’s 49.0 reading. Meanwhile, the Non-Manufacturing PMI declined to 50.3 from the previous 50.4 figure, falling short of the expected reading of 50.6. The Aussie Dollar could be impacted by Chinese economic data as both countries are close trading partners.

Australian Bureau of Statistics (ABS) showed that Gross Domestic Product (GDP) grew by 0.2% quarter-over-quarter in Q1, declining from the previous 0.6% growth. Australia’s economy fell short of the expected 0.4% rise. Meanwhile, the annual GDP growth rate remained consistent at 1.3%, below the expected 1.5%.

The S&P Global Australia Composite Purchasing Managers’ Index (PMI) fell to 50.5 in May from April’s 51.0 reading, expanding for the eighth successive month. However, the pace indicates marginal growth in business activity, albeit the slowest so far in 2025.

The S&P Global Australia Services PMI came at 50.6 in May, marking a 16th straight month of expansion but at the slowest pace in six months. The Ai Group Manufacturing PMI posted a -23.5 reading, an improvement from the previous -26.5. Manufacturers experience delays in major projects and rising market hesitation due to global and domestic uncertainty.

Reserve Bank of Australia (RBA) Minutes of its May monetary policy meeting suggested that the board viewed the case for a 25 basis point cut as stronger, preferring a policy to be cautious and predictable. The policymakers highlighted that US trade policy posed a significant and adverse impact on the global outlook, but had not yet affected the Australian economy. However, they did not persuade that a 50 bps rate increase was needed.

RBA Assistant Governor Sarah Hunter expressed caution on Tuesday that “higher US tariffs will put a drag on the global economy.” Hunter noted that higher uncertainty could dampen investment, output, and employment in Australia. However, she also added that Australia’s exporters are relatively well-placed to weather the storm and assumes that Chinese authorities will support their economy through fiscal stimulus.

Australian Dollar challenges 0.6500 barrier ahead of seven-month peak

The AUD/USD pair is trading around 0.6500 on Thursday, with a persistent bullish bias. The daily chart’s technical analysis indicates that the pair remains within the ascending channel pattern. The short-term price momentum remains stronger as the pair stays above the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) is positioned above the 50 mark, suggesting a bullish outlook.

On the upside, the AUD/USD pair may target a seven-month high of 0.6537, which was recorded on May 26. Further advances explore the region around the upper boundary of the ascending channel around 0.6670.

The primary support appears at the nine-day EMA of 0.6468, aligned with the ascending channel’s lower boundary around 0.6460. A break below this crucial support zone could dampen the bullish bias and lead the AUD/USD pair to test the 50-day EMA at 0.6400.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

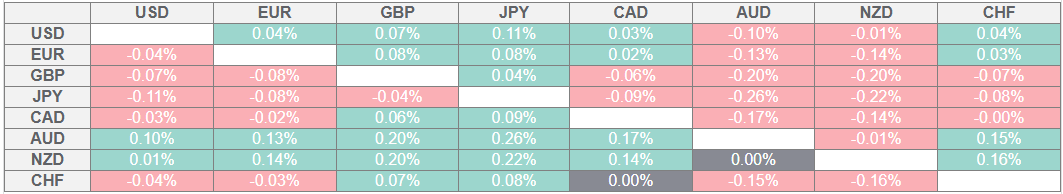

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.