200,000 New Investors Buy Ripple (XRP) 30-Days After Gensler’s Farewell: What Next for Stellar (XLM)?

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

Ripple (XRP) price consolidated around $2.40 on Thursday, up 11% since Monday, as the market stabilized following an initial contractionary reaction to US CPI data.

XRP total addresses have risen by more than 200,000 since SEC Chair Gary Gensler’s farewell interview on January 14.

Stellar continues to track XRP’s uptrend this week, indicating more upside potential as the XRP network expands.

Ripple (XRP) price consolidated around $2.40 on Thursday, up 11% since Monday, technical indicators suggest Stellar (XLM) has joined the rally.

Stellar (XLM) and Ripple (XRP) Price Score Double-Digit Gains Despite US CPI Inflation Shock

The crypto market endured intense volatility e this week after the United States Consumer Price Index (CPI) data came in hotter than many analysts had predicted.

Fears of tighter monetary policy initially sent shockwaves through risk-on assets, prompting sell-offs across various digital currencies. However, XRP and Stellar (XLM) have proven resilient, delivering double-digit gains despite the challenging macroeconomic backdrop.

Ripple (XRP) vs. Stellar (XLM) Price Action

While other major cryptocurrencies like Bitcoin, Ethereum, and Solana have struggled to hold onto their weekly openings, both XRP and XLM have continued to press forward, scoring considerable gains over the last four days.

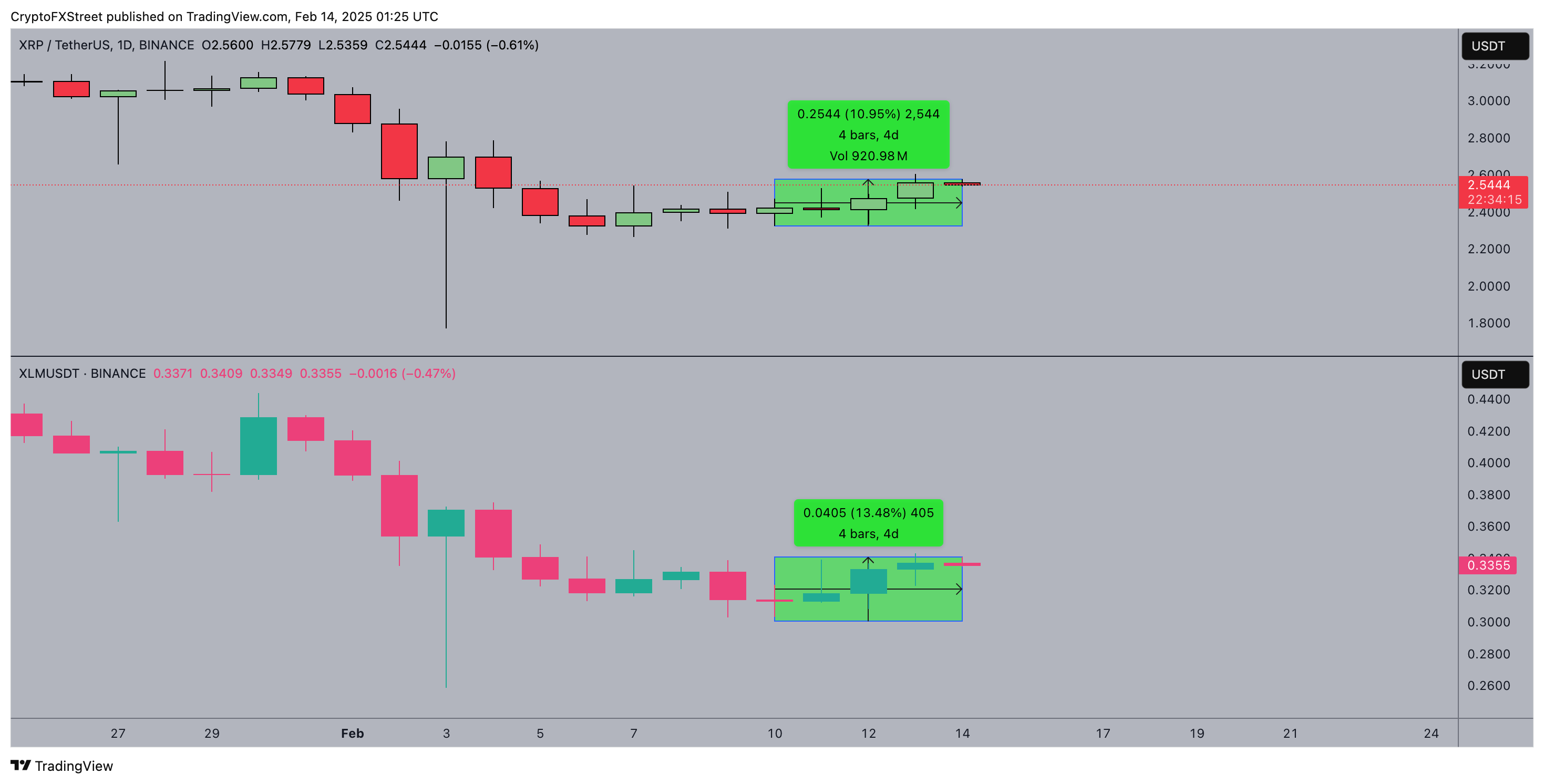

The TradingView chart data above shows XRP price has crossed $2.40, gaining 11% since opening around $2.15 on Monday. Likewise, XLM has rallied 13.5%, consolidating just below the $0.35 range. This week, both tokens have comfortably outperformed rival layer-1 assets signaling distinct bullish factors driving the current uptrends.

