Ethereum Price Forecast: ETH surges 5% on Bitcoin's all-time high and GameSquare treasury announcement

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Ethereum gained over 5% on Wednesday and could test the $2,850 resistance after clearing a symmetrical triangle.

The surge follows Bitcoin lifting the general crypto market after it soared to a new all-time high near $112,000.

GameSquare has announced plans to raise $100 million to launch an ETH treasury.

Ethereum (ETH) rallied past $2,700 alongside the broader cryptocurrency market on Wednesday, notching a 5% gain following Bitcoin's (BTC) surge to a record high near $112,000. The rise in the market underscores Bitcoin's strong correlation with top cryptocurrencies.

GameSquare to launch $100 million ETH treasury

ETH's rally is notable as it has extended for a second consecutive day, following Nasdaq-listed esports and media company GameSquare's announcement on Tuesday that it will launch a $100 million Ethereum treasury after receiving approval from its board.

The company aims to secure proceeds of $8 million through a public offering of 8.42 million shares priced at $0.95. It also gave Lucid Capital, its underwriter, a 45-day option to purchase an additional 1.26 million shares at the price of the offering.

The offering is the first tranche of a series of "staged" investments that the company plans to make over time, allocating the proceeds to pursue an Ethereum treasury strategy.

"This new treasury management strategy enhances our financial flexibility and allows us to support a defined capital allocation plan that is focused on pursuing additional ETH asset purchases, funding potential share repurchases, and reinvesting in our growth initiatives," said Justin Kenna, CEO of GameSquare.

GameSquare stated its ETH treasury will be built on Medici, a yield optimization platform from investment crypto management firm Dialectic, to generate returns on its holdings. The company added that it may leverage other yield-generation strategies on Ethereum using stablecoins and non-fungible tokens.

The company's stock, GAME, is up 40% on Wednesday, stretching its rally since unveiling the ETH treasury on Tuesday to over 100%.

The development follows a growing trend where low-capped publicly listed companies are launching crypto treasuries leveraging Bitcoin — with a few opting for altcoins like ETH and Solana (SOL).

On Monday, Bit Digital stock rallied after the company announced it had expanded its treasury holdings to 100,603 ETH using proceeds from a 280 BTC sale and a $172 million offering. SharpLink Gaming's stock also saw an uptick on Tuesday after the company unveiled additional ETH purchases, boosting its holdings above 205,000 ETH. Both companies stated that they're staking their entire holdings, thereby reducing the supply pressure of ETH available for sale in the market.

In a CNBC interview on Tuesday, Consensys CEO and SharpLink chairman Joe Lubin noted that Ethereum treasuries are "not only a great business to run but [will] be critical to enable the supply-demand of ETH to rightsize" as more applications launch on its blockchain.

Ethereum Price Forecast: ETH eyes $2,850 resistance as it tests triangle's resistance

Ethereum saw $143 million in futures liquidations in the past 24 hours. The total amount of long and short liquidations amounted to $14 million and $129 million, respectively, according to Coinglass data.

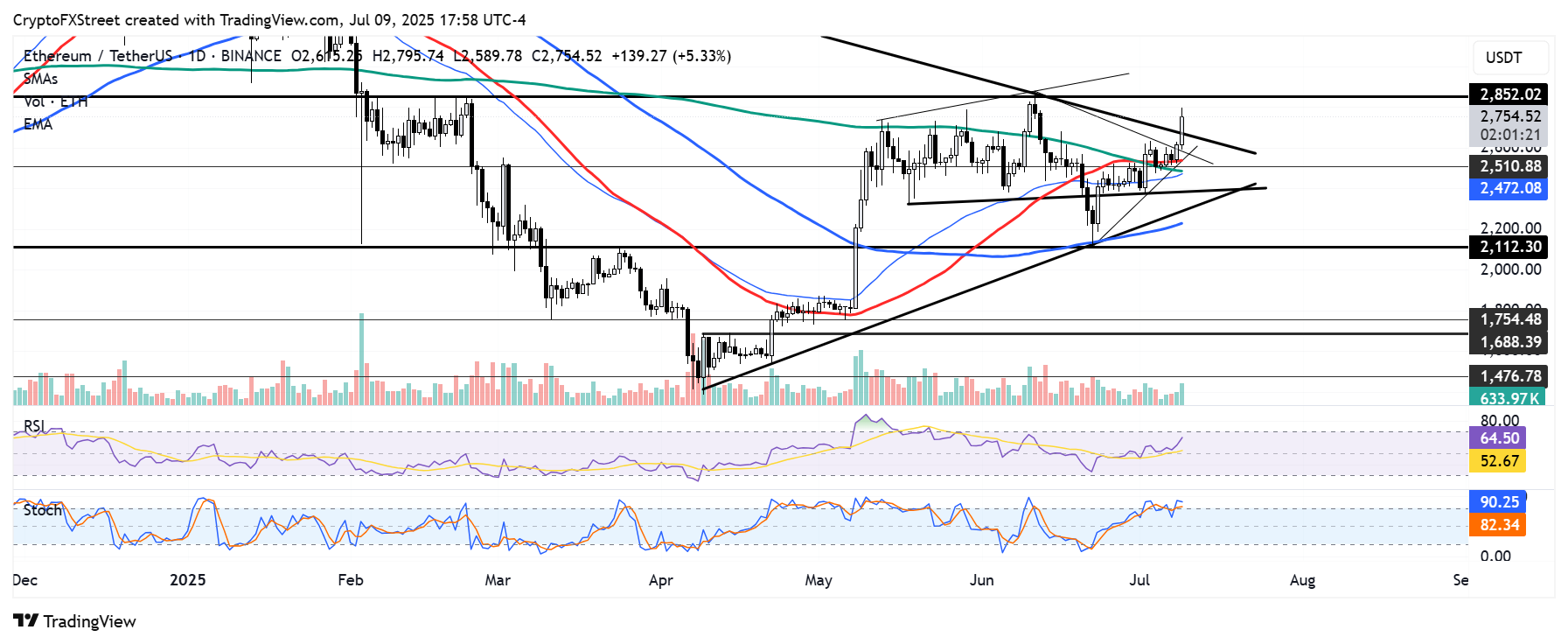

Since finding support on Sunday near the $2,500 key level — which is strengthened by the convergence of the 200-day Simple Moving Average (SMA) and 50-day Exponential Moving Average (EMA) — ETH has rallied over 7%.

ETH/USDT daily chart

As a result, the top altcoin has moved above the upper boundary of a wider symmetrical triangle pattern and is eyeing the $2,850 resistance. A further move above this key resistance — which has stood since February 4 — could spark a strong uptrend in ETH.

On the downside, ETH could find support near $2,500 if ETH sees a rejection at $2,850.

The Relative Strength Index (RSI) is above its neutral level, while the Stochastic Oscillator (Stoch) has crossed into the overbought region. This indicates a dominant bullish momentum, albeit with a potential for a short-term correction due to overbought conditions in the Stoch.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.