Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

Ethereum price today: $1,580

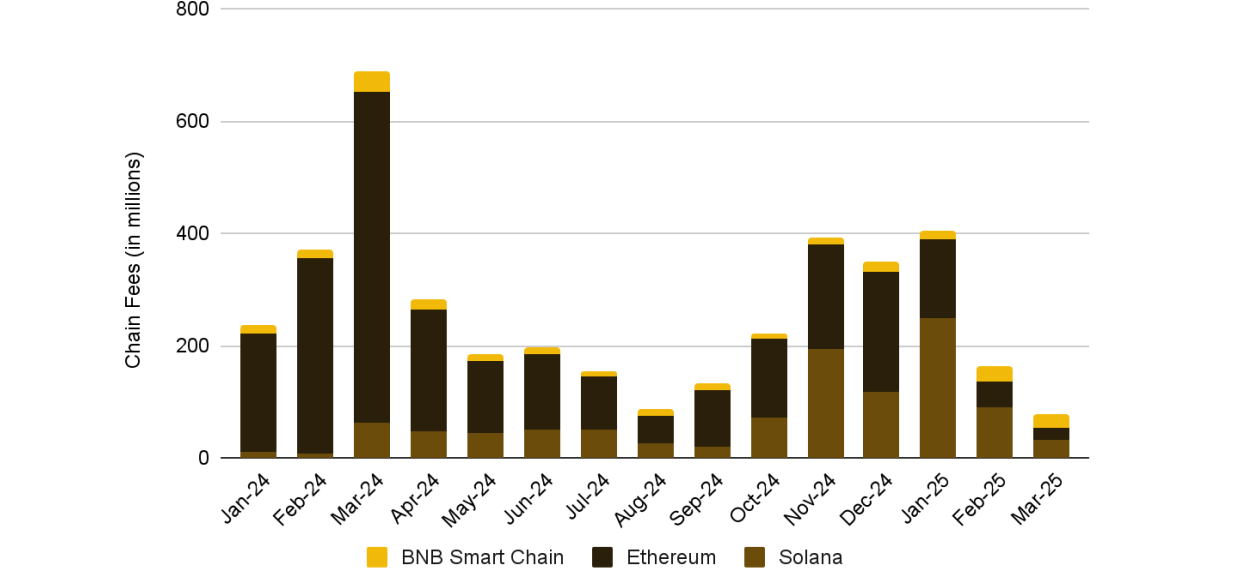

Ethereum is losing ground to Solana and BNB Chain in terms of fees captured since it introduced blobs.

Based rollups could improve ETH's value accrual, but it's not a "top priority" in the upcoming Pectra and Fusaka upgrades.

ETH could find support within the $1,450-$1,550 range amid signs of weakness in its technical indicators.

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Ethereum loses momentum as data availability roadmap has limited its value accrual

Since Ethereum flipped on its data availability roadmap after the Dencun upgrade in March 2024, its scalability surged by a "scale factor of 15.95x" but to the detriment of fees captured on the L1, the report notes.

The upgrade saw L2s improve their throughput and significantly reduce costs while paying negligible fees for L1 settlement. This has hurt ETH value accrual and the "ultrasound money" narrative, which largely relies on gas fees. As a result, Ethereum is losing ground to Solana and BNB Chain in terms of fees captured.

Chain Fees. Source: Binance Research

A popular suggestion among Ethereum community members to fix ETH value accrual involves repricing the blob fee market while continuing with the vision of increasing blob count. "However, given L2s are rational businesses, they might be price sensitive and move towards cheaper alternatives should minimum blob fees be too high," the report states.

