XRP May Fall Under $3 Before Reaching New All-Time High

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- Bitcoin Rebounds After Falling to $62,500 Low, Crypto Market Still Extremely Fearful

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP post cautious recovery amid downside risks

XRP recently achieved a new all-time high (ATH) of $3.40 during a two-week bull run, marking a significant milestone in the cryptocurrency’s history. However, this upward trajectory appears to have hit a ceiling.

All indicators now suggest a period of correction before XRP can attempt to repeat such performance. The token, currently trading at $3.11, seems to be stabilizing but shows signs of vulnerability.

XRP Could Witness A Drop

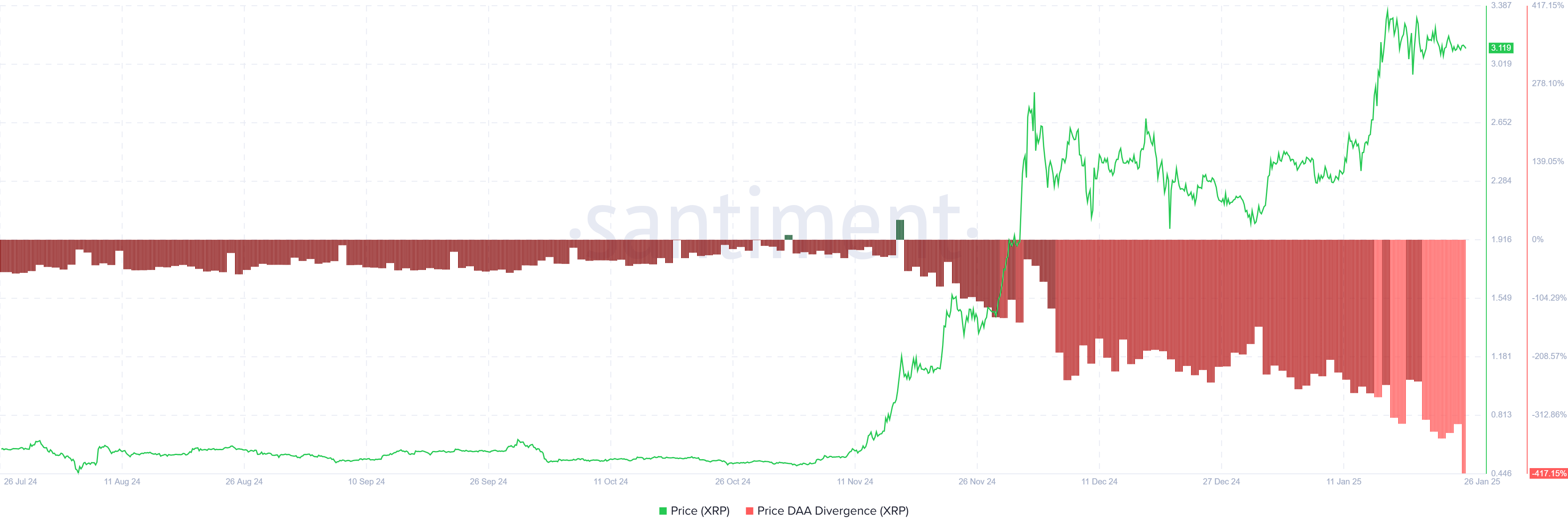

One of the key signals pointing toward a potential correction is the Price Daily Active Addresses (DAA) Divergence, which is flashing a sell signal. Despite the bullish price action, the number of active wallet addresses interacting with XRP has seen a noticeable decline. This divergence between price and participation is often a sign of waning investor interest, which could lead to a negative impact on XRP’s price.

The decreasing participation is concerning because it highlights reduced market engagement at a time when XRP would benefit most from strong support. If this trend continues, it could undermine the token’s ability to sustain current price levels, leaving it exposed to further declines.

