Trump vs. Powell: Bullish or Bearish for Bitcoin?

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Introduction

The clash between Donald Trump and Federal Reserve Chair Jerome Powell has become a major talking point in financial markets. As the U.S. president, Trump has had a significant influence on global markets through his trade and economic policies. Powell, as the head of the Fed Chair, steers U.S. monetary policy. This confrontation affects not only traditional financial markets but also Bitcoin (BTC). This article will explore their policy differences and examine how these dynamics impact the Bitcoin market.

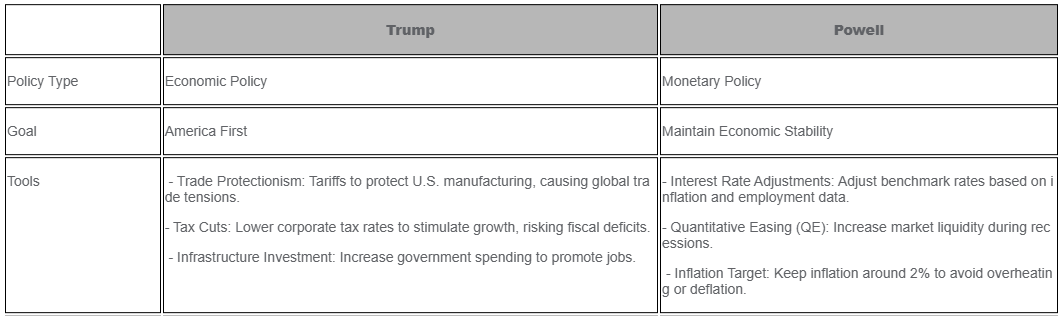

Policy Differences Between Trump and Powell

Since Trump was re-elected president in January 2025, he has repeatedly called on the Fed to lower interest rates and has even threatened to fire Powell. However, Powell has upheld the Fed's independence, resisting immediate rate cuts.

Trump has publicly criticized the Fed’s monetary policy on multiple occasions. During his first term, he blamed interest rate hikes for slowing economic growth and consistently pushed for rate reductions. At the heart of the Trump-Powell conflict is a fundamental clash between fiscal and monetary policy:

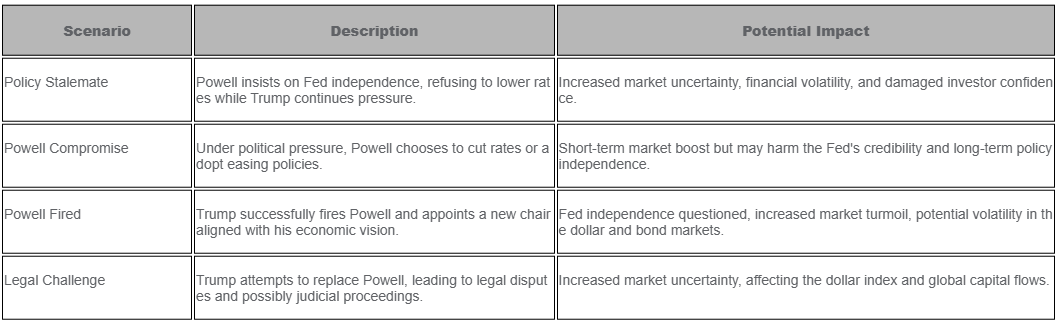

Possible Scenarios in the Trump-Powell Showdown

What might happen in the Trump-Powell showdown? While no one can predict the outcome, four scenarios could emerge:

How the Policy Clash Affects Bitcoin?

The core of the Trump-Powell clash revolves around interest rates. Trump wants the Fed to cut rates swiftly, while Powell remains cautious and is in no hurry to make adjustments. Changes in interest rates affect not only traditional financial products and but also alternative assets like Bitcoin.

Bitcoin in a Low-Interest Environment

In a low-interest environment, investors tend to seek higher-yielding assets to offset reduced returns. Bitcoin, with its limited supply and decentralized nature, becomes particularly attractive. When markets anticipate low rates, demand for Bitcoin typically rises, driving up its price.

Bitcoin in a High-Interest Environment

If Powell maintains rates or raises interest rates, capital tends to flow into fixed-income products, reducing demand for riskier assets like Bitcoin. In such scenario, high interest rates generally suppress Bitcoin prices as investors favor the stable returns of traditional financial instruments.

Future Trends for Bitcoin Amidst Policy Struggles

On January 31, 2025, President Trump announced a 25% tariff on goods imported from Canada and Mexico. That same day, Bitcoin dropped 2% , nearing $100,000 mark. Since then, Trump has escalated tariffs while calling for interest rate cuts. He imposed equal tariffs on multiple countries and repeatedly raised tariffs on Chinese imports. These moves triggered market anxiety, with Bitcoin continuing to fall alongside U.S. equities.

On April 9, 2025, after Trump reiterated his commitment to enforcing equal tariffs, Bitcoin plummeted to $75,000—its lowest level since November 2024—erasing all gains made since his election. However, later that afternoon, Trump announced a 90-day delay on the tariffs, prompting a sharp rebound in Bitcoin. His subsequent softening on trade policy, including an April 21 statement that he had no intention of firing Fed Chair Powell, helped lift Bitcoin back to a key resistance level of $95,000.

Bitcoin price trend chart, source: TradingView.

Despite Trump's more conciliatory tone, some analysts believe it may be a strategic move to gain Powell’s support and restore market confidence. This does not signal an end to the conflict.

If Trump fails to persuade Powell to cut rates, tight liquidity conditions may persist, potentially dragging Bitcoin back to $75,000. On the other hand, if conditions ease, Bitcoin could rally to retest its previous high of $110,000—or even surpass it.

Geoffrey Kendrick, Head of Global Digital Assets Research at Standard Chartered Bank, maintains that the Federal Reserve’s independence remains a critical concern. He forecasts that Bitcoin could rise to $200,000 by the end of 2025.

How to Respond to Policy Clash Impacts

The potential impact of the Trump-Powell confrontation is significant and unpredictable. Investors should be prepared with various strategies:

1. Monitor Market Dynamics

Stay updated on Trump and Powell's statements and policy changes, especially during economic data releases and elections. Trump is very active on social media, so follow his account @realDonaldTrump.

2. Diversify Your Portfolio

Spread investments across different asset types, including Bitcoin, stocks, and bonds, to reduce single-market risk. Consider investing in traditional safe-haven assets like gold (XAUUSD) and silver (XAGUSD) during increased uncertainty.

3. Maintain a Long-Term Investment Perspective

For those optimistic about Bitcoin's future, consider holding long-term and ignoring short-term fluctuations. Use dollar-cost averaging to spread investments over time and reduce risk.

4. Use Derivatives for Hedging

When the market turns against your positions, consider using Bitcoin options or futures to hedge against risks, protecting your capital during volatility.

Conclusion

The ongoing showdown between Trump and Powell is set to have lasting implications for Bitcoin. Whether low rates attract capital or high rates dampen demand, both scenarios will directly influence Bitcoin's price trajectory. Investors must adopt flexible and comprehensive strategies that mitigate risks while capturing potential upside. By closely monitoring market developments, diversifying portfolios, employing hedging instruments, and maintaining a long-term perspective, investors can aim for relatively stable returns amid an increasingly uncertain financial environment.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.