The Euro hit a nearly two-month high at 1.1495 following the ECB’s decision.

ECB President Lagarde shocked investors with an unusually hawkish message.

Investors are focusing on the US Nonfarm Payrolls data on Friday.

EUR/USD is trading moderately lower on Friday, moving near the 1.1430 level at the time of writing, after having reached levels near 1.1500 the previous day. A hawkish European Central Bank (ECB) statement boosted the common currency on Thursday, but the market is turning more cautious while awaiting the US Nonfarm Payrolls (NFP) report due later.

The ECB cut interest rates by 25 basis points, lowering the key Rate On Deposit Facility to 2.0% as widely expected after Thursday’s monetary policy meeting. Still, President Christine Lagarde struck an exceptionally hawkish tone, suggesting that the easing cycle might be nearly over.

Investors pared back hopes of further ECB monetary easing for the coming months, and the Euro (EUR) rallied alongside the German Treasury bond’s appreciation.

The US Dollar (USD), on the contrary, remained on its back foot, weighed by a string of downbeat macroeconomic releases this week and the lack of progress in US President Donald Trump’s negotiations with trading partners.

The long-awaited phone call between Trump and Chinese President Xi Jinping has failed to bring any advance on the uncertain trade relationship between the world’s two major economies, but the positive comments from the republican have contributed to soothing investors.

Euro PRICE Today

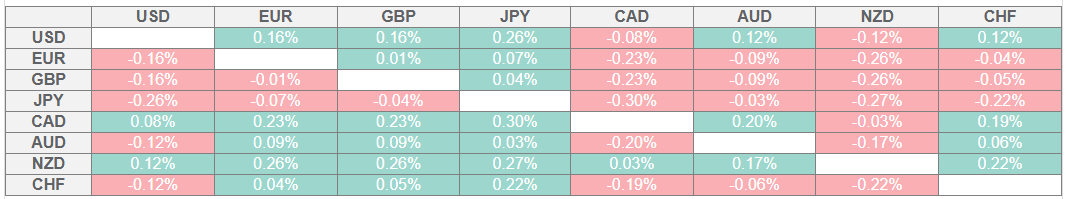

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The ECB signals the end of the cycle

The ECB President Christine Lagarde said on Thursday that the central bank is “in a good place to navigate uncertainties,” and suggested that it is nearing the end of the monetary easing cycle.

Regarding the economic outlook, Lagarde warned about downside risks to the economy and observed the highly uncertain inflation outlook. Her tone, however, was more optimistic than in previous meetings, which prompted investors to dial down hopes for further easing in the coming months.

Futures markets are now pricing only a 20% chance of another rate cut in July, from about 30% before the meeting, according to data by Reuters. The market is now betting on the possibility of just one more rate cut, which will probably take place in December.

In the Eurozone economic calendar, April’s retail sales will be the main attraction on Friday. Consumption year-over-year (YoY) is expected to remain growing at a steady pace in April, 1.4%, following a 1.5% growth in March.

Apart from that, ECB’s Lagarde will speak again, although she is unlikely to say anything new, before the release of the Eurozone’s final Q1 Gross Domestic Product (GDP), which is expected to be revised to a 0.4% quarterly growth from the previous 0.3% estimation. The yearly rate will probably be confirmed at 1.2%.

The highlight of the day, however, will be the US Nonfarm Payrolls report, which will be closely watched after a string of weak US releases this week. Private payrolls are expected to have grown by 130,000 in May from the previous 177,000, but the unemployment rate might have increased to 4.3% from the previous 4.2%. The US Dollar is likely to be more vulnerable to a negative surprise today.

Technical analysis: EUR/USD needs to stay above 1.1400 to confirm the bullish bias

EUR/USD is trading on a positive trend, printing higher highs and higher lows since mid-May as seen in the 4-hour chart below. The pair found sellers at the psychological 1.1500 level on Thursday, but the overall trend remains positive despite the weaker bullish momentum.

The pair is pulling back on Friday, with investors cautious ahead of the release of the US Nonfarm Payrolls report, as prices approach a key support area at 1.1400 (round number, upward-sloping trendline). Below there, the bullish trend would be challenged, with bears focusing on 1.1360 and 1.1315, which have been acting as support and resistance since mid-April.

On the upside, resistances are at 1.1495, which limited the recovery on Thursday, and the 261.8% Fibonacci extension at 1.1585.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.