EUR/USD drops below 1.1750 after US NFP beats estimates.

The Fed’s wait-and-see stance to remain as US economy adds more jobs than expected in June.

ECB Minutes show some pushback against June’s rate cut decision.

The Euro falls against the US Dollar on Thursday following the release of June’s employment figures in the United States (US), which showed why the Federal Reserve (Fed) is not ready to reduce borrowing costs. At the time of writing, the EUR/USD trades at 1.1744, down 0.45%.

The Nonfarm Payrolls (NFP) report took center stage on Thursday, as it fell on a shortened week in observance of the US Independence Day. The data pushed aside investors' hopes for a rate cut, exceeding estimates and May’s print. Additional metrics showed that the Unemployment Rate fell and Average Hourly Earnings remained steady.

Recently, breaking news revealed that US President Donald Trump's “One Big Beautiful Bill” has been passed by the US Congress and is expected to be signed on July 4, at 5:00pm EST, according to the White House.

Across the Atlantic, HCOB Services PMIs were revealed across the European Union. Figures showed an improvement in the economic outlook, yet Germany’s Services PMI remained in contractionary territory. The European Central Bank (ECB) released its latest Meeting Minutes, which revealed that some policymakers wanted to keep interest rates unchanged.

Ahead in the week, traders will eye the release of Factory Orders in Germany, ECB speeches and the release of the Producer Price Index (PPI) in the European Union.

Euro PRICE This week

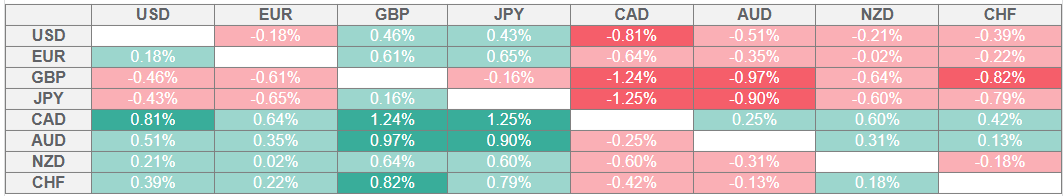

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: EUR/USD on the defensive on strong NFP report

June’s US NFP numbers showed the economy added 147K people to the workforce above analyst estimates of a 110K increase and 144K jobs created in May. The Unemployment Rate dipped from 4.2% to 4.1%

Initial Jobless Claims for the week ending June 28 fell to 233K below the expected 240K and lower than the previous week’s reading, signaling a resilient labor market. Meanwhile, the ISM Services PMI rose to 50.8 in June from 49.9 in May, indicating the sector has returned to expansion territory.

Atlanta Federal Reserve President Raphael Bostic said that he favors a wait-and-see stance to monetary policy due to uncertainty over economic policy. He added that increases to prices, tariff-related, could cause a jump in inflation readings over the next year.

According to Bloomberg, “President Donald Trump secured a sweeping shift in US domestic policy as the House passed a $3.4 trillion fiscal package that cuts taxes, curtails spending on safety-net programs and reverses much of Joe Biden’s efforts to move the country toward a clean-energy economy.”

EU HCOB Services PMI in June improved from 50 to 50.5, a sign that business activity is improving. “This marks a prolonged period of relatively weak growth, and one which has never been surpassed in length over the course of the PMI’s 27 years of data,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

The HCOB Services PMI in Germany improved from 49.4 to 49.7 but remained in contractionary territory.

Euro technical outlook: EUR/USD consolidates near 1.1750

The EUR/USD dips to a three-day low of 1.1716 but maintains its upward bias. The Relative Strength Index (RSI) exited overbought territory, triggering a sell signal, and sellers took advantage of this, driving the exchange rate below 1.1800.

The pair’s dip could extend as low as 1.1700, reaching 1.1631, the June 12 high. On the flip side, if EUR/USD climbs back above 1.1800, the following key resistance areas are the yearly peak at 1.1829, followed by 1.1850 and 1.1900.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.