XRP Price DAA Divergence. Source: Santiment

XRP Price DAA Divergence. Source: Santiment

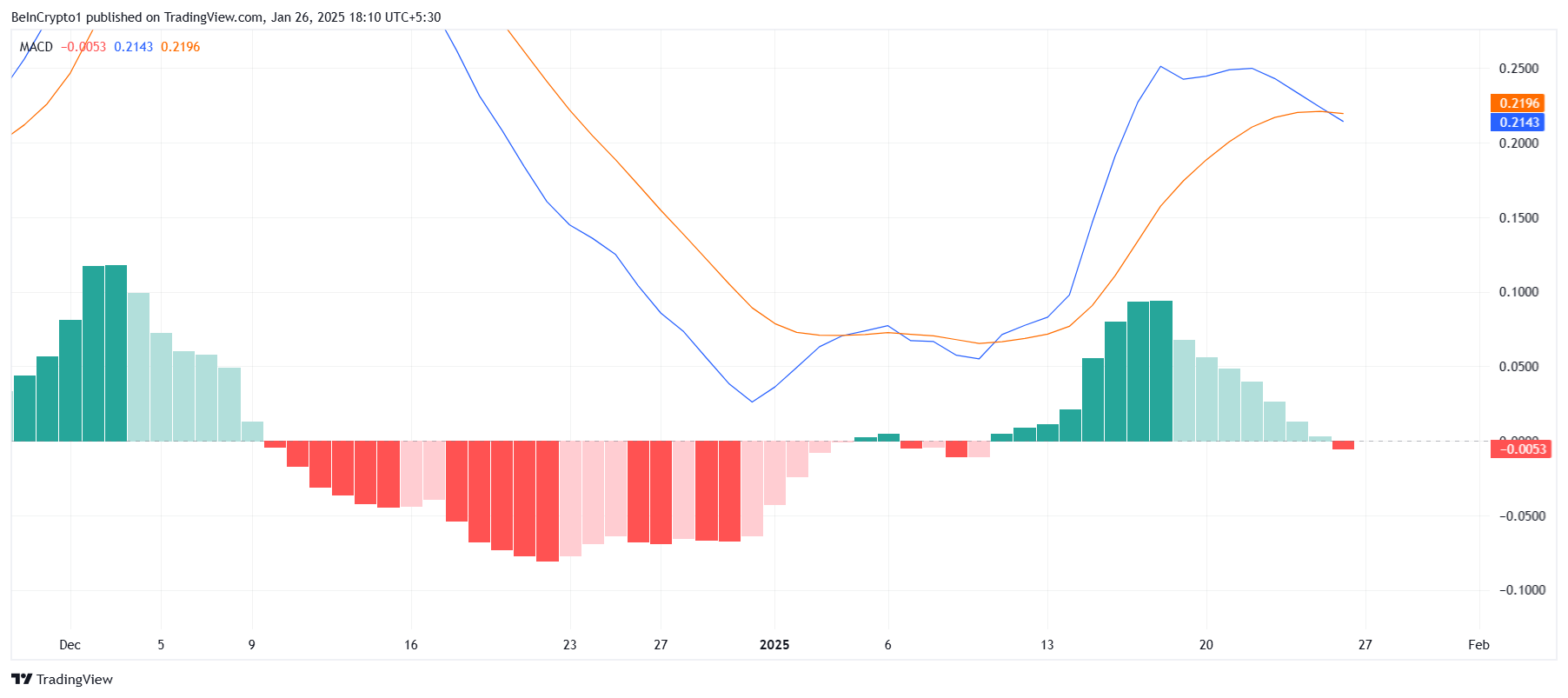

On the technical side, the Moving Average Convergence Divergence (MACD) indicator has recently noted a bearish crossover. This shift comes just two weeks after XRP’s bullish momentum led to its latest ATH. While the previous rally was short-lived, it was impactful enough to push XRP into new price territory.

However, the bearish crossover on the MACD suggests that the broader market momentum is beginning to weaken. Without renewed buying pressure or positive market cues, XRP is likely to experience a price decline.

XRP MACD. Source: TradingView

XRP MACD. Source: TradingView

XRP Price Prediction: Looking For Support

XRP’s recent ATH of $3.40 has not been followed by a major selloff, with the token now trading at $3.11. At this level, the price seems to be stabilizing. However, the current trends suggest this stabilization may be temporary.

Given the sell signals from DAA Divergence and the bearish MACD crossover, XRP could face a correction in the near term. The price may fall to $2.73, dipping below the $3.00 mark before finding support and bouncing back. This correction would provide a more solid foundation for a future rally.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

On the other hand, a shift in broader market conditions could tilt the balance toward bullishness. If XRP breaches its ATH of $3.40, it would invalidate the bearish outlook and pave the way for a new ATH. Such an outcome would depend heavily on increased market participation and a surge in investor confidence.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.