Tron Price Forecast: TRX stablecoin activity soars to $396 million in a week

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Gold declines to near $4,850 as low liquidity, easing tensions weigh on demand

- Gold weakens as USD uptick and risk-on mood dominate ahead of FOMC Minutes

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises above $4,950 as US-Iran tensions boost safe-haven demand

- Gold drifts higher to $5,000 on heightened US-Iran tensions

Lookonchain data shows that in the past 7 days, stablecoins on Tron increased by $396 million, reflecting growing network usage.

Artemis data shows that the TRX blockchain collected the most fees in the last 24 hours, with $1.3 million.

The emergence of a meme wave on the TRON blockchain could be a potential catalyst for ecological growth.

Lookonchain data shows that in the past 7 days, stablecoins on Tron (TRX) increased by $396 million, reflecting growing network usage. Additionally, Artemis data shows that the TRX blockchain collected the most fees in the last 24 hours, with $1.3 million. The emergence of a meme wave on the TRON blockchain could be a potential catalyst for ecological growth.

Tron stablecoin activity rises

According to Lookonchain data, the value of the stablecoins USDT and USDC on Tron has increased by $396 million in the last seven days. The rising stablecoin activity on Tron’s blockchain signals growing trust and usage, likely driven by Tron’s low-cost and high-speed transactions for stablecoin activity.

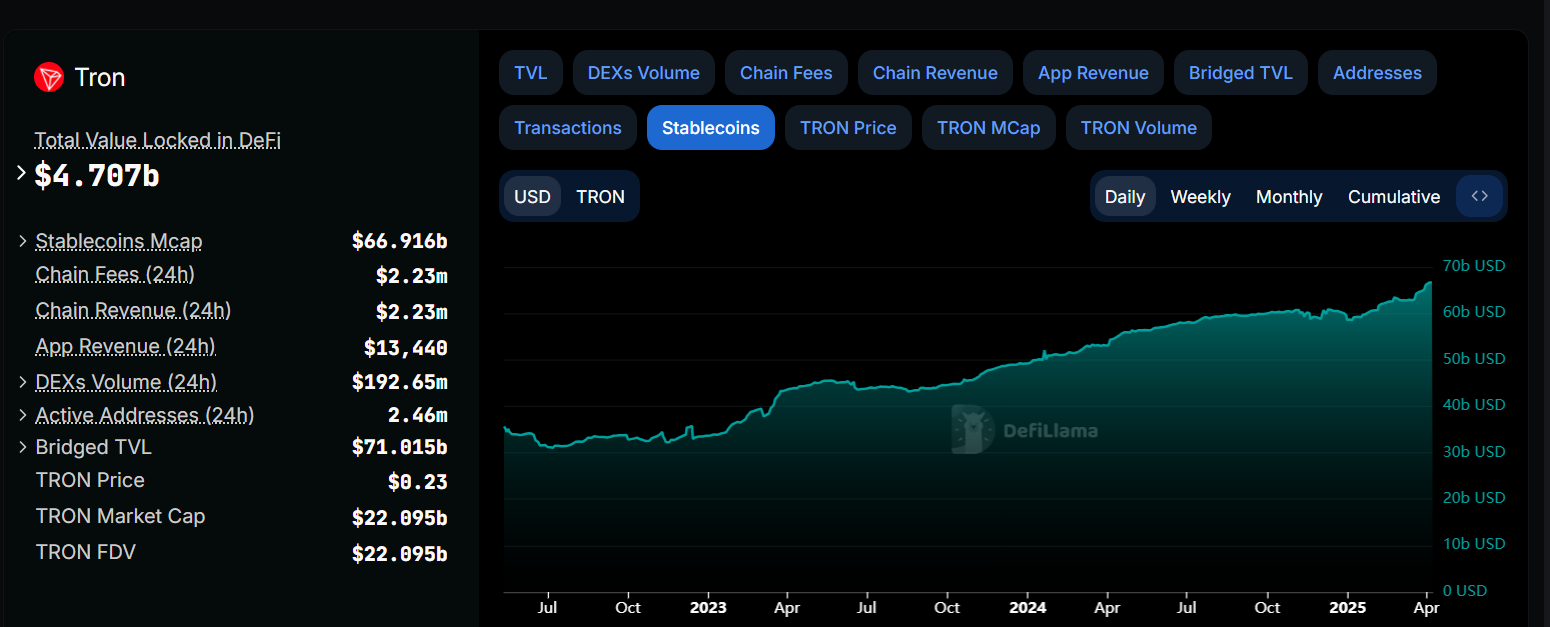

Moreover, stablecoin value on the Tron blockchain has been constantly rising since early January. According to DefiLlama data, the stablecoin market capitalization currently stands at $66.91 billion. Such stablecoin activity and value increase on Tron project a bullish outlook as it increases network usage, helps the burn mechanism with USDD and can attract more users to the ecosystem.

Stablecoins on Tron chart. Source: DefiLlama

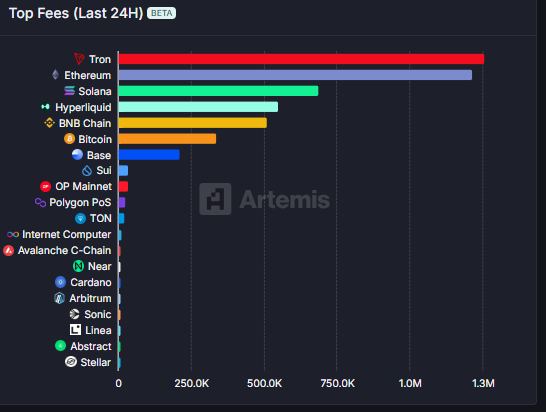

Artemis data shows that the TRX blockchain collected the most fees in the last 24 hours, with $1.3 million, surpassing major blockchain networks like Ethereum (ETH) and Solana (SOL), as shown in the graph below.

Top Fees chart. Source: Artemis

The emergence of a meme wave on the TRON blockchain could be a potential catalyst for ecological growth. The community actively participates in events like the TRON Meme King Challenge, indicating strong grassroots support and engagement. The announcement on March 18 that the TRX token will soon be on the Solana blockchain also boosted the TRX bullish outlook.

Tron Price Forecast: TRX holds $0.21 support level

Tron price retested and found support around the 200-day Exponential Moving Average (EMA) at $0.21 on Monday after facing rejection from its weekly level of $0.24 the previous week. At the time of writing on Tuesday, it trades slightly higher, above $0.23.

If TRX breaks and closes above its weekly resistance at $0.24, it could extend the rally to retest its next daily resistance at $0.27.

The Relative Strength Index (RSI) on the daily chart reads 49, pointing upward towards its neutral level of 50, indicating fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above its neutral level of 50.

TRX/USDT daily chart

However, if TRX fails to find support around the 200-day EMA at $0.21 and closes below it, Tron could extend the decline to retest its December 2 low of $0.20.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.