2025 Digital Asset Summit Concludes: What Did Trump Say?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

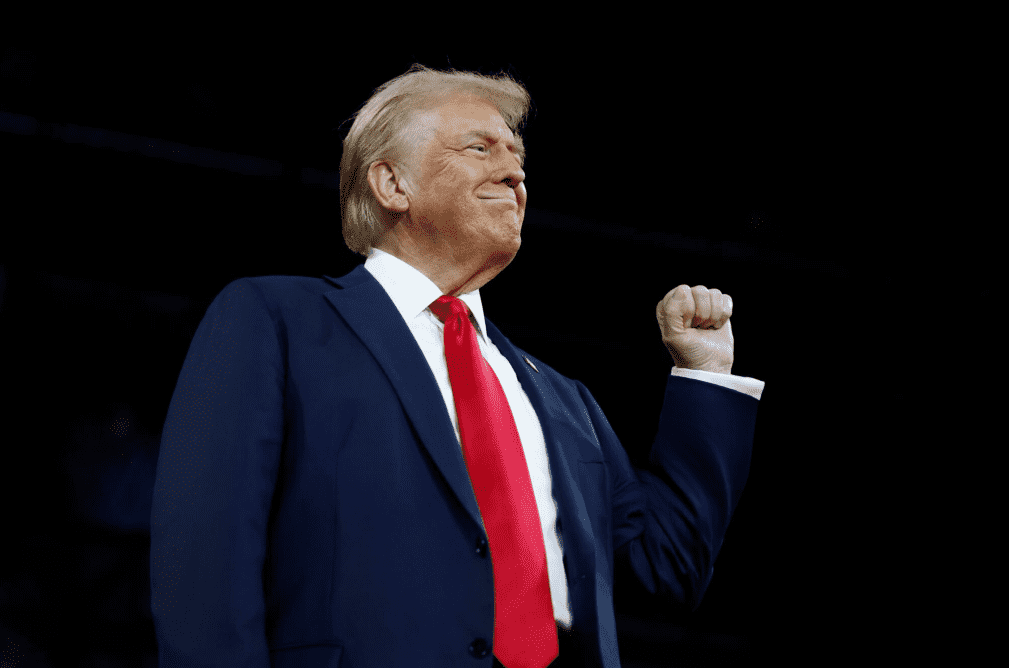

TradingKey - Trump's speech at the 2025 Digital Asset Summit fell short of expectations, with no new crypto policies announced.

On Thursday evening, the 2025 Digital Asset Summit (DAS) in New York City concluded, with U.S. President Trump delivering a roughly two-minute video speech covering topics such as Bitcoin (BTC) and stablecoins.

During his speech, President Trump stated, "The United States is leading in cryptocurrency and next-generation fintech. We are ending the previous administration's regulatory war on cryptocurrency and Bitcoin." He also added, "We will make the U.S. the undisputed Bitcoin superpower and the world's crypto capital."

Trump pledged, "We will not sell the Bitcoin confiscated by the U.S. government." However, this is not new, as the establishment of a Bitcoin strategic reserve already implies that the government will not easily sell its holdings.

One notable point was Trump's call for Congress to pass stablecoin legislation to expand the dominance of the U.S. dollar. If passed, this legislation would significantly reduce barriers to stablecoin development, helping to grow its market cap and inject new funds into the crypto market.

Previously, the market had expected Trump to announce new crypto policies at the U.S. Digital Asset Summit. However, his speech largely reiterated previous plans and slogans, falling short of expectations with no new policies introduced.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.