Here is what you need to know on Friday, June 6:

Financial markets remain relatively quiet early Friday as investors move to the sidelines ahead of the highly-anticipated May employment report from the US, which will feature Nonfarm Payrolls, Unemployment Rate and wage inflation figures. Earlier in the day, the European economic calendar will offer revisions to first quarter Gross Domestic Product (GDP) and Employment Change data, alongside Retail Sales figures for April.

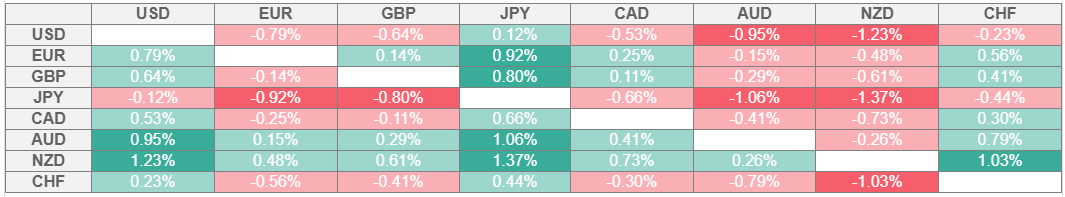

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The European Central Bank (ECB) announced on Thursday that it cut key rates by 25 basis points after the June policy meeting, as expected. In the post-meeting press conference, ECB President Christine Lagarde reiterated that they are confident that inflation will stabilize at their target level noted that they were getting to the end of the current monetary policy cycle. EUR/USD gained traction with the immediate reaction to Lagarde's comments and reached its highest level since late April near 1.1500. Although the pair corrected lower later in the American session, it ended the second consecutive day in positive territory. Early Friday, EUR/USD trades in a narrow channel below 1.1450.

The US Dollar (USD) came under renewed selling pressure following the disappointing Jobless Claims data on Thursday, which showed that the number of first-time applications for unemployment benefits rose to 247,000 from 239,000. Meanwhile, news of United States (US) President Donald Trump holding a phone call with Chinese President Xi Jinping to discuss trade helped the risk mood improve and limited the USD's losses.

Later in the American session, markets turned risk-averse as President Donald Trump and Tesla CEO Elon Musk got into a heated argument. Trump said that the easiest way to save money in the budget would be to terminate Musk's governmental subsidies and contracts. In response, Musk said that SpaceX will decommission its Dragon spacecraft, which is used to transport crews to and from the space station, immediately. When asked by a user whether he thinks that Trump should be impeached, Musk replied, "Yes." Tesla Inc stocks fell nearly 15% following this development and the tech-heavy Nasdaq Composite ended the day with a 0.8% loss. Early Friday, US stock index futures trade marginally higher on the day and the USD Index holds steady slightly below 99.00. Nonfarm Payrolls in the US are expected to rise by 130,000.

USD/CAD dropped to a fresh 2025-low below 1.3650 on Thursday before erasing its losses to close flat. In the European morning on Friday, the pair holds steady above 1.3670. Statistics Canada will publish employment data for May later in the day.

After reaching its strongest level since February 2022 above 1.3600 on Thursday, GBP/USD lost its traction. At the time of press, the pair was trading in negative territory at around 1.3550.

USD/JPY continues to stretch higher and trades near 144.00 after posting modest gains on Thursday.

Gold benefited from the broad-based USD weakness in the first half of the day on Thursday and climbed above $3,400. Growing optimism about improving US-China trade relations, however, weighed on XAU/USD. After losing about 0.6% on Thursday, XAU/USD stays in a consolidation phase above $3,350 in the European morning on Friday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.