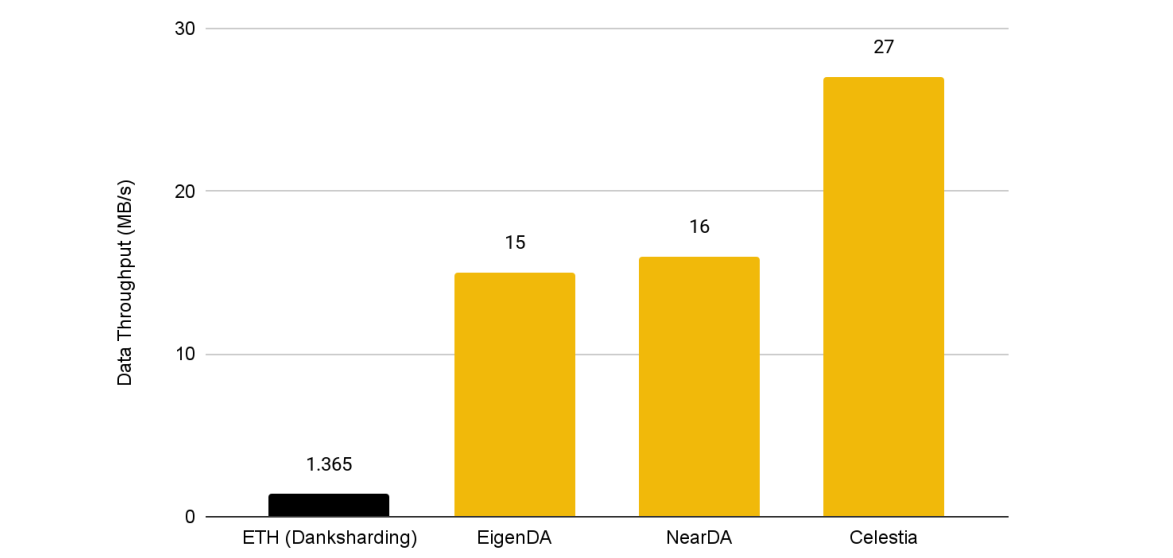

Alternative data availability layers like Celestia, EigenLayer and NearDA provide higher throughput at very low fees.

Data Throughput (Ethereum vs competitors). Source: Binance Research

However, Ethereum far outpaces competitors in terms of security, boasting over 1 million nodes "compared to Celestia at 100 and EigenDA at 170."

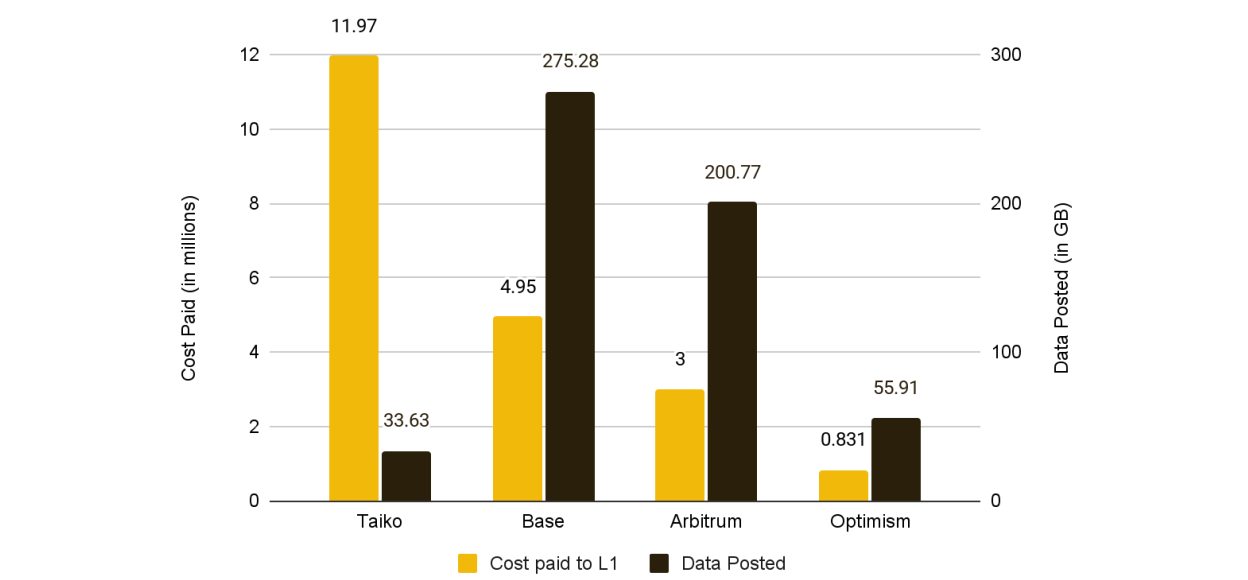

Many consider based rollups, which rely on L1 sequencing, to be the answer to Ethereum's scalability-value accrual dynamics. Taiko, a based rollup, contributed more fees to Ethereum than the top 3 L2s combined while posting the least amount of data to the L1 over the past year.

Cost paid to L1/Data posted. Source: Binance Research

The report highlights that despite its potential to address current value accrual challenges, based rollups is not a "top priority" in upcoming Ethereum upgrades, Pectra and Fusaka, which could hit mainnet on May 7 and Q4 '25.

Ethereum Price Forecast: ETH could find support within the $1,450-$1,550 range

Ethereum experienced $57.08 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $38.16 million and $18.92 million, respectively.

ETH has slightly tilted toward the downside since seeing a rejection at the $1,688 resistance level on Monday. The 50-day Simple Moving Average (SMA) and a descending trendline extending from March 23 also stand as key resistance that could limit an upside move for the top altcoin. If ETH flips and holds these resistance levels as support, it could be primed for a major recovery.

ETH/USDT 12-hour chart

On the downside, the $1,450 to $1,550 support range could prove crucial as bulls outweighed bears the last time prices reached the zone. Additionally, investors bought over 1.2 million ETH within this range, per Glassnode data.

The Relative Strength Index (RSI) is below its neutral level and is testing its moving average line. Meanwhile, the Moving Average Convergence Divergence (MACD) is posting receding green histogram bars. A move below its neutral level and moving average line could accelerate the bearish pressure.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.