Telegram Meme Coin DOGS Could Be Set Up for a Potential Rebound

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Top 3 Price Prediction: BTC, ETH and XRP remain range-bound as breakdown risks rise

DOGS, the recently launched meme coin on the Telegram-associated TON blockchain, could be ready to bounce. Since its launch, the token has lost 32% of its value.

With growing market interest in meme coins, DOGS has shown signs of resilience, making it one of the top 100 cryptocurrencies to keep an eye on.

Data Shows DOGS Buyers Are Back

DOGS, launched on August 26 following Telegram CEO Pavel Durov’s arrest in France, saw a highly volatile Token Generation Event (TGE) where over 400 billion tokens were distributed to users.

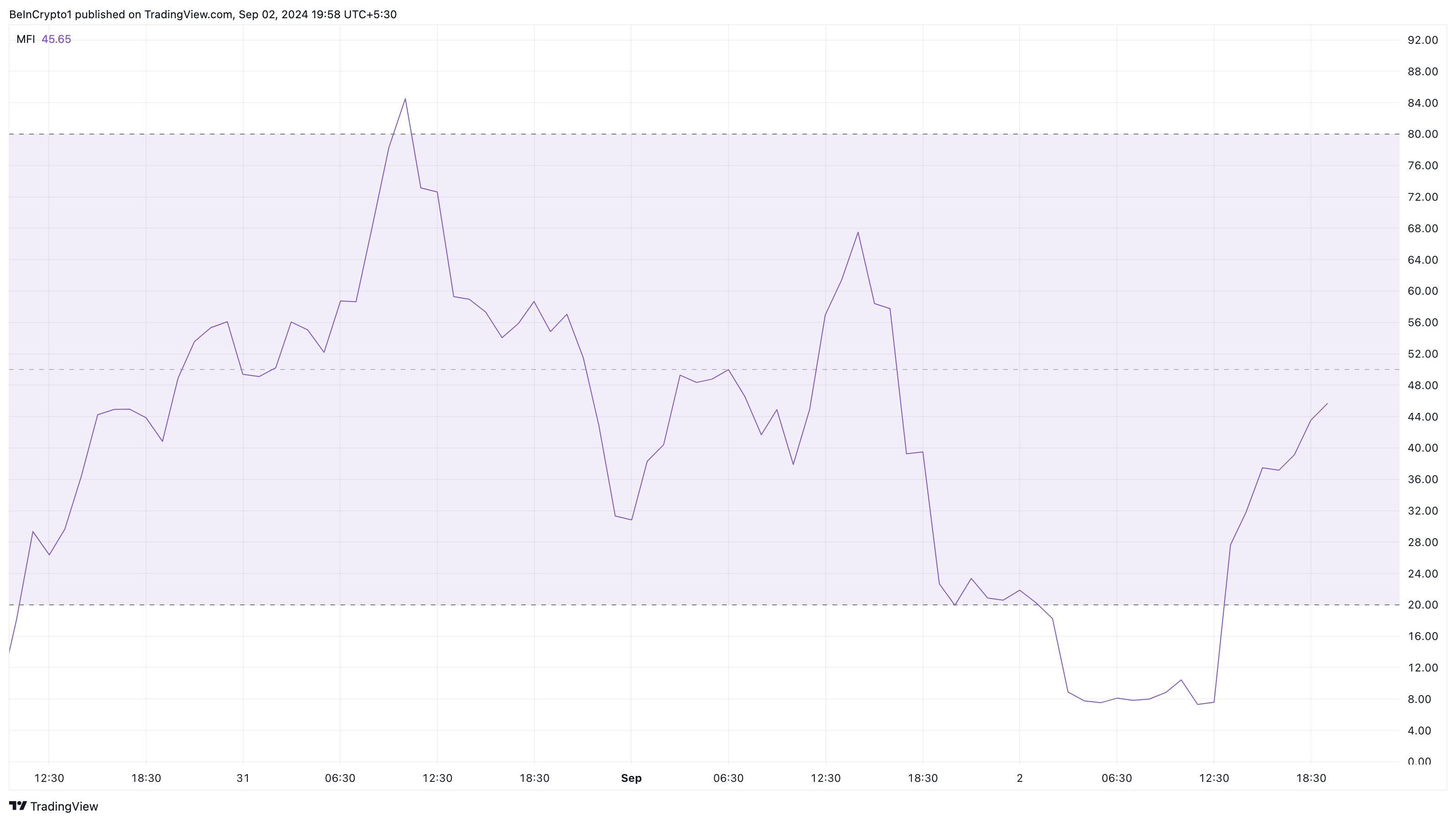

The heavy selling pressure caused DOGS’ price to drop from $0.0017 to $0.0010. However, analysis of the hourly chart shows a notable increase in the Money Flow Index (MFI), indicating rising capital inflow into the cryptocurrency.

The MFI is a technical indicator showing the level of capital inflow into a cryptocurrency. When it decreases, it implies a rise in selling pressure. An increase, on the other hand, indicates otherwise.

DOGS Money Flow Index. Source: TradingView

DOGS Money Flow Index. Source: TradingView

