Ethereum (ETH) Price Rally to $2,600 Comes with Unsettling Risks

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Ethereum’s (ETH) price has surpassed $2,500 for the first time since October 1. However, despite the market’s rising optimism, this upward movement may not be as smooth as it seems.

In this analysis, BeInCrypto highlights several on-chain metrics that suggest a significant portion of ETH’s gains could be stifled.

Ethereum Is Not Yet Free from Problems

Ethereum’s price increase represents a 6% hike in the last 30 days. Within the last 24 hours, the cryptocurrency’s volume has increased by 90%, indicating rising investor interest in Ethereum.

Despite this, data from IntoTheBlock shows that Ethereum’s Coins Holding Time has decreased by 56% in the last seven days. Coins Holding Time shows the amount of time investors have held a cryptocurrency without selling it.

Typically, longer holding times correlate with higher chances of price increases, while shorter holding times often signal potential price drops. In Ethereum’s case, the recent decline in holding time suggests that, despite the recent price rise, ETH holders are still selling.

Read more: How To Buy Ethereum (ETH) With a Credit Card: Complete Guide

Ethereum Coins Holding Time. Source: IntoTheBlock

Ethereum Coins Holding Time. Source: IntoTheBlock

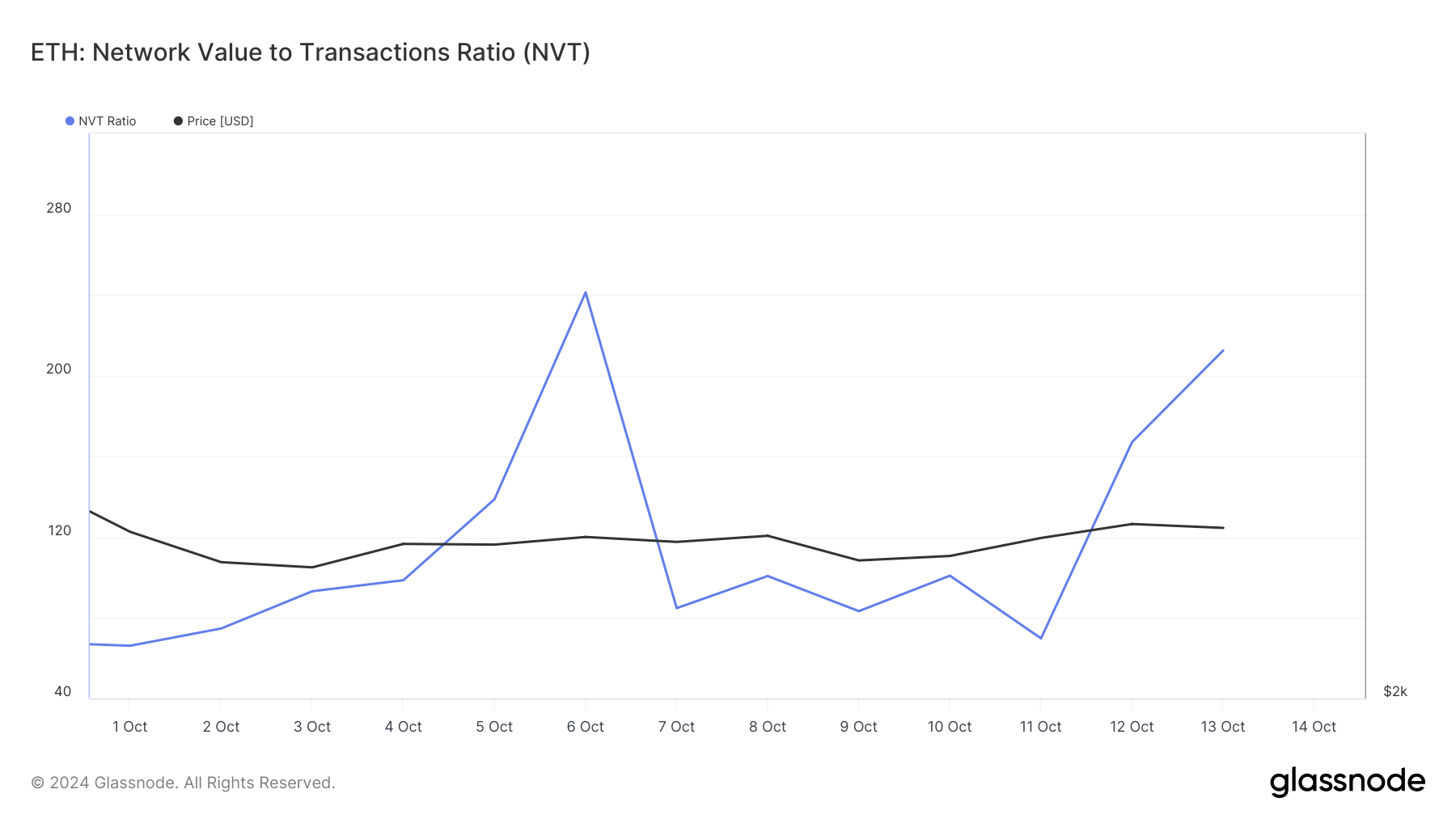

If sustained, the cryptocurrency’s value might drop in the short term. The Network Value to Transaction (NVT) ratio is another metric supporting a drawdown. A high NVT ratio suggests that market capitalization is higher than the value transacted on the network.

A low NVT ratio, on the other hand, indicates that transaction volume is outpacing the market cap growth. While the former is a bearish sign, the latter is a bullish one.

According to Glassnode, Ethereum’s NVT ratio has been rising for the last few days, suggesting that ETH’s price could be overvalued relative to the current market condition.

Ethereum NVT Ratio. Source: Glassnode

Ethereum NVT Ratio. Source: Glassnode

ETH Price Prediction: Likely Drop Below $2,400

A look at the ETH/USD daily chart shows that the Average True Range (ATR) has remained flat. Low readings of the ATR suggest low volatility and the possibility of a reversal or continued consolidation.

High ATR, on the other hand, suggests rising volatility and a potential for prices to keep moving upward. Since the indicator is flat, it appears that ETH’s price could drop to $2,345. But that would only be the case if buying pressure decreases and bears take control of the altcoin’s direction.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Daily Price Analysis. Source: TradingView

Ethereum Daily Price Analysis. Source: TradingView

Ethereum’s price might climb if bulls ensure that bears do not run the show. In that situation, the cryptocurrency’s value could rally much higher than $2,600, possibly hitting $2,983.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.