USD/CHF falls below 0.7950 as expectations for further rate cuts by SNB diminish

USD/CHF weakens as hotter-than-expected inflation data reduces the likelihood of further SNB rate cuts.

The SNB is expected to maintain its interest rate at 0% through 2026.

Trump’s “one big, beautiful” tax bill passed the House of Representatives.

USD/CHF loses ground after registering gains in the previous two sessions, trading around 0.7930 during the Asian hours on Friday. The pair depreciates as the Swiss Franc (CHF) receives support from the decreasing expectations of further rate cuts by the Swiss National Bank (SNB), driven by the latest hotter inflation data released on Thursday.

Swiss Consumer Price Index (CPI) inched up 0.1% year-on-year in June, rebounding from a previous fall of 0.1% and defying market expectations of a 0.1% drop. Meanwhile, the monthly CPI increased 0.2% following a 0.1% previous rise.

SNB’s officials are expected to keep the interest rate unchanged at 0% in September. Many analysts anticipate rates will remain at zero through 2026. Moreover, Swiss policymakers have cautioned against dipping into negative territory, citing potential risks to savers, banks, and pension funds.

The USD/CHF pair also faces challenges as the US Dollar (USD) struggles, while traders adopt caution due to ongoing uncertainty over the US President Donald Trump's plans for tariffs on various countries.

According to Reuters, President Trump said on Thursday that he “will begin sending letters on trade tariffs starting Friday.” He stated that he planned to send letters to 10 countries at a time, outlining proposed tariff rates ranging from 20% to 30%.

President Trump’s “One big beautiful” tax legislation passed the House of Representatives, which includes significant tax cuts designed to stimulate economic growth. Trump lauded the bill's passage on Truth Social, calling it a “historic victory for American workers, families, and businesses.”

Swiss Franc PRICE Today

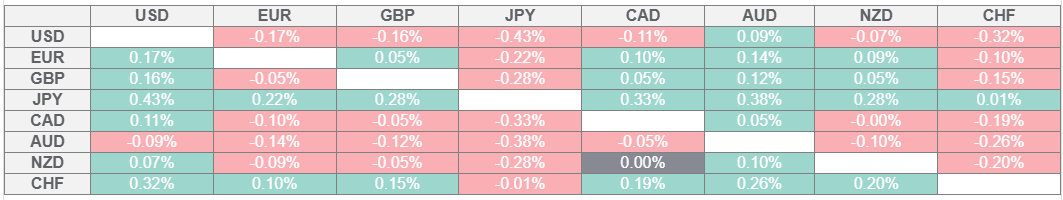

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.