The Euro retreats below 1.1800 against a firmer US Dollar amid cautious markets.

The USD regains lost ground after slower business activity figures.

Fed Chair Jerome Powell warned that further interest rate cuts are not guaranteed, but failed to support the USD.

EUR/USD has pulled back to the 1.1800 area at the time of writing on Wednesday, from weekly highs near the 1.1820. The pair, however, remains looking for direction within a tight range, both sides of the 1.1800 level for the second consecutive day, as investors remain reluctant to take excessive risks.

US data released on Tuesday revealed that business activity slowed down for the second consecutive month in September, in line with expectations. The S&P Global's report suggested that tariffs are pushing costs higher, while a weak demand and fierce competition limit firms' ability to raise prices, which rose at their slowest pace since April.

Somewhat later, the Federal Reserve (Fed) Chairman, Jerome Powell, reiterated the bank's challenges to set the correct monetary policy to combat higher inflation risks without damaging the labor market further. Powell maintained his cautious stance on further monetary easing, but he failed to alter the market's view that the central bank will cut interest rates in each of the two remaining monetary policy meetings this year.

In Europe, preliminary Purchasing Managers Index (PMI) figures showed mixed data, with a larger-than-expected improvement in services activity offsetting the unexpected contraction in the manufacturing sector, weighed by a sharp drop in new orders.

The economic calendar is lighter on Wednesday. During the European morning, the German IFO Business Climate will be the main data release, while the US August's New Home Sales and a speech from San Francisco Fed President, Mary Daly, will gather the market's attention during the American session.

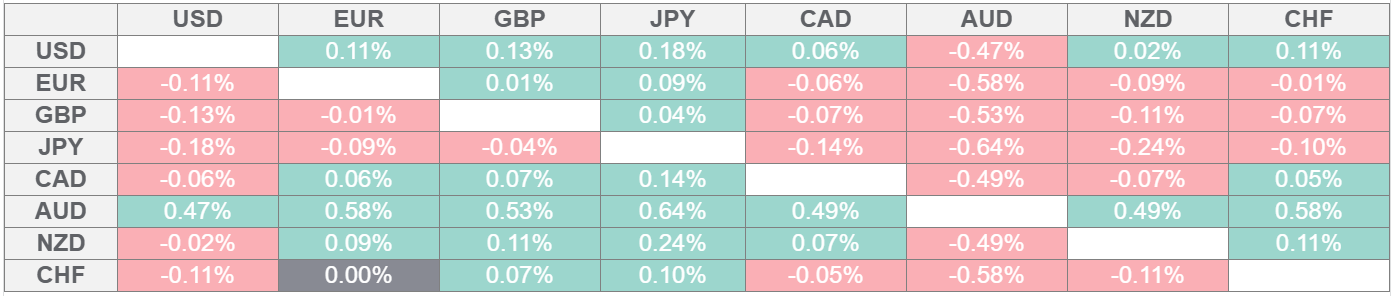

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Rangebound trading awaiting key releases

Major crosses have been moving within previous ranges over the last sessions, with investors looking from the sidelines in the absence of key macroeconomic releases. The economic calendar is thin this Wednesday, and the market might remain sideways ahead of US GDP and Durable Goods Orders reports on Thursday and, above all, Friday's US Personal Consumption Expenditures (PCE) Price Index data.

Preliminary PMI figures from the US revealed that services activity eased to 53.9 in September, from 54.5 in August, while the manufacturing activity slowed down to 52 from 53 in the previous month. The data meet the market's consensus in both cases.

Fed Chair Powell highlighted the "challenging situation" ahead for the central bank's policymakers and warned that further rate cuts are not guaranteed, but investors paid little attention. The US Dollar dropped following his speech, Gold and Stocks hit fresh highs.

Data from Europe showed an unexpected acceleration of service activity growth. The preliminary PMI rose to 51.4 against expectations of a steady 50.5 reading. Manufacturing activity, on the other hand, fell to 49.5 from 50.7, against expectations of a slight improvement to 50.9.

Likewise, German Manufacturing PMI fell to 48.5 from 49.8 against expectations of an improvement to the 50.0 level. Services activity, on the other hand, accelerated to 52.5 from 49.3, beating expectations of a weaker improvement to 49.5.

In France, the Manufacturing PMI dropped to a three-month low of 48.1, from 50.4 in August, well below the 50.2 anticipated by the market's consensus, while the services sector's activity accelerated its contraction, to 48.9 from 49.8 in the previous month, well below the 49.6 reading expected by the market.

Technical Analysis: EUR/USD keeps treading water below 1.1820

EUR/USD's rebound from the 1.1725 area has found resistance in the vicinity of 1.1820, and the pair is trading sideways, with support at 1.1780 holding bears for now. Technical indicators on the 4-hour chart remain within positive territory, although both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) reflect a waning momentum.

Tuesday's low at the mentioned 1.1780 is closing the path towards the trendline support from the September 2 lows, now in the area of 1.1740. A confirmation below here would increase bearish pressure towards the September 22 low at the 1.1730 area ahead of the September 12 low, near 1.1700.

To the upside, Tuesday's high at 1.1820 is capping rallies. Further up, the next targets are the September 18 high, near 1.1850, and the September 16 high at 1.1878.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.