XRP slides below $2.72 as Elon Musk's DOGE shift focus to SEC

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

DOGE shifts focus toward the SEC as crypto investors expect the examination to reveal abuse in its case against Ripple.

SEC could pause its appeal against Judge Analisa Torres ruling of XRP retail sales not constituting securities.

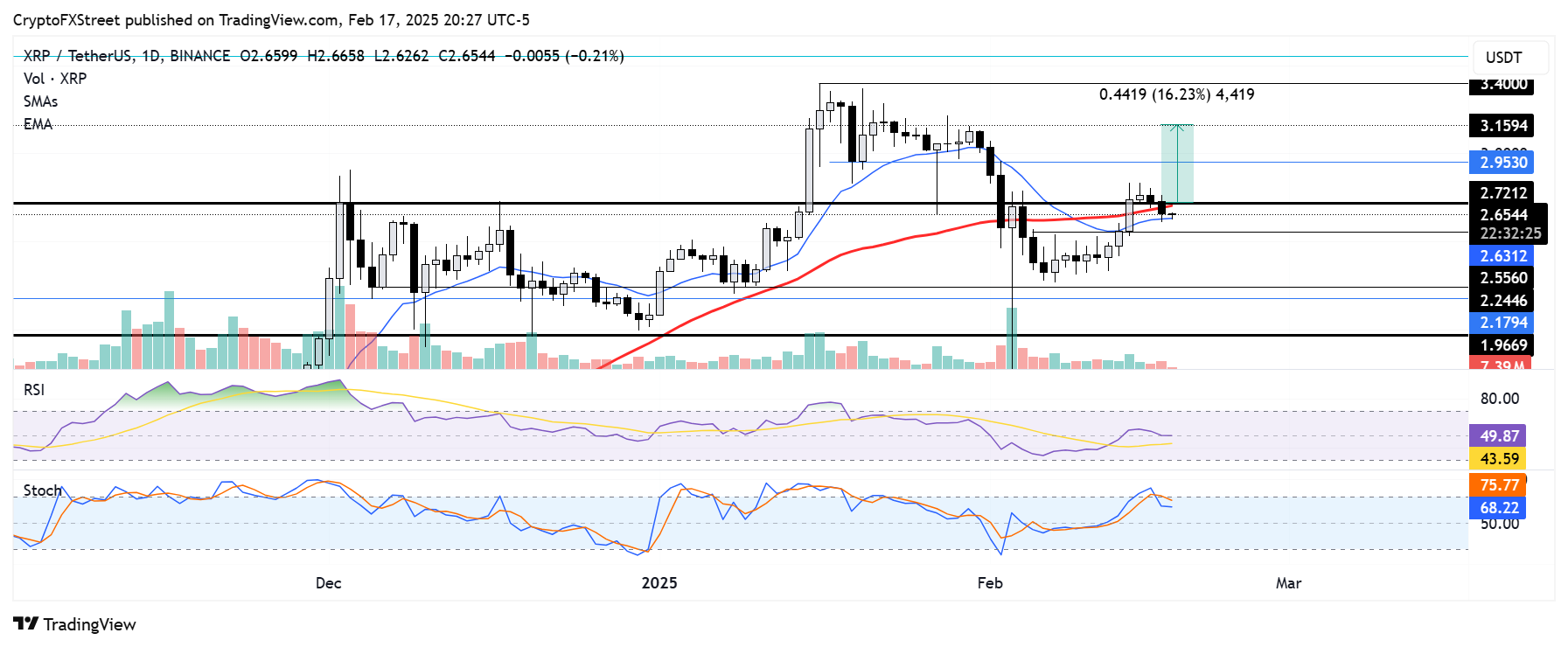

XRP could decline to $2.24 if it fails to bounce off the $2.55 support and recover $2.72.

Ripple's XRP saw a 4% decline in the early Asian session on Tuesday following an announcement that the Department of Government Efficiency (DOGE) is targeting the Securities and Exchange Commission (SEC) as the next agency to face its examination process.

DOGE to examine SEC as XRP community members expect a positive outcome

The Department of Government Efficiency (DOGE), spearheaded by Tesla and SpaceX CEO Elon Musk, is shifting its focus to the SEC to examine them for waste, fraud and abuse.

The DOGE's foray into examining the SEC has increased volatility in the past 24 hours. Most crypto community members anticipate the Ripple vs. SEC case will come under the spotlight during the DOGE's examination.

If the DOGE finds much waste or abuse related to crypto cases like that of Ripple vs. SEC, it could reinforce opinions that the agency illegally persecuted crypto-related companies under former Chair Gary Gensler.

DOGE has allegedly discovered waste and abuse of goverment funds across several agencies in the US.

Meanwhile, the new SEC administration is set to hold a closed-door meeting concerning the case on February 20. The agency may decide to pause its appeal against Judge Analisa Torres' ruling — filed by the previous administration — similar to the recent pause it implemented on cases against Binance and Coinbase. Such an outcome could signal the end of its legal battle against Ripple.

This could prompt the approval of XRP ETF applications, which the SEC acknowledged on Friday.

XRP could find support near $2.24 if it fails to recover $2.72

XRP failed to maintain a move above the $2.72 level after experiencing a 3% decline in the past 24 hours. This marks a pullback following its 10% recovery last week.

The 14-day Exponential Moving Average (EMA) near the $2.55 level could provide support for XRP to bounce back above $2.72. However, if the $2.55 support fails, the remittance-based token could decline to the $2.24 support level.

XRP/USDT daily chart

The Relative Strength Index RSI and Stochastic Oscillator are above their neutral levels but trending downwards, indicating weakening bullish momentum.

A daily candlestick close below $1.96 will invalidate the thesis and send XRP toward the $1.35 level.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.