XRP Network Attracts 200,000 New User Wallets Within 30-Days From Gensler’s Farewell

Beyond price movements, on-chain analytics highlight a significant internal catalyst for XRP’s performance. Since Gary Gensler’s farewell interview on January 14, the total number of XRP addresses has grown by over 200,000.

Ripple (XRP Ledger) Total Addresses vs. XRP Price

Ripple (XRP Ledger) Total Addresses vs. XRP Price

The CryptoQuant chart above shows a XRP ledger total addresses increase from 6.4 million to 6.6 million between Jan 14, to Feb 14.

Industry observers cite increased confidence after Gensler’s exit as the key reasons for the surging user adoption on the XRP ledger blockchain network.

This could drive up prices for a number of reasons.

First, an expanding address base often corresponds to increased transaction volume and liquidity, enhancing network effects.

More users generally translate into greater on-chain activity, potentially attracting additional capital inflows and fueling price appreciation.

Second, fresh adoption can reflect shifting sentiment, particularly if new wallets belong to institutional or long-term holders.

In the wake of Gensler’s departure from the SEC, some investors may anticipate a more favorable regulatory environment for Ripple, thus prompting them to accumulate XRP.

The correlation between XRP and XLM has long been noted, owing to their shared lineage through Jed McCaleb, who co-founded Ripple before launching Stellar.

Both projects emphasize fast, low-cost cross-border transactions, appealing to similar market segments.

Historical data shows that XLM often follows XRP’s lead in bullish market phases, and the current rally reinforces this pattern.

With XRP poised to maintain its upward trajectory, Stellar (XLM) could likewise continue its climb, as evidenced by its 13.5% gains this week despite macroeconomic turbulence.

Market Outlook:

Looking ahead, investors will closely monitor further developments related to XRP’s ongoing legal proceedings, as well as potential regulatory shifts following Gensler’s exit from the SEC.

If XRP continues to attract new addresses at t

his pace, the network’s growing user base could offer a sturdy foundation for sustained gains.

Meanwhile, Stellar’s parallel rise suggests it may remain an appealing alternative for those seeking to capitalize on the broader resurgence of payment-focused digital assets.

Ripple (XRP) Price Forecast: Eyeing a $0.45 Breakout

XRP price remains in a consolidation phase, trading around $2.54 after a recent attempt to reclaim higher levels.

The Parabolic SAR dots hovering above the price suggest lingering bearish pressure, as sellers have controlled momentum since the early February downturn.

However, the XRP has found temporary stability in the highlighted accumulation zone between $2.40 to $2.50, with the four-day 10.95% recovery hinting at a potential breakout if buyers sustain their efforts.

The Average Daily Range (ADR) at 3.05 signals that volatility remains elevated, allowing for sharp price movements in either direction.

A decisive close above $2.60 would invalidate the bearish structure, flipping market sentiment bullish as buyers reclaim control.

Such a move could drive XRP toward $2.80, where the next liquidity cluster sits. Beyond that, a rally to $3.00 remains on the table, provided broader market sentiment supports further upside.

Conversely, failure to break higher risks a reversal, with XRP potentially retesting support at $2.40. If this level fails, a sharper decline toward $1.78—the next significant support level—could materialize

Stellar (XLM) Price Forecast: Bulls testing the $0.50 Threshold

Stellar (XLM) price action suggests a prolonged consolidation phase, with the token trading at $0.3354 after a failed attempt to breach the $0.35 resistance.

The Donchian Channel (DC) highlights a tightening range, with the upper boundary at $0.35 and lower support at $0.26, reinforcing the market’s indecision.

A breakout above $0.35 would validate a bullish continuation, with the next upside target near $0.44, where liquidity is likely concentrated.

However, a failure to break above this key level could extend the sideways movement or initiate another leg downward.

The MACD indicator signals a potential shift in momentum, with the blue MACD line flattening after a prolonged descent, suggesting bearish exhaustion.

A bullish crossover with the signal line could accelerate buying pressure, further strengthening the case for a rally.

However, if the MACD fails to confirm a crossover, sellers may regain control, pushing XLM back toward the $0.30 psychological support.

A breakdown below this threshold could trigger a decline toward the Donchian Channel’s lower boundary at $0.26.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.