EUR/USD bounces up as focus shifts to tariffs, US fiscal health

- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold Price Forecast: XAU/USD tumbles to near $3,950 on Fed's hawkish comments, trade optimism

- Gold holds gains near $3,950 ahead of Trump-Xi meeting

- Bitcoin, cryptos fail to rally as Fed Chair sparks cautious sentiment

- Silver slips below $47.00 due to optimism over US-China trade deal

- Bitcoin Stalls Below $110,000 as Miners Step In to Sell

The Euro picks up as the impact of the strong US Nonfarm Payrolls report fades.

Growing concerns about tariffs and the US fiscal health are adding pressure on the US Dollar.

Trading volumes are expected to remain subdued on Friday with US markets closed for the Independence Day holiday.

The EUR/USD pair is trimming some losses on Friday, trading at 1.1785 at the time of writing, after bouncing from lows of 1.1715 on Thursday. The Dollar is giving away post-NFP gains with the US markets closed on the Independence Day holiday, and investors' focus shifts to the US tariffs deadline on July 9.

In light of the scarce progress on trade deals, Trump affirmed that he will start sending letters to trading partners on Friday, informing them about the levies that will be applied to their products. Market concerns that high tariffs might boost inflation and lower economic growth have been a major weight for the US Dollar since April's "Liberation Day".

Beyond that, Trump's "big, beautiful tax bill" passed the scrutiny of the House of Representatives on Thursday and is likely to become law in the coming days. The Congressional Budget Office estimated that the bill will boost the current fiscal deficit of $39.2 trillion by $3.3 trillion over the next 10 years, which raised fears of a debt crisis in the world's major economy and has been another source of negative pressure for the US Dollar.

The US Dollar jumped on Thursday as the Nonfarm Payrolls report showed that the US economy created way more employment than expected in June, highlighting the resilience of the labour market and dampening hopes of imminent rate cuts by the Federal Reserve (Fed). Chances of a Fed cut in July have dropped to 5%, from around 20% before the data release, according to the CME Group's Fed Watch Tool.

Euro PRICE Today

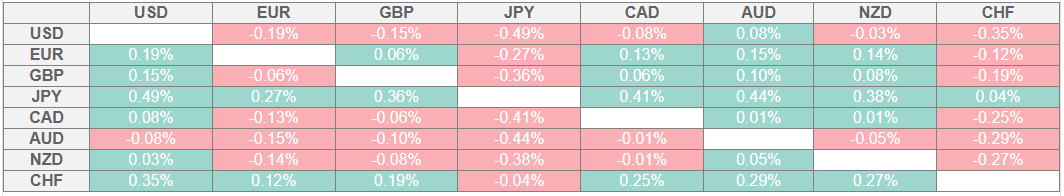

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Rangebound trading with US markets closed

The EUR/USD is trading within Thursday's range, on track to a moderate advance on the week. The pair is likely to go through an "inside day" with trading volume subdued, with the US market closed for the Independence Day holiday and the Eurozone calendar lacking first-tier data releases.

On Thursday, US Nonfarm Payrolls data surprised, showing a 147,000 increase in net jobs, beating expectations of a 110,000 reading. The Unemployment Rate fell to 4.1% from 4.2%, against expectations of an increase to 4.3%.

Later on Thursday, the US ISM Services PMI showed a stronger-than-expected rebound of the sector's business activity. June's index improved to 50.8 from the 49.9 print seen in May, also beating expectations of a 50.5 reading.

Data released on Friday showed that the German Factory Orders declined by 1.4% in May, well beyond the 0.1% contraction forecasted by market analysts, following a 1.6% growth in April. These figures add to evidence of the weak economic prospects in the Eurozone's major economy and are likely to weigh on the Euro.

Likewise, France's Industrial Output declined by 0.5% in May following a 1.4% drop in April, against market expectations of a 0.3% improvement.

On Thursday, the Eurozone services activity data revealed the sector grew again in June. The final HCOB Services PMI was revised to 50.5 from the 50.0 flash estimate, following a 49.7 reading in May. The report, however, warned about a weak demand despite the improving business sentiment. The impact on the Euro was minimal.

EUR/USD is losing momentum with the 1.1800 area holding bulls

,

EUR/USD has been consolidating gains for most of the week after having reached its highest levels in nearly four years at 1.1830. The pair, however, is losing momentum, unable to find significant acceptance above 1.1800, with the 14-period Relative Strength Index (RSI) testing the 50 level that divides the bullish from the bearish territory.

The lower low on Thursday is another bearish sign, although the pair has not confirmed below the 1.1745-1.1750 area (June 26 and 27 highs and July 2 low). Below here, the June 30 low, at 1.1710, and the June 27 low at 1.1680 would be the potential downside targets.

On the upside, the pair might find resistance at the 1.1800 level, where the trendline resistance from Monday's highs lies, ahead of the mentioned high at 1.1825, and the 127.2% Fibonacci extension level of the July 1-2 reversal at 1.1850.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.