Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call.

Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

ETH could face strong bearish pressure if its technical indicators confirm a breakdown signal.

Ethereum (ETH) has seen immense buying from whales on Thursday following core developers fixing April 30 as a tentative date for the Pectra upgrade to go live on mainnet.

Ethereum whales increase buying pressure ahead of Pectra mainnet upgrade

In its latest All Core Developers Consensus (ACDC) call, Ethereum developers tentatively scheduled April 30 for the Pectra mainnet upgrade.

The Pectra upgrade successfully went live on the new Hoodi testnet (or test network) on Wednesday. However, developers are still observing potential issues, considering the hiccups seen in the Holesky and Sepolia testnets after a similar upgrade.

If April 30 is confirmed in the ACDC call next Thursday, ETH could see increased volatility as investors may begin to position for potential price changes following the upgrade.

While Pectra has no updates that directly impact ETH's valuation metrics, the new features it brings could boost network activity and attract capital back to the Ethereum Layer 1. This is evidenced in recent positioning among ETH whales.

Whales increased their ETH buying pressure in the past few hours, with some depositing their assets in staking protocols and others adding leverage on their holdings through DeFi lending protocols, per Lookonchain data.

Notably, a whale bought 51,209 ETH for $103 million on the Coinbase exchange.

The immense decline in ETH's exchange reserve aligns with the latest whale activity. The reserves have plunged by nearly 1 million ETH since March 3, indicating immense buying pressure.

-638787327474267110.png)

ETH exchange reserve. Source: CryptoQuant

However, prices have remained fairly muted, weighed down by macroeconomic conditions and traditional investors' sentiments, as revealed in the sustained outflows recorded in Ethereum exchange-traded funds (ETFs) since February, per Farside Investors' data.

Meanwhile, the US government transferred 884 ETH worth $1.77 million to an unknown wallet in the past few hours, per Arkham data. This stirred attention from the crypto community, considering President Donald Trump signed an executive order for the US to create a Strategic Bitcoin Reserve and digital asset stockpile earlier in the month.

Ethereum Price Forecast: ETH technical indicators on verge of a breakdown confirmation

Ethereum saw $29.38 million in futures liquidations in the past 24 hours, per Coinglass data. The total value of long and short liquidations is $22.36 million and $6.02 million, respectively.

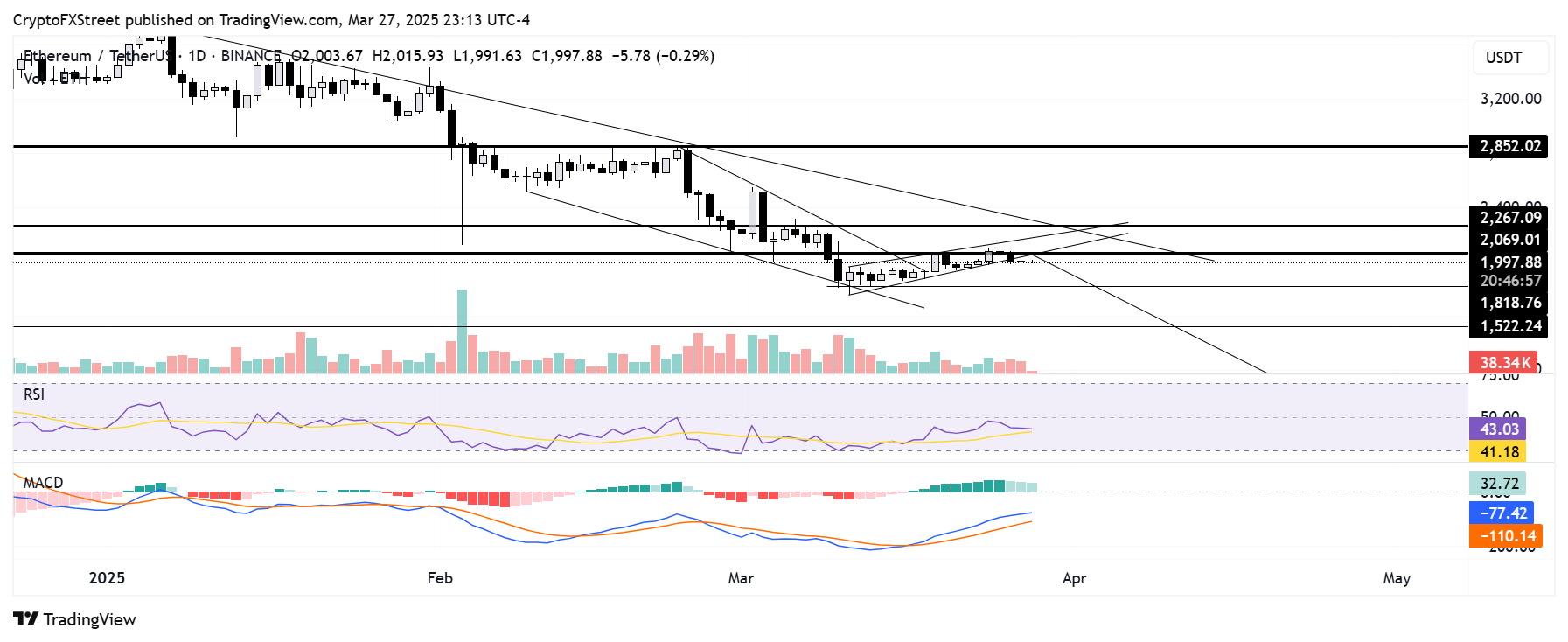

ETH crossed below the lower boundary of a key channel after seeing a rejection at the $2,069 resistance. A sustained decline below this trendline could send ETH to test the support level near $1,800.

ETH/USDT daily chart

A firm move below $1,800 will validate a bearish flag pattern, potentially sending ETH below $1,500 and toward $1,200 — a level obtained by measuring the height of the flag's pole and projecting it downward from the breakdown point.

On the other hand, a recovery above the lower boundary of the key channel and the $2,069 resistance could trigger a short-term ETH rally.

The Relative Strength Index (RSI) is declining below its neutral level and could test its yellow moving average line. Meanwhile, the Moving Average Convergence Divergence (MACD) posted consecutive receding green bars.

The bearish momentum could accelerate if the RSI declines below its moving average line and the MACD histograms flip red.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.