The Australian Dollar strengthened as improving global trade sentiment lifted risk appetite.

Australia’s Employment Change report showed 89,000 new jobs added in April, significantly exceeding the forecast of 20,000.

Easing global trade tensions have dampened market expectations for Federal Reserve rate cuts this year.

The Australian Dollar (AUD) edges higher against the US Dollar (USD) on Thursday after registering more than 0.50% losses in the previous session. The AUD/USD pair gained ground as easing global trade tensions boosted demand for risk-sensitive currencies like the Aussie Dollar.

The Australian Bureau of Statistics (ABS) reported on Thursday that Employment Change rose to 89,000 in April, up from 36,400 in March and well above the expected 20,000. Meanwhile, the Unemployment Rate held steady at 4.1% in April, unchanged from the previous month.

A senior adviser to Iran’s supreme leader, Ali Shamkhani, stated on Wednesday that Iran is prepared to sign a nuclear agreement with US President Donald Trump. According to NBC, the offer includes Iran’s commitment to never develop nuclear weapons in exchange for the immediate lifting of all US economic sanctions.

Over the weekend, the US and China reached a preliminary agreement during trade talks in Switzerland to substantially roll back tariffs. Under the terms of the deal, the US will reduce tariffs on Chinese goods from 145% to 30%, while China will cut its tariffs on US imports from 125% to 10%. This development is widely seen as a significant step toward de-escalating the trade conflict.

Australian Dollar appreciates as US Dollar struggles over improved risk appetite

The US Dollar Index (DXY), which measures the US Dollar against a basket of six major currencies, is trading lower at around 100.90 at the time of writing. Traders will keep an eye on the release of the US Retail Sales and Producer Price Index (PPI) for April later on Thursday.

Easing global trade tensions have boosted optimism, leading traders to reduce the perceived risk of a recession. This shift may offer some support to the US Dollar. Market expectations for Federal Reserve (Fed) rate cuts this year have also softened. According to LSEG data, there is now a 74% probability of a 25-basis-point cut in September, down from earlier projections that anticipated a cut as soon as July.

US Consumer Price Index (CPI) rose by 2.3% year-over-year in April, slightly below the 2.4% increase recorded in March and market expectations of 2.4%. Core CPI—which excludes food and energy—also climbed 2.8% annually, matching both the previous figure and forecasts. On a monthly basis, both headline CPI and core CPI rose by 0.2% in April.

US President Donald Trump told Fox News that he is working to gain greater access to China, describing the relationship as excellent and expressing willingness to negotiate directly with President Xi on a potential deal.

China's Consumer Price Index (CPI) declined for the third consecutive month in April, falling 0.1% year-on-year, matching both the market forecast and the drop recorded in March, according to data released Saturday by the National Bureau of Statistics. Meanwhile, the Producer Price Index (PPI) contracted 2.7% YoY in April, steeper than the 2.5% drop in March and below the market expectation of a 2.6% decline.

Australia's seasonally adjusted Wage Price Index rose by 3.4% year-over-year in Q1 2025, up from a 3.2% increase in Q1 2024 and surpassing market forecasts of a 3.2% gain. This marks a recovery from the prior quarter, which recorded the slowest wage growth since Q3 2022. On a quarterly basis, the index climbed 0.9% in Q1, surpassing the projected 0.8% rise.

Australian Prime Minister Anthony Albanese was sworn in for a second term on Tuesday after a decisive election victory. Key cabinet positions—including treasurer, foreign affairs, defense, and trade—remain unchanged. Albanese is scheduled to attend the inauguration Mass of Pope Leo XIV in Rome on Sunday, where he will also meet with leaders such as European Commission President Ursula von der Leyen to discuss trade relations.

Easing global trade tensions have prompted investors to dial back expectations for aggressive interest rate cuts in Australia. Markets now project the Reserve Bank of Australia (RBA) to reduce the cash rate to approximately 3.1% by year-end, a revision from earlier forecasts of 2.85%. Nevertheless, the RBA is still widely expected to proceed with a 25 basis point cut at its upcoming policy meeting.

Australian Dollar advances to near 0.6450; rebounds from levels around nine-day EMA

AUD/USD is hovering near 0.6440 on Thursday. Daily chart analysis suggests a bullish bias, with the pair holding above the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) remains above the 50 threshold, supporting the positive momentum.

On the upside, the pair could potentially retest the six-month high of 0.6515, last seen on December 2, 2024. A sustained move beyond this level might set the stage for a rally toward the seven-month high of 0.6687, marked in November 2024.

The initial support is seen at the nine-day EMA around 0.6429, followed by the 50-day EMA near 0.6355. A firm break below these levels may weaken the short- to medium-term outlook and open the path for a deeper decline toward 0.5914 — a level last reached in March 2020.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

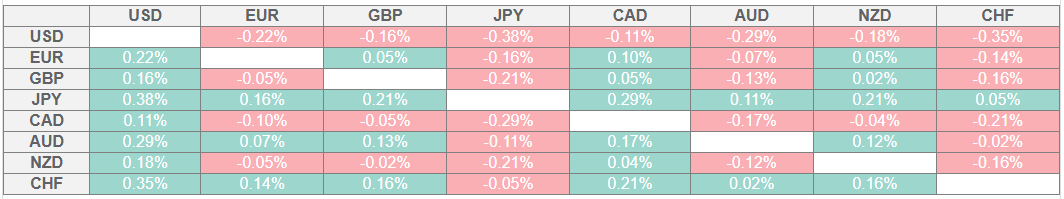

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote)

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.