Toncoin Price Analysis: TON nears $4 as LTC and DOGE ETF hype lifts PoW sector

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

Toncoin price has consolidated in a tight 2% range between $3.80 and $4.00 over the last 12 days.

Whales have invested over $250 million in TON since the US SEC acknowledged new altcoin ETF filings last week.

Rising market volumes suggest TON price could be on the verge of a major breakout.

Toncoin price has consolidated within the 2% tight range between $3.8 - $4 over the last 12 days. On-chain analytics show whales making rapid TON purchases after the US SEC acknowledged new altcoin ETF filings last week. Is TON price on the verge of a major breakout?

Toncoin (TON) flashes breakout signals after 12-day consolidation phase

Toncoin (TON) price action has flatlined over the last two weeks, mirroring top assets like Bitcoin and Ethereum, which have also stagnated below the $48,000 and $2,750 resistance levels, respectively.

However, the postponement of fFounder Pavel Durov’s trial in France introduced mild bearish headwinds. On the other hand, the US SEC’s acknowledgment of Dogecoin ETF filings last week injected bullish sentiment into the Proof-of-Work (PoW) sector, offsetting some of the downward pressure.

Toncoin Price Action | TONUSDT

These bullish and bearish factors have effectively canceled each other out, creating a neutral market sentiment.

This is reflected in the recent price action, with Toncoin consolidating in a narrow channel between $3.70 and $3.90 for the past 12 trading days.

The market indecision is further underscored by the absence of significant price fluctuations, reinforcing the notion of a period of accumulation.

However, a closer look at market dynamics suggests TON could be gearing up for a breakout.

Trading volume has steadily increased over the last three consecutive days, a development that often signals a buildup of investor interest and potential for higher volatility.

When trading volume rises during a consolidation phase, it typically precedes a decisive move in either direction.

If the buying pressure continues to intensify, Toncoin could soon challenge its resistance level at $4.00, potentially setting the stage for a sustained bullish run.

Whales have acquired TON coins worth $250 Million after US SEC acknowledged Dogecoin ETF

While Toncoin price has been stuck in a sideways trend between $3.70 and $3.90 for nearly two weeks, on-chain data trends show a notable surge in whale demand, a factor that could catalyze a major price breakout.

