Bitcoin price defends $60K as whales hold onto their BTC despite market dip

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

■ Bitcoin price remains below $63,000, distancing itself further from $73,777 all-time high.

■ BTC whales cling firmly to their holdings despite a month of market dips.

■ Halving is out four days, expected on April 20, causing increased anticipation and speculation in the market.

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Daily digest market movers: Whales hold onto their Bitcoin despite market dip

Bitcoin price continues shedding after slipping below an ascending trendline. It is in the lower section of a market range measured between $60,678 and $73,777, where selling pressure climaxed and buying pressure peaked respectively.

However, despite the ongoing dump, large holders are not selling, with Santiment researchers reporting that the whales continue to hold onto their coins. Specifically, they choose to block out all manner of FUD.

#Bitcoin key stakeholders aren't budging on their holdings, despite the concerning volatility that brought the top market cap #cryptocurrency's market value as low as $61.5K over the weekend.

— Santiment (@santimentfeed) April 15, 2024

With #FUD circulating among traders as markets close in on the April 19th #halving,… pic.twitter.com/TYmvQA6WBc

It comes as the countdown to the halving continues, slated for April 20, which is only four days away as only 500 blocks remain. Reports indicate that Google searches for “halving” are skyrocketing.

Google searches for "Halving" are going parabolic.

— Bitcoin Archive (@BTC_Archive) April 16, 2024

Awareness Adoption pic.twitter.com/8jsf8JsG73

Typically, in the days leading up to and on the day of the halving, there is increased anticipation and speculation in the market. In some instances, BTC price has increased significantly before or after the halving, driven by increased demand and speculation. Already, the implied volatility for April expiry surged by 13% over the weekend, moving from 62% to 75%. This suggests a short-term price turbulence ahead.

#BTC implied volatility for April expiry soared from 62% to 75% over the weekend, hinting at short-term price turbulence ahead. pic.twitter.com/1t0EYz4DUt

— Kaiko (@KaikoData) April 16, 2024

In the same spirit, analysts such as @CryptoCapo_ urge traders to brace for a sell-off that will see Bitcoin price drop below $60,000, where the pioneer cryptocurrency could establish a potential local bottom.

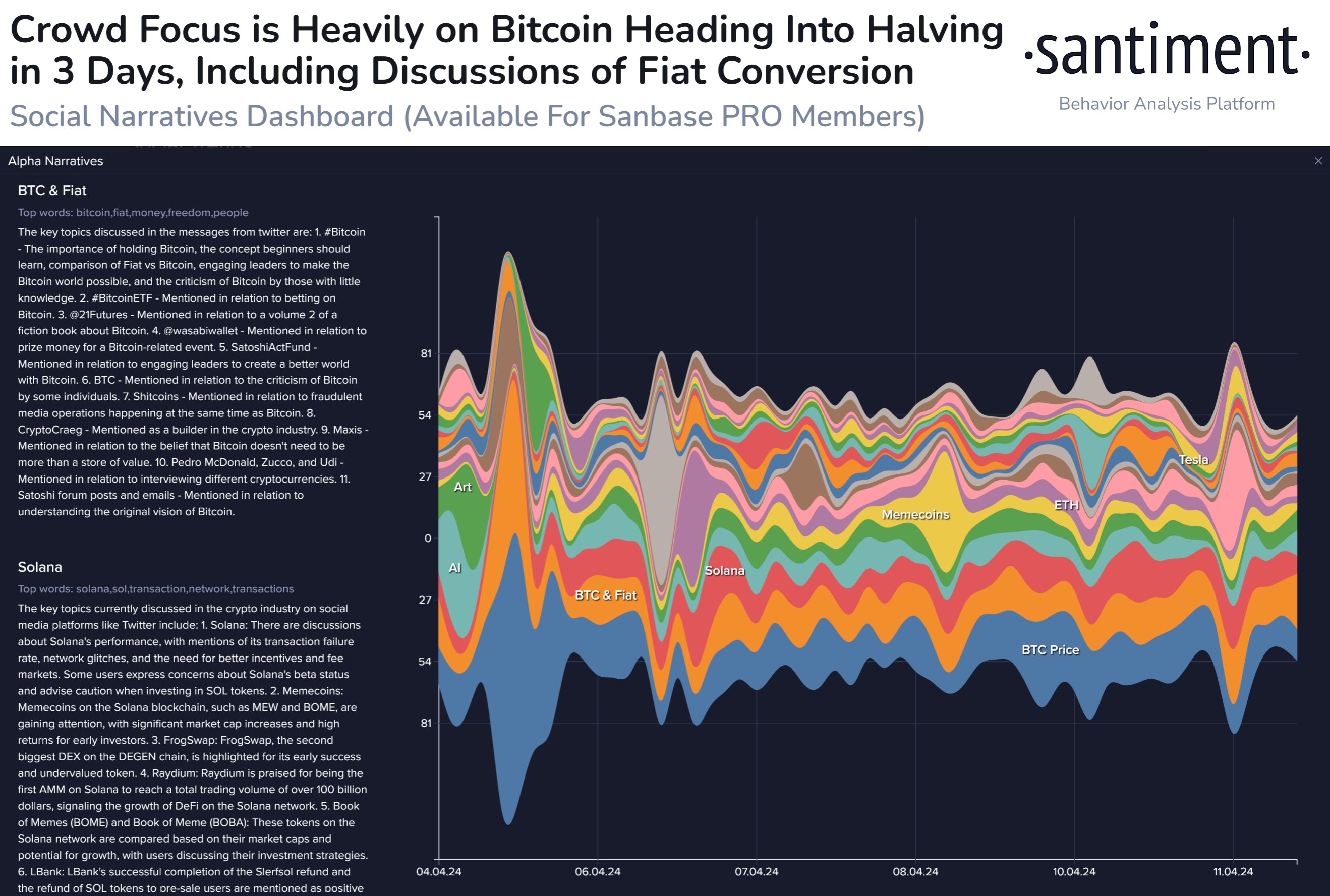

Traders are also increasing conversations about “BTC and the viability of holding through a potential extended correction past the halving,” Santiment reports.

BTC, fiat discussions post-halving

With altcoin sectors such as AI, gaming, DeFi, memecoins, and others shedding significantly, mainstream attention will continue to grow in favor of BTC and fiat liquidations amid growing FUD.

Technical analysts: Bitcoin price outlook amid growing FUD

Bitcoin price downside momentum continues to grow after breaking below the ascending trendline. The nose-diving Relative Strength Index (RSI) shows momentum is falling, accentuated by the position of the Awesome Oscillator (AO) in negative territory.

The DXY indicator is also climbing, putting downward pressure on Bitcoin price as investors move their funds into traditional safe-haven assets like the US Dollar.

Increased selling pressure could see Bitcoin price drop to the bottom of the market range at $60,678. In a dire case, the downtrend could extend for BTC price to slip below the $60,000 psychological level to levels as low as $59,005, a liquidity collection for the intraday low of March 5.

BTC/USDT 1-day chart

On the other hand, if the bulls seize the opportunity to buy the dip, the ensuing buying pressure could send Bitcoin price north. A move above the ascending trendline, and effectively the 50% Fibonacci placeholder, would draw in more bulls.

Enhanced buying pressure above the aforementioned level could set the pace for a move above $69,000, before Bitcoin price can reclaim the $73,777 ATH. In a highly bullish case, the price could clear this range high to record a new peak above the $74,000 or $75,000 thresholds.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.