XRP sees growing investor confidence following end of SEC legal battle against Ripple

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

XRP whale holdings and network activity signal rising optimism among investors.

However, signs of bearish sentiment in the derivatives market could hamper XRP's price growth.

XRP could retest the $2.60 resistance if it bounces off the upper boundary of a descending channel.

Ripple's XRP trades near $2.43 on Thursday after seeing a rejection at the $2.60 resistance. The remittance-based token has seen a 400% growth in network activity since the beginning of March. The growth may continue, considering the Securities and Exchange Commission (SEC) recently dropped its appeal against Ripple.

XRP on-chain metrics signals growing investors' confidence

XRP whales expanded their holdings by 10% in the past two months. Despite prices being subdued by macroeconomic factors, these whales — wallets holding between 1 million to 10 million XRP — continued accumulation, boosting their holdings to 5.81 billion XRP worth about $14 billion.

[00.01.03, 21 Mar, 2025]-638781085317376765.png)

XRP supply distribution. Source: Santiment

However, whales holding between 10M to 100M XRP have seen a mix of distribution and accumulation during the same period.

Meanwhile, XRP network activity has skyrocketed since the beginning of March, with over 400% more daily active addresses than recorded in February.

[00.04.11, 21 Mar, 2025]-638781086694926885.png)

XRP active addresses. Source: Santiment

Additionally, XRP Dormant Circulation shows investors have significantly slowed down their distribution in the past few days. Holders remained relatively mute despite the price increase on Wednesday.

The combination of these metrics suggests rising optimism among investors in XRP's growth potential, especially with the recent announcement that the SEC has ended its legal battle with the company.

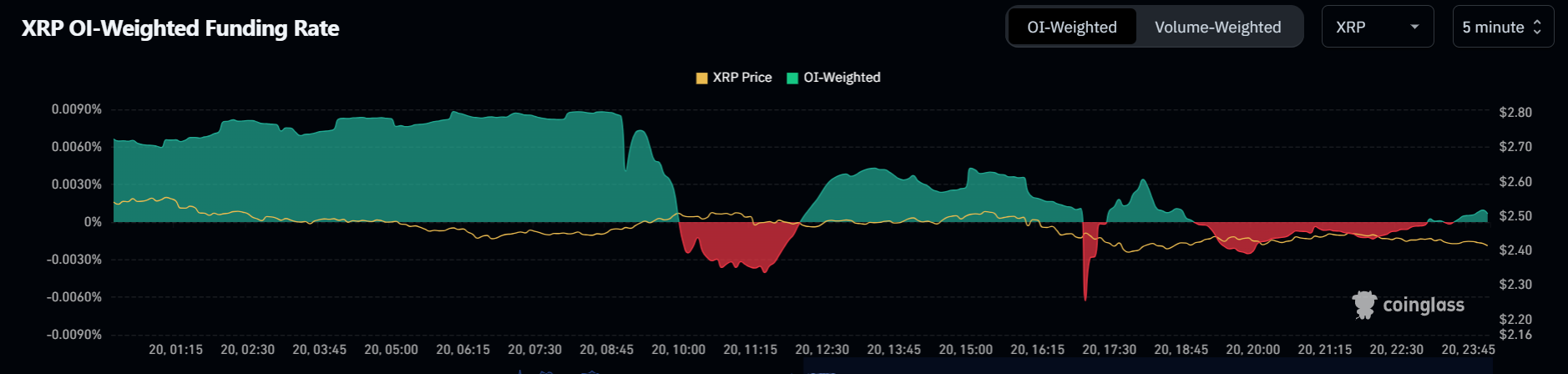

However, the strong bullish sentiment doesn't extend to the XRP derivatives market, where funding rates are flashing negative. This partially explains the reason for XRP's recent retracement after rising about 14% on Wednesday.

XRP funding rates. Source: Coinglass

In a recent interview with Bloomberg, Ripple CEO Brad Garlinghouse expressed optimism that an XRP ETF will debut in the US in 2025.

"I have immense confidence in the [XRP] ETF," said Garlinghouse. "I think those will be live in the second half of the year," he added.

The SEC recently delayed its decision on several XRP ETF filings from asset managers, including Bitwise, Franklin Templeton and 21Shares. Garlinghouse also mentioned that the US digital asset stockpile will likely include XRP.

XRP could bounce off descending channel's upper boundary

XRP experienced $13.86 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $11.68 million and $2.18 million, respectively.

XRP saw a rejection at the resistance near $2.60 and has declined by 4% on the day, mimicking the broader crypto market retracement.

XRP/USDT daily chart

If XRP bounces off the upper boundary of a descending channel, it could retest the $2.60 resistance. A move above $2.60 could propel the remittance-based token to tackle its seven-year high resistance at $3.40. However, it must first clear key hurdles near $2.78 and $2.95 for such a move to materialize.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are attempting to cross below their respective moving average lines, indicating a weakening bullish momentum.

A daily candlestick close below the upper boundary of the descending channel will invalidate the thesis and potentially send XRP to find support at $1.96.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.