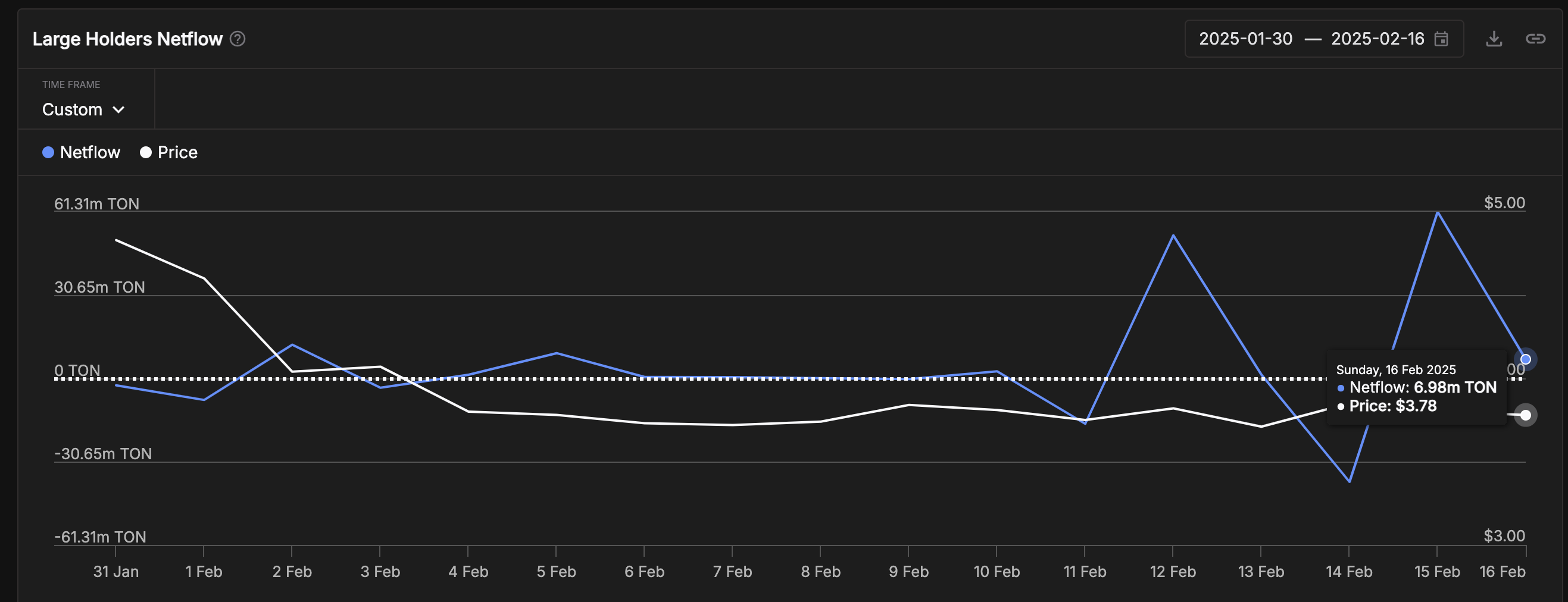

Supporting this narrative, on-chain analytics from IntoTheBlock’s Large Holder Netflow metric highlight a sustained accumulation trend among Toncoin’s wealthiest addresses since the US SEC acknowledged DOGE ETF filings on February 14.

This metric tracks the net balance changes in wallets holding at least 0.1% of TON’s total circulating supply, offering insight into whale activity during critical market phases.

Toncoin Large Holder Netflow | TONUSDT

According to the data, Toncoin’s largest holders have maintained positive net inflows since February 14.

Over the past three days, these whale wallets have acquired a cumulative 68 million TON, valued at approximately $250 million based on the current market price of $3.80 per coin.

This level of sustained buying activity reflects growing confidence among Toncoin’s biggest stakeholders despite broader market uncertainties.

The increase in whale balances suggests that institutional and high-net-worth investors remain committed to Toncoin’s long-term value proposition.

Historically, such accumulation trends have often preceded significant price recoveries, as concentrated buying pressure from whales tends to drive broader market rallies.

This shift in market structure could set the stage for TON to break out of its 12-day consolidation phase and test new monthly peaks above $4.00.

With rising market volumes and robust whale accumulation, Toncoin appears poised for a decisive move.

If momentum continues to build, a breakout above $4.00 could drive further upside, potentially targeting the next major resistance level at $4.50 in the coming weeks.

Toncoin Price Forecast: $4 breakout ahead if this happens

Toncoin price has been locked in a tight consolidation range between $3.70 and $3.90 for the past 12 days, with mounting signs of a potential breakout.

The Bollinger Bands (BB) indicator shows narrowing volatility, with the upper band at $4.00 and the lower band at $3.21, indicating compression that often precedes a volatile move.

The 50-day moving average remains overhead at $4.79, suggesting that TON still faces resistance before reclaiming previous highs.

Toncoin Price Forecast | TONUSDT

The Parabolic SAR (Stop and Reverse) dots remain above the price, reflecting an ongoing bearish trend.

However, the Money Flow Index (MFI) is hovering at 16.79, signaling oversold conditions.

Historically, such low MFI readings have led to strong rebounds, especially if accompanied by a surge in volume.

Notably, daily trading volume has picked up over the past three sessions, hinting at increasing investor participation.

If buying pressure intensifies, TON could break above $4.00, targeting the $4.79 resistance level.

Conversely, failure to hold support near $3.70 may trigger a retest of $3.21, where stronger liquidity could provide a rebound opportunity.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.