USDT's market cap hits a new high. Will the cryptocurrency rebound continue?

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

The market cap of USDT keeps rising. But this doesn't guarantee a rebound in the crypto market. A decline is still possible.

On April 26, Tether's CEO, Paolo Ardoino, announced on X that USDT's market cap reached $147 billion, setting a new record.

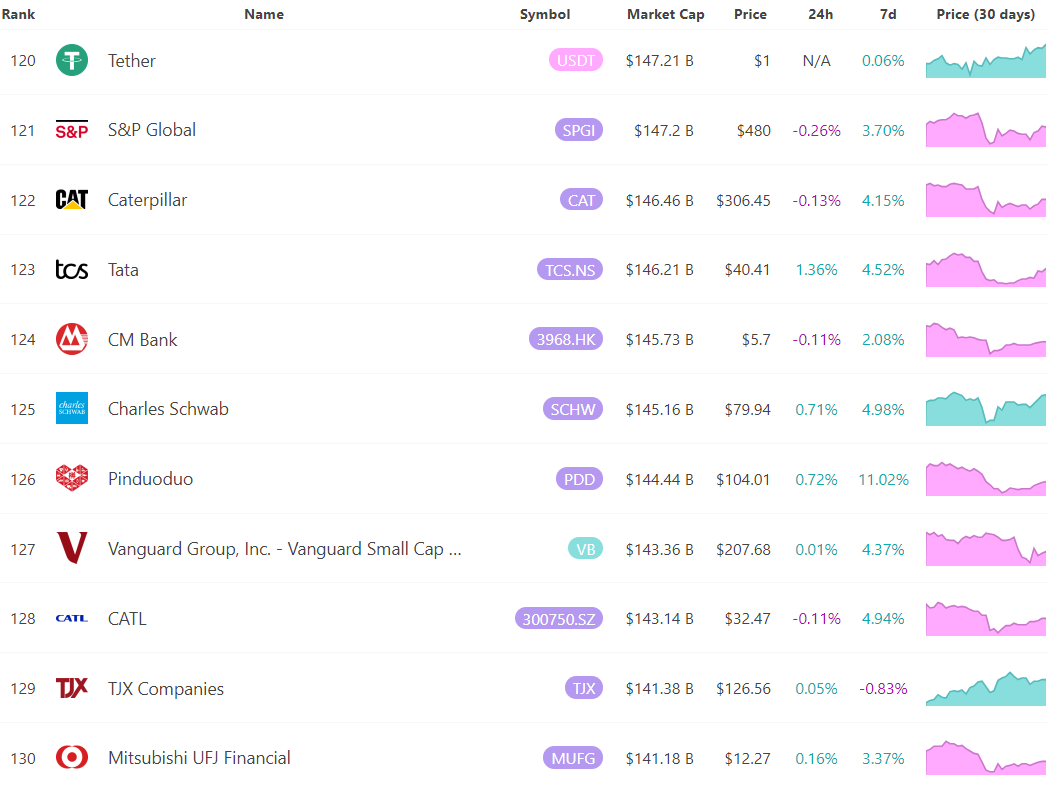

As of this writing, USDT's market cap stands at $147.21 billion. It ranks 120th globally, surpassing companies like S&P Global Inc, Caterpillar Inc, and Tata Motors Ltd.

Assets ranked 120-130 in global market capitalization, source: 8marketcap.

Despite USDT's growth, the total crypto market cap remains stagnant. It's even showing signs of decline. This suggests that funds are slowly exiting the market, making it hard for a rebound to last. If outflows continue, it could trigger a crash in the crypto market.

Total market cap changes in the crypto market over the last 30 days, source: CoinMarketCap.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.