In DOGS’ case, the decreasing price alongside a rising Money Flow Index (MFI) suggests that selling pressure is easing, and buyers are stepping in, creating a bullish divergence. This formation typically indicates that the price could be poised to rise.

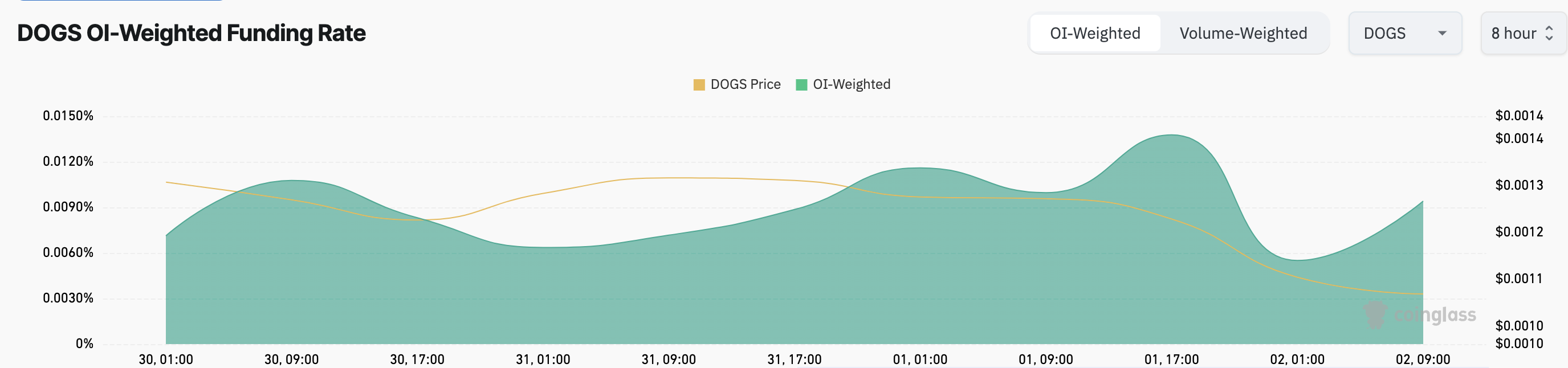

Additionally, the derivatives market shows similar optimism, as evidenced by the increasing funding rate. A higher funding rate suggests that buyers (longs) are paying sellers (shorts) to keep their positions open, signaling broader bullish sentiment. Conversely, a negative funding rate would indicate bearish expectations.

DOGS Funding Rate. Source: Coinglass

DOGS Funding Rate. Source: Coinglass

Given the rising funding rate and recent price action, it appears that DOGS may be on the verge of a move toward its overhead resistance.

DOGS Price Prediction: The Meme Coin Looks Ready to Retest $0.0012

Further analysis of the hourly chart suggests that DOGS could be approaching price discovery, a process driven by supply and demand where buyers and sellers determine the token’s fair value.

After the sharp drop from $0.0012, it seems sellers are losing momentum, with bulls defending the $0.0010 support level. Holding this support is crucial for a potential recovery.

DOGS Hourly Analysis. Source: TradingView

If DOGS maintains its position, a return to $0.0012 could be the next move. However, if it fails to hold $0.0010, the token might drop to new lows.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.