Sui Price Forecast: SUI targets $4 breakout as community vote begins on Cetus funds

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

The Sui Foundation releases a code for an on-chain vote for its community to decide on the recovery of stolen funds.

With 34 votes in favor, an additional 24 'yes' responses are required to regain control of the frozen funds.

SUI soars as the voting begins and announces the extension of bug bounty to protocols with $50 million in TVL.

Sui (SUI) trades at $3.70, experiencing an over 6% surge at press time on Wednesday, as validators and the community begin to vote on a special transaction to return the stolen Cetus funds from the hacker’s account to a multi-sig account. Concurrent with the voting, the Sui Foundation has offered a loan to Cetus to compensate for user losses.

The voting begins

The Sui Foundation began voting on May 27 at 8:00 PM UTC to decide on a protocol upgrade to be included in the next Sui release, which enables one-time authentication of two special transactions. These transactions are hard-coded with the attacker's two wallet addresses as senders and are designed to transfer stolen assets to a multi-sig receiving wallet. Cetus, the Sui Foundation, and OtterSec will maintain the wallet.

The voting will be open for 7 days, with an early passing available in 48 hours. To pass the proposal, 50% of the total stake must be in favor, excluding those who abstain from the decision-making process. Notably, the weighted stake voting in favor must exceed the weighted stake voting against the transfer.

Sui Voting Session. Source: Sui Explorer

According to Sui Explorer, out of 114 validators, 34 are in favor at press time, with 80 yet to vote. Interestingly, Galaxy Digital, a digital asset platform, has cast an early vote in favor of the upgrade. To pass the vote in favor, an additional 24 yeses are required to achieve 50% of the votes, at 58.

Sui extends support to Cetus and layer two protocols

The Sui Foundation expands its support to users and layer two protocols by lending to Cetus to compensate for user losses in the recent $223 million hack. The Cetus team will utilize the loan funds alongside its treasury to reimburse the losses bridged out of the Sui Network. This loan remains a separate funding source from the frozen funds that could be recovered if the community votes in favor of it.

To avoid such future scenarios, Sui becomes one of the early layer-1 networks to extend its bug bounty program to its layer two protocols, with more than $50 million in total value locked (TVL) expected over the next six months.

SUI holds support at $3.50, shoots 5% up

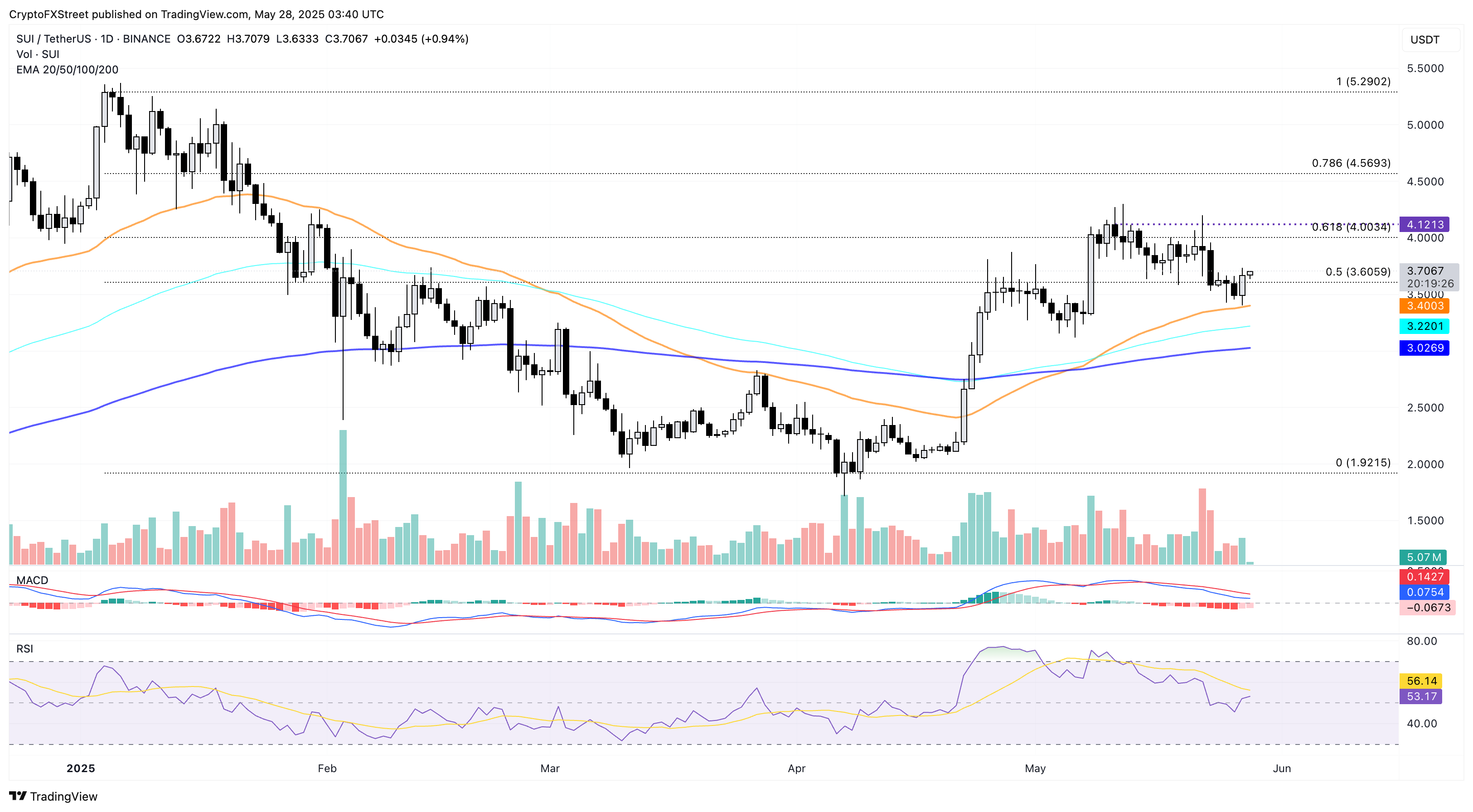

SUI jumps 5.22% on Tuesday, with a nearly 1% extended gain today reflecting the increase in bullish momentum and improved sentiment. Forming a bullish engulfing candle, the altcoin bounces off the 50-day Exponential Moving Average (EMA) at $3.40.

The technical indicators reflect a boost in bullish momentum as the Relative Strength Index (RSI) rises to 53 points and resurfaces above the halfway line. Additionally, the Moving Average Convergence/Divergence (MACD) indicator inches closer to its signal line, teasing a bullish crossover alongside the declining bearish histograms.

The Fibonacci retracement is between the closing price of $5.29 on January 9 and the opening price of $1.92 on April 7, which points the 50% halfway line at $3.60. As SUI exceeds the halfway level, investors might face profit booking headwinds at the 61.8% level at $4 and the 78.6% level at $4.56.

SUI/USDT daily price chart. Source: Tradingview

On the flip side, the 50-day EMA at $3.40 remains a crucial dynamic support, followed by the 100-day EMA at $3